Rune (Maker founder) caused quite a stir on CT the other day with his proposal to begin development on a Maker appchain based off of the Solana (SVM) codebase. This tweet has reached >1M views in a few short days and numerous discussions. First, a quick summary of what Rune is actually proposing:

- “NewChain” will be a standalone blockchain to handle Maker’s back-end operations

- This chain is not to be launched on Solana, but rather fork Solana and create a new L1 with its own validator set

This has sparked a lively discussion in the Maker forums over the past few days with people from various communities and ecosystems coming in to pitch their own solutions, from the Solana community being supportive or arguing why they should just launch on Solana, from Ethereum people asking why not an EVM rollup, to Eclipse suggesting an SVM rollup instead of an SVM L1, to Cosmos arguing why the Cosmos SDK’s customizability is the ideal model for Maker.

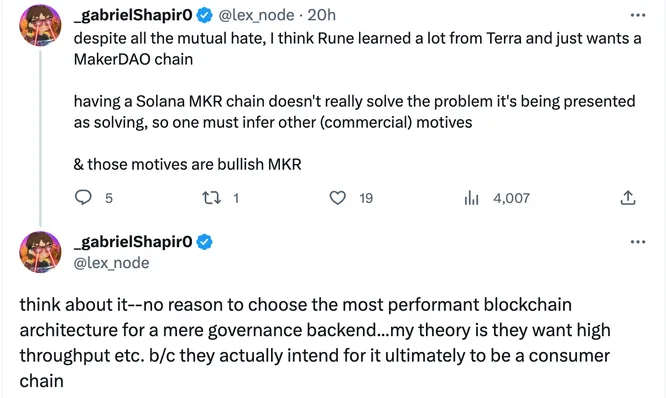

So why an SVM L1? Rune argues Solana has a strong community of developers growing and technically superior to other options giving it the scale it needs. He also argues they need to be an L1 to fork, although as many others have pointed out this isn’t strictly limited to an L1, sovereign rollups can also fork as well. But are these the real motives? I think Gabe had a good point here that may be hidden under all of the debate, if Rune wants to fork one of (if not the) most high performant chain then there must be a commercial motive as well.

This is where I believe we’ll see a lot of DeFi protocols go, namely, trying to become a complete consumer finance app. This is the endgame for all the successful DeFi protocols. Think about Uniswap. Their recent shift with UniswapX is a move away from AMMs. Uniswap fillers don’t even need to use Uniswap for their routing or filling orders. Add in the Uniswap wallet and it’s clear what Uniswap is leveraging, their brand. I believe in a few years AMMs will not even be what Uniswap is known for the most; they’re trying to be the killer consumer finance app and that means building off of their brand.

As a fun side-story, Vitalik sold some of his MKR shortly after Rune’s post, which we don’t have much to add other than to say it is indeed quite funny.

For Solana, regardless of what Maker decides it can’t be looked at as anything other than a positive. Solana becoming one with the “appchain thesis” is definitely not a narrative they would pitch themselves, and to see it rise organically by external parties is absolutely a sign that they’re doing something right. Even though this chain would not pay SOL in fees, or use SOL as the gas token (would use ETH or MKR), it adds to Solana’s developer moat which, imo, is the most important metric when deciding if an L1 ecosystem is to “make it”.

I’m sure there will be a lot of back and forth here, and this is merely a proposal at this stage, but it’s an important one to follow; Maker is the OG DeFi app with arguably the most success, the only other in its category being Uniswap. The implications are not to be understated.