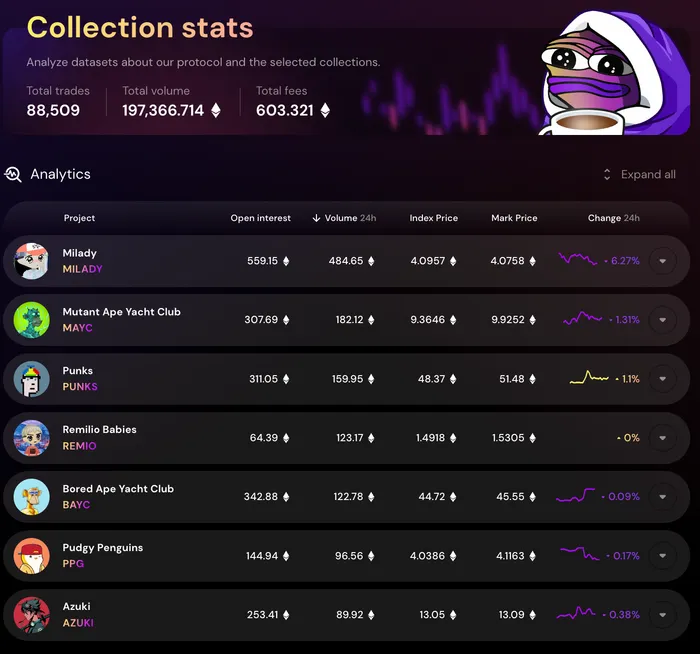

NFTPerp is an open-source decentralized NFT perpetual exchange that allows traders to long or short NFT collections. The project kicked off its beta mainnet on Arbitrum in November last year, becoming the first DEX to allow the trading of NFT perps.

Currently, NFTPerp offers the following NFT collections for perps trading:

-

BAYC

-

MAYC

-

Punks

-

Azuki

-

Milady Maker

-

Pudgy Penguins

-

Remilio Babies

Traders are able to trade with any amount of ETH collateral and take directional bets in long or short positions on supported collections up to 10x leverage.

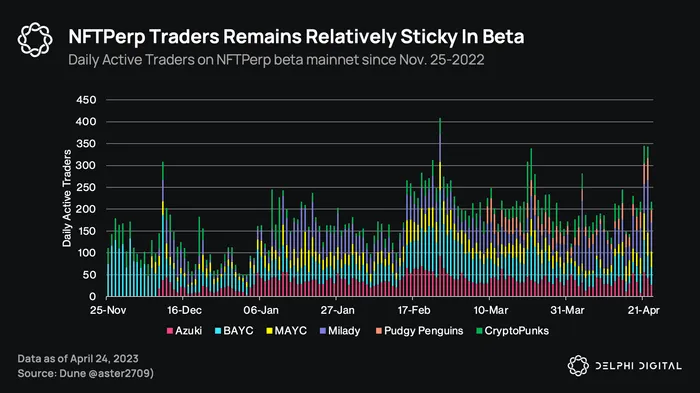

Daily active traders maintained above 200 through April, likely due to the platform’s Odeshi Airdrop, which is a retroactive airdrop campaign that rewards active users based on their trades and overall volume.

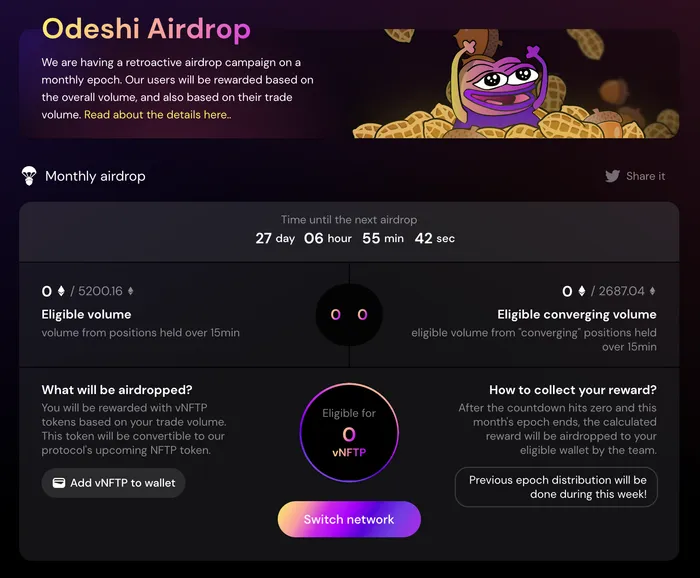

NFTPerp’s Ongoing Odeshi Airdrop Campaign

Rewards were airdropped to eligible traders on a monthly basis in the form of vNFTP tokens. vNFTP tokens will be convertible to their upcoming NFTP token when the official mainnet launches, which remains unclear at the time of writing.

NFTPerp currently releases two types of monthly rewards for its users: volume rewards and converger rewards.

The total monthly supply of vNFTP tokens released for volume rewards is 1.5M, representing 0.15% of the total token supply, while the total monthly supply for converger rewards is 500k vNFTP tokens, representing 0.05% of the total token supply.

The duration of both reward systems is currently indefinite, subject to the NFTPerp DAO’s governance. However, note that vNFTP tokens are non-transferable.

Volume rewards are distributed based on a trader’s volume relative to the total trading volume during the month. To qualify for volume rewards, traders must keep their positions open for at least 15 minutes.

Converger rewards are distributed based on the notional value of converging trades, which must be open for more than 30 minutes. The distribution is triggered when the vAMM price and index price deviate beyond 2.5%. In simple terms, when the price of the perpetual futures contract is close to the underlying spot price, it is said to be “converging,” indicating that the contract is accurately tracking the price of the underlying asset.