Axie Infinity’s utility token SLP has seen outsized growth in the midst of this recent increase in market activity. Over the past seven days, SLP has pumped over 70% & roughly 100% over the last 14 days. We saw similar price action across Sky Mavis’ other core tokens (AXS & RON), although to a much lesser extent.

A sudden increase in volume caused the spike, most likely in preparation for the eventual announcement from Binance that stated the CEX would introduce SLP perpetuals on October 31st. On October 29th, the trading volume for SLP increased by 762% overnight, followed by a further 179% on the 30th ($6.95M to 166.88M over the 48 hours leading up to the announcement). Trading volume for AXS and RON increased by 306% and 666%, respectively, over the same 48-hour period.

Front running aside, this was enough to direct my attention back to the Ronin ecosystem. So, here is a quick update and some predictions on where thing may go from here.

Starting of with Axie Infinity, throughout October, an average of 10 SLP tokens were burned (via in-game sinks) for every 1 SLP minted (as in-game rewards). This has changed somewhat since the price pump, as I assume more players focus on min/maxing token rewards, but this is far better than at Axie’s peak in late 2021.

Axie Infinity (Origins) is one of the most popular Web3 games on the market. According to Nansen, there are roughly 150 new Axie holders every day, and the total number of new Axies minted (which burns SLP) bounces between 500 and 1500 per day, depending on whether a new season has launched or not. IT is this core player base that is the focal point of the wider Ronin ecosystem.

