Radiant Capital, an Aave fork on Arbitrum, was recently hacked for 1,900 ETH (~$4.5M) and has since paused lending markets. The vulnerability had been found and fixed on Aave but not on forked protocols.

First of all, if you or someone you know was impacted by this exploit, my condolences. These exploits negatively impact all of DeFi, and I am in no way celebrating people getting rekt. However, I do think this event could be final straw in a string of smaller shifts that ultimately see DeFi get back on track.

All aave fork follow same pattern:

1) copy the code but not the safety culture

2) create high emission token to have artificial high APY via LM

3) learned alongside their users what we do is actually the most difficult job in DeFi the hard way.

Many such cases.

— Marc “Chainsaw” Zeller 👻 💜 🦇🔊 (@lemiscate) January 2, 2024

Aave’s Mark Zeller refers to Radiant as an Aave copy paste. I think he’s being way too kind. Radiant is worse than a copy-paste of Aave, they innovated *backwards*.

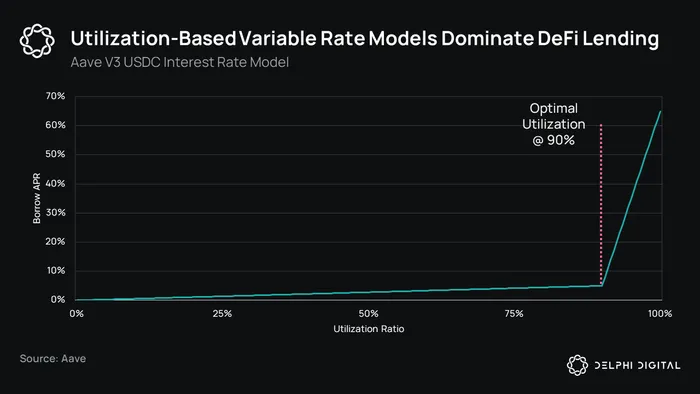

If you read the interest rate derivatives section of our year ahead report, you’re well acquainted with just how big of a problem rate spreads are in DeFi. The utilization-based variable interest rate model works, but it is far from perfect.

The variable borrow rate on most lending protocols is a function of the utilization rate. The rate chart resembles a hockey stick graph, with a hitch at the optimal utilization ratio. As the utilization ratio exceeds the optimal level, the borrow rate increases sharply. This has proven to be an effective measure at pushing the rate back down. The model is far less effective at pushing the utilization ratio towards the optimal level from a smaller point, and we see utilization sit anywhere from 50-85%, which results in problematic rate spreads.

If there is $10K supply and $7K debt (utilization = 70%), and we assume an interest rate of 10%, annual interest cost equates to $700. Once this is split among the entirety of the supply pool, the lending APR is only 7%, leaving a 3% rate spread due to the idle capital.

The spread worsens when you factor in the reserve factor, which is the protocol’s portion of fees. The reserve factor is 10% for Aave’s most popular lending markets.

The supply rate = borrow rate * utilization ratio * (1 – reserve factor).

After incorporating the reserve factor, the lending rate in the above example is 6.3%.

