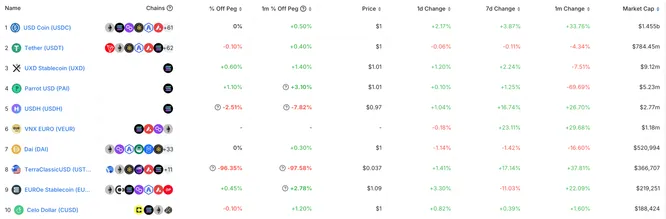

Solana is getting a new stablecoin from MarginFi expected to be released on mainnet in mid to late March. If we look at stables on Solana, $2.24B of the $2.26B total (99%) are from centralized stablecoins USDC and USDT. There are not really any decentralizes alternatives. UXD is an Ethena type model that only uses DEX’s which has proven harder for it to scale.

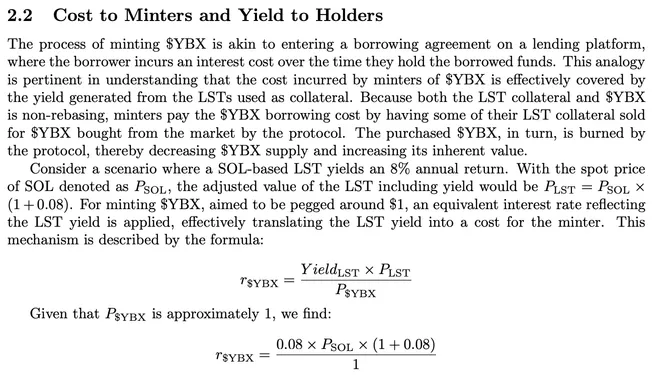

MarginFi’s stable YBX is a CDP stable like DAI but with one small twist. The stable is to only be backed by LSTs jitoSOL, mSOL, bSOL and LST (MarginFi’s own SOL LST. The yield from the LST will be directed to the stable, giving it a 6-8% or so native yield. Similar models have been tried on Ethereum last year but they never gained much traction. Solana has no dominant CDP like DAI however ($5B outstanding) so there is an opportunity for someone to step in here.

The way YBX works is quite simple.

-

Borrowers deposit LST

-

Borrower mints YBX

-

Yield from LST is sold for YBX which is then burned

Borrowers who mint with an LST pay the opportunity cost of their forgone yield. This yield is sold by the protocol over time for YBX which is then burned & increases value of YBX.

MarginFi will be waiting for Sanctum’s launch to have ample liquidity for LSTs on-chain. Also, the USD is not rebasing, the yield will continue to accrue to the price (like a c-token) and so the value of YBX will drift from $1.00 over time.

For the full breakdown you can check out the whitepaper in the tweet linked above.