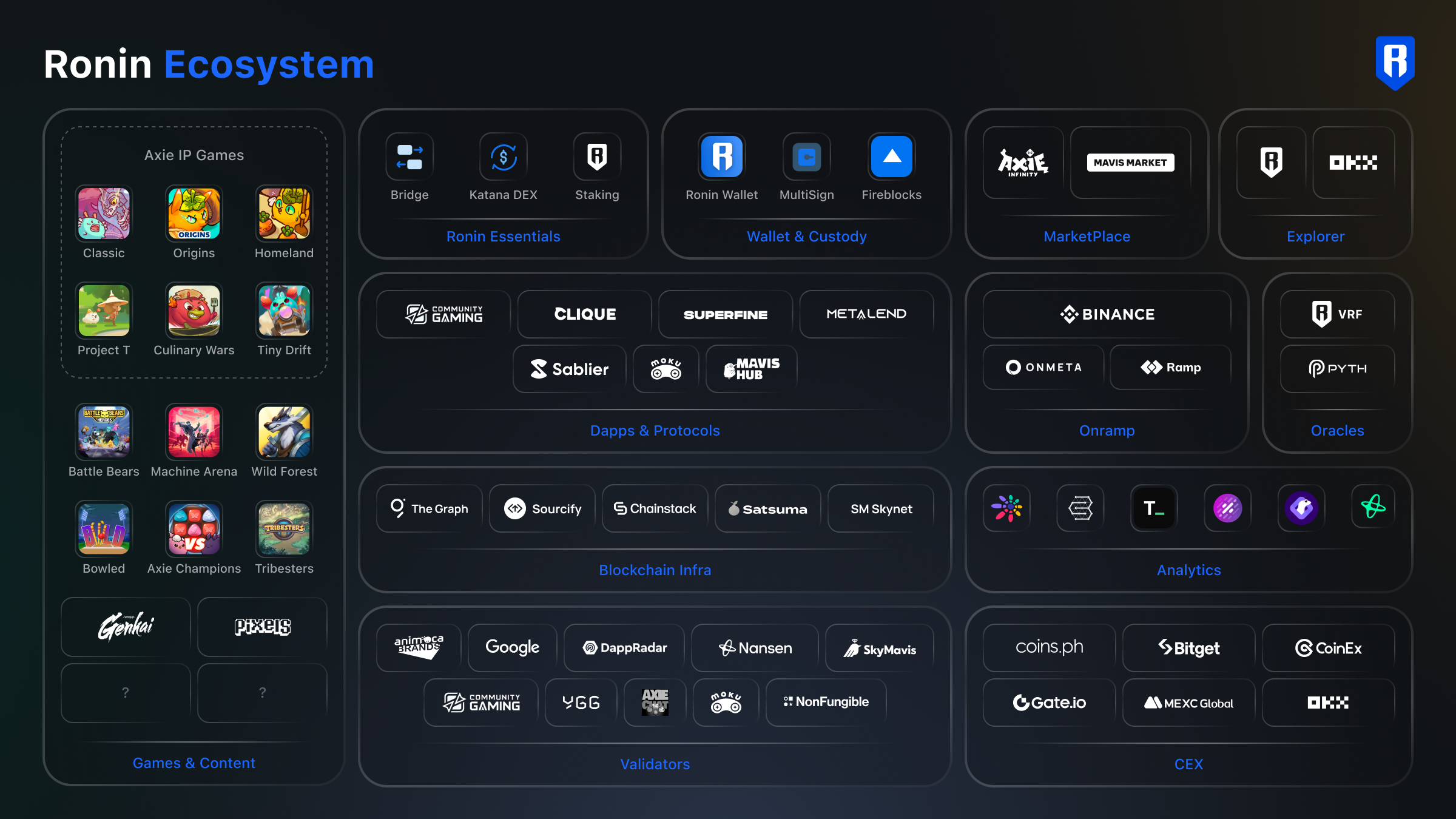

The Ronin ecosystem has seen considerable growth since this time last year. Aside from launching a number of casual games under the Axie IP, Ronin has onboarded half a dozen third-party studios.

Most recently, Pixels, an open-world farming sim similar to the legacy title Stardew Valley, moved from Polygon to Ronin. Pixels has a reported 100k monthly active wallets, 5k DAU, and roughly 1.5M monthly transactions. Shortly after migrating to Ronin, the Pixel team reported that players were spending an average of 5x less in costs across all types of transactions and as much as 10x less on gas when minting NFTs.

Pixel’s native utility token BERRY (and soon-to-be-released PIXELS) launched on Ronin’s native DEX Katana via a RON/BERRY liquidity pair on November 1st, and saw a 50% increase in price over the past 24hrs. BERRY currently has almost 2.4k holders on Ronin and almost 2k holders of their genesis land collection on Ethereum.

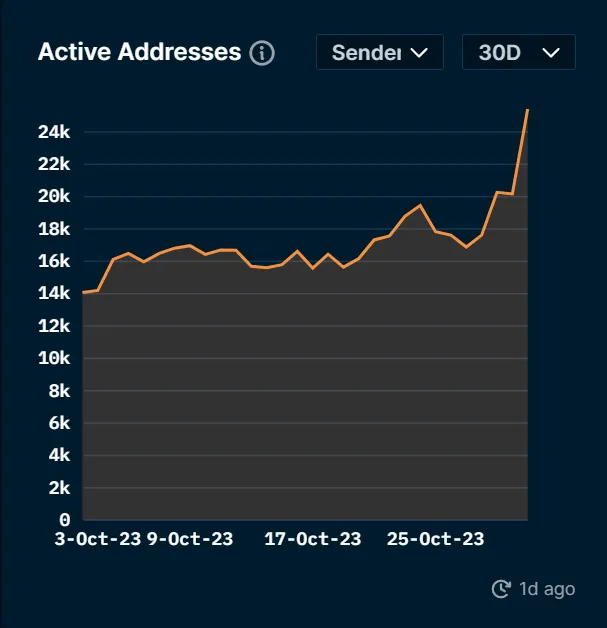

This gradual onboarding of new games is exactly what Ronin needs to attract new users. The number of active addresses on the Ronin blockchain has increased by 80% over the past month to reach more than 25k daily active wallets (out of 11.47M total Ronin addresses). Seeing as RON is the native gas and exchange token used throughout the Ronin ecosystem, this will directly increase demand for the token. That said, will this directly lead to value accrual for RON?

Ronin lacks any buyback, burn, or halving mechanisms that would help reduce supply as demand increases. Ronin will implement a DAO, however, which will be responsible for treasury allocation. So, although we can not say for sure how the treasury will be used to drive value back to the token, as almost all DAOs are self-serving, we should find out soon.