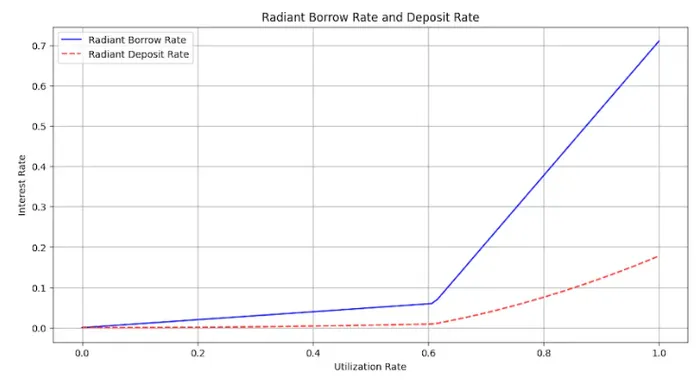

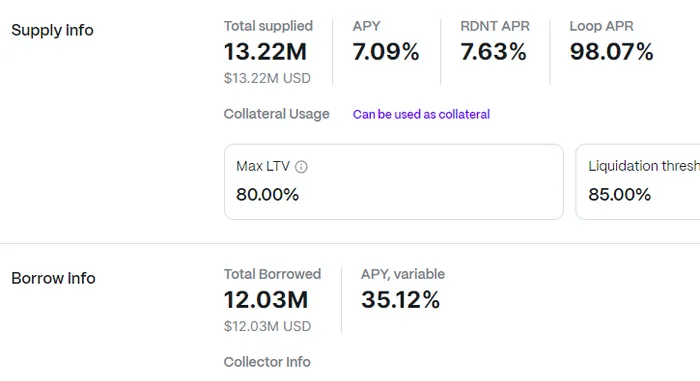

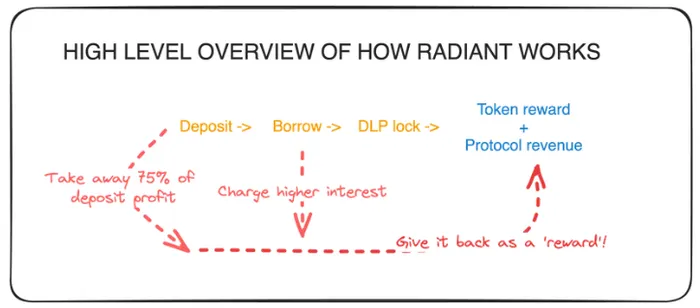

Radiant drastically lowers its target utilization rate and jacks up the reserve factor to 75%. This results in borrowers paying much higher rates, with huge spreads for lenders. This grossly inefficient market exists by design, so that the RDNT token can find a role as a cog in an intricate ponzi.

This research piece by the Backlash Finance team does an excellent job of summarizing how the RDNT token allows the entire system to function.

In a nutshell, Radiant makes a far worse version of Aave in which it creates substantial waste. It masks the added costs for users by subsidizing activity with valueless governance tokens, and creates a convoluted ponzi where users can earn back the waste by locking ETH/RDNT LP tokens.

To create a narrative around the standalone value of the project, they built on top of LayerZero to become the first omnichain lending protocol.

This is like Aave’s Portal feature, which is ready to go, but governance has not deemed it safe enough to deploy at this time. For Radiant to jump ahead on this concept, all to onboard Binance Smart Chain as its only omnichain supported blockchain, feels a bit sleezy and attention grabby. It was also an early sign of Radiant clearly diverging from Aave’s safety culture, which Marc alludes to in his tweet.

Radiant’s design reminds me of my great disdain for veTokens. I consider these projects to be interchangeable. These projects take up developer mindshare and resources, along with retail’s capital, attention, and trust, all to create less efficient markets than we had before. It’s a real shame to see a talented dev team build the nth veToken meta-aggregator which allows veCRV holders to be slightly less down-bad. I will caveat this by saying that while veTokens are just as wasteful and inefficient as projects like Radiant, the way in which the ve-ecosystem came to be was much more organic and experimental in nature than Radiant, which felt like an SBF pool2 from the start.

Regardless, the ‘pasta corridor’ of DeFi feels like it is falling out of favor. There are finally real things to be excited about again. DeFi’s pasta corridor is emblematic of a bear market’s PvP meta. The narrative shift back to RWA’s, parallelization, intents, memecoins, and restaking is a great sign we are heading back to bull market PvE.

I’m not saying we’ve graduated low effort ponzis and DeFi is rapidly maturing. But even before this hack, the CVX, RDNT type games have fallen out of the discussion. PvP speculation games are still here, but they are more simple, they don’t take themselves as seriously or masquerade as something they are not… I don’t know, it just feels different now, in a good way.