In the May 10th activity feed post, CPI Print Meets Expectations, we noted a few key points:

- “Inflation slowed for the 10th consecutive month, with CPI coming in at roughly 4.9%, slightly lower than the 5.0% expectations.”

- “As noted in the tweet, with the labor market remaining strong, corporate earnings surprising to the upside, and inflation still at unacceptable levels, a June rate hike cannot be ruled out.”

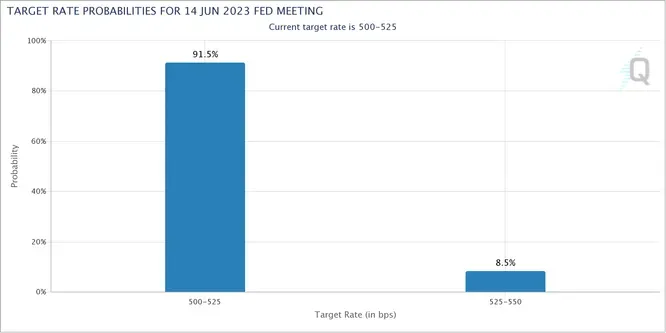

The above is a screenshot from May 10th, indicating a >90% of no rate hike at the upcoming June FOMC meeting. What happens if we fast forward a week? Well, this was discussed in last week’s activity feed post titled, Revisiting Interest Rate Expectations Post CPI.

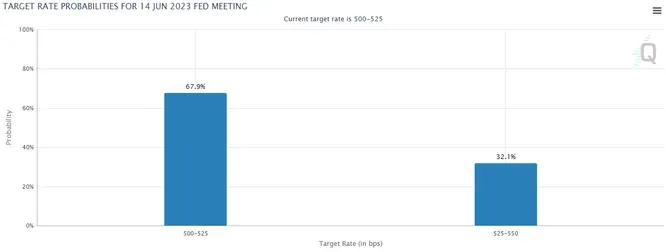

The above is a screenshot from May 18th, indicating that markets had begun to price in a higher chance of an additional 25bps rate hike at the June FOMC meeting. This change occurred on the back of the most recent CPI print.

So what happens if we fast forward another week?

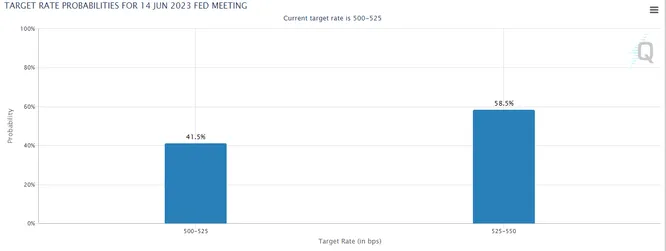

The above screenshot was taken this morning, May 26th. As we can clearly see, markets are now giving a nearly 60% chance of an additional 25bps rate hike at the June FOMC meeting. Quite the stark contrast to what was seen just 2 short weeks ago, right?

Revisiting a quote from last week, “The longer I continue to participate in markets while actively managing capital, the more I realize that things are never ‘really’ fully priced in.”

I hope this short 3 week exercise helped shed some light on the ‘forecastoooooors’ and how market pricing probabilities are never set in stone, and can (and will) often be wrong.