Vertex is introducing its VRTX token via a Liquidity Bootstrapping Auction (LBA), ensuring liquidity from inception. Nevertheless, it is imperative to underscore the potential risks of participating in the LBA.

Source: Vertex Twitter

The LBA operates on two isolated pools comprising pre-allocated VRTX tokens from trading rewards and USDC. Given the implementation of an XYK AMM, the VRTX price will be calculated as follows: Amount USDC / Amount VRTX in the pool = VRTX price.

Upon conclusion of the LBA, the two pools will combine to establish the VRTX-USDC Liquidity Pool (LP) on the Vertex AMM.

Participants opting to contribute liquidity to the LBA will have their LP position locked for 120 days. To elaborate, 1/3 of the liquidity will be vested on the 60th day, with the remaining 2/3 undergoing a linear vesting over the next two months.

Source: Vertex Twitter

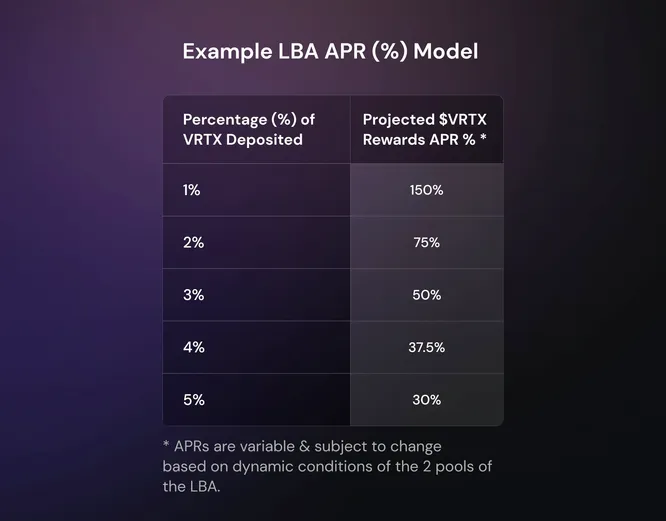

Notably, 1% of the total VRTX token supply, or 10M VRTX, is earmarked as LP rewards to incentivize liquidity lock-up for LBA.

Risks of Participation

-

The VRTX tokens supplied are acquired in advance through farming trading rewards. As an initial participant on the USDC side of the pool, you effectively ‘purchase’ the required VRTX for the pool from users who have previously farmed it.

-

I harbor reservations regarding the adequacy of VRTX rewards in offsetting the Pool2 risks associated with VRTX-USDC LPs. The VRTX rewards, exclusive of liquidity provisioning, are released during the token genesis phase and are immediately available for sale. You inadvertently become the exit liquidity by contributing liquidity during the LBA.

To provide a backdrop, the initial token phase of trading rewards constitutes 9% of VRTX’s total token supply. With only 21.5% of the supply in circulation, these trading rewards account for ~42% of the initial circulating supply.

-

While Vertex’s LBA is pivotal in price discovery, it is crucial to acknowledge that alternative methods such as Liquidity Bootstrapping Pool (LBP) or Dutch Auction could have been employed to foster protocol-owned liquidity. These options were likely bypassed to mitigate the risk of being targeted by snipers post-launch.

-

Another plausible rationale could be the protocol’s deliberate choice to refrain from serving as the initial LP, a strategy to avoid the burden of being the exit liquidity. This responsibility is subsequently transferred to public liquidity through the LBA process.

-

It is important to note that the liquidity provided via LBA is temporary, with a tenure of 120 days. There is a potential for a linear decrease in participation, mirroring the vesting schedule, particularly if the performance is suboptimal.

Before participating in the LBA, participants must diligently evaluate the risks before committing their assets.