The upcoming Shanghai upgrade plus a chaotic regulatory landscape have elevated LSDs and stablecoins as crypto’s two main narratives.

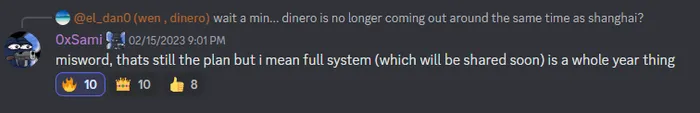

Thanks to its upcoming LSD-backed stablecoin, Dinero, Redacted Cartel is nicely positioned to be the fusion of these dominant themes. The Redacted team has been very tight-lipped about any technical details, but we finally got some hints during the most recent community call. Redacted will soon release a Dinero litepaper, along with a governance proposal to launch the first phase, Pirex ETH, on testnet.

Tokenization of future votes and yield via Reward Futures Notes (RFNs) has been an underutilized feature of Pirex thus far, and looks likely to be a key part of the Dinero stack. Redacted’s experience with veToken wrappers, bribe markets, and token bonding offers several tools that could be repurposed into an interesting stablecoin design.

Speculation aside, BTRFLY currently sits at $57M market cap and may become a major player in two big narratives. Given Redacted Cartel’s existing partnerships, liquidity-centric product suite, and large holdings of FXS/CVX, this LSD-backed stablecoin venture makes a lot of sense. Incentivizing liquidity for DINERO on Balancer and Curve will be seamless, and Redacted has developed strong working relationships with LSD projects who incentivize peg stability on the Hidden Hand bribe market. Dinero represents a lucrative opportunity built on top of an established business. Stay tuned for more updates on Redacted Cartel and Dinero as soon as we know more.