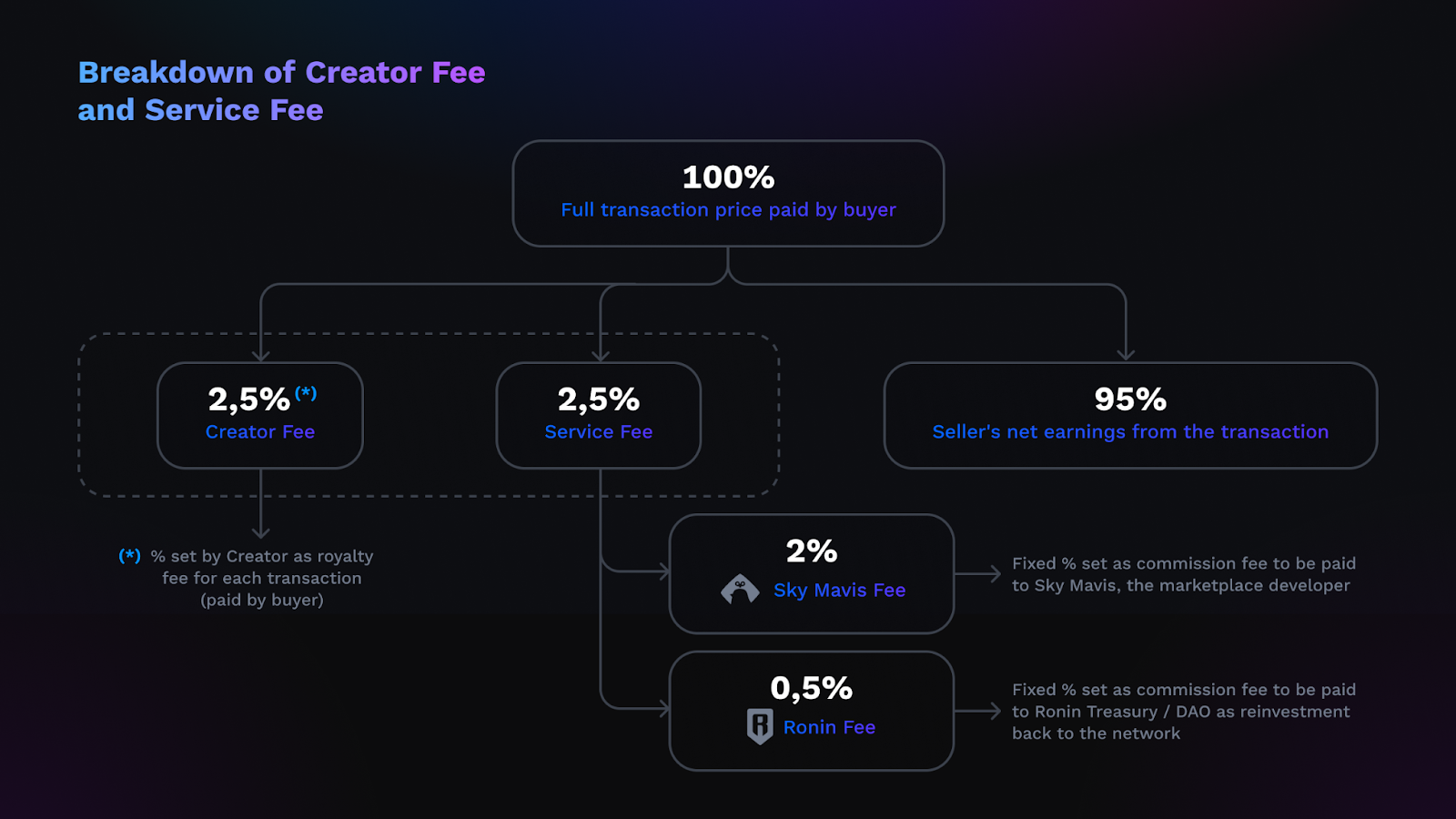

Currently, 0.05% of all fees on Katana DEX will go to the Ronin Treasury. With a cumulative total of $8.69B in Katana DEX volume, this is no trivial amount. Further, this does not include the 0.5% of all RON marketplace fees that also flow into the treasury. Only time will tell how these funds are allocated, but as mentioned, the majority of proposals will likely serve one of two purposes: onboard more users and increase the value of Ronin’s ecosystem token(s).

Regardless, based on Ronin’s self-published token release schedule, there is between 65% and 69% of the total token supply unlocked at the time of writing. By the end of Q1 2024, that figure will have reached just over 80%. Over 155M RON (20% of the total unlocked supply by the end of Q1’24) is currently being staked across 22 validators (a number that is steadily rising), and Sky Mavis has reportedly sold almost none of their unlocked holdings.

Ronin’s calculated approach of onboarding new projects and users into the ecosystem, paired with a potentially impending bull market, makes RON a token I will be paying close attention to once prices retrace a little from the currently unsustainable highs.