To follow on Yun Heng’s post on “Blur’s New Product Suite: Blend”, it’s been really interesting to observe user behaviors since its launch…

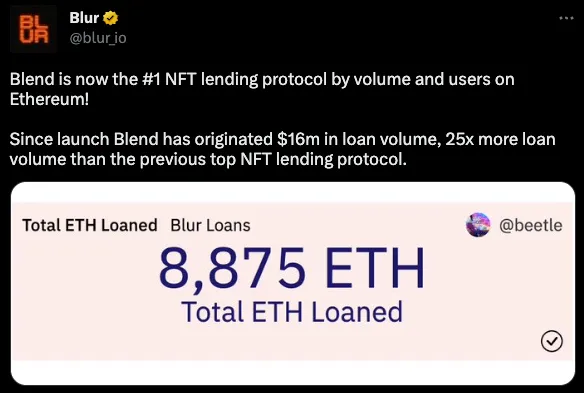

Blend is providing borrowers the highest LTV + lowest APRs for loans — subsidizing it with $BLUR tokens. It’s no surprised that Blur is seeing a large amount of loan volume in these last few days.

The question we should be asking is: What’s the end goal here? All of the lending activity is clearly inorganic (ie. lenders wouldn’t be making these types of loans if there were no token incentives).

When you can buy an Azuki for 0.6 ETH upfront (LTV 95%+), it becomes more akin to an at-the-money call option, rather than a loan. It also creates price volatility, bringing traders in.

We’ve already seen some interesting behaviors here (below) as lenders rush to earn lending points. Pretty sure there’s more insanity to come!