Everyone expected ETH to follow in BTC’s footsteps following the spot ETF filing by Blackrock. On the day, ETH/BTC rallied 13% (from low to high) but didn’t see any continuation after that move.

That said, ETH/BTC finds itself in an interesting position.

ETH/BTC has been range-bound for over two years now. There were three deviations, i.e., false breakouts/breakdowns from the range with no follow-through. Currently, we are seeing a potential deviation in the making which, if confirmed (on a weekly close above 0.057), then the range highs around 0.07 will be eyed.

Although unconfirmed, we have some evidence that might lend support to our hypothesis.

The ETH/USDT pair has successfully closed three weekly candles above the weekly range highs. It has also successfully retested that region as support. The last time ETH attacked this region was in May, but it was met with a strong rejection. The lack of a strong rejection this time around is noteworthy.

Also, the fact that BTC’s spot ETF approval timeline is fast approaching (less than 2mo), the R/R of being long BTC diminishes with each passing day. Considering these two factors, it seems likely that ETH would stick to this breakout and eventually trade higher around the mid-2000s.

The funding rates have neutralized, and the basis is slightly negative, which suggests spot-led bids coming in.

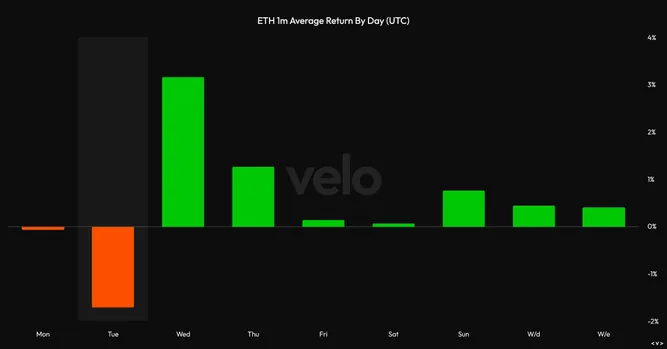

Lastly, ETH has sported its highest weekly returns on Wednesday in the past month. Given how primed the setup is, we might finally be in for a breakout of this range this week.