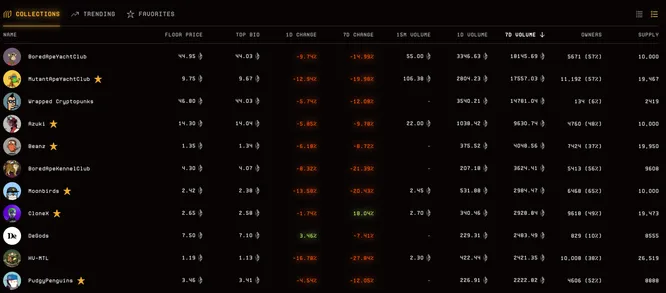

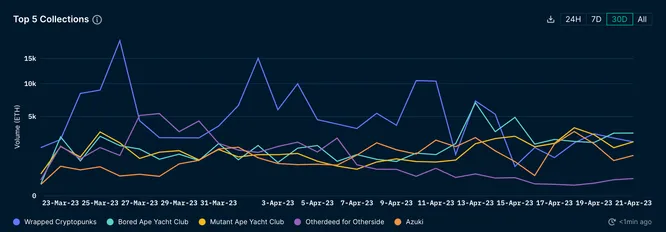

NFT floor prices have fallen off the cliff as the majors (e.g., BAYC and CryptoPunks) saw their floor prices plummet more than 10% over the past week. As the tweet rightfully mentioned, there are not enough real buyers and too many real sellers. More details on possible reasons why this is so are covered in the thread.

While Blur has deepened the liquidity of NFTs, it has also accelerated the process of NFT projects finding their true floor price. While Blur’s bid side incentives drove up prices and disrupted a longer-term downtrend in NFT floor price, the current Season 2 incentives are causing higher selling pressure as point farmers become more willing to take losses in hopes of higher opportunity costs from BLUR incentives, while actual buyers remain sidelined to wait until the knife stops dropping.

This is likely not a direct result of Blur, as CT likes to point fingers at, as the majority of sell-side pressure is derived from OG holders who started selling in size, including Franklin, OSF, J1mmy.eth, and Machi Big Brother, as well as farmers who are fighting a PVP battle on Blur/OS Pro to dump at the next lowest floor price to continue bidding and earning points.

Prospective collectors can take advantage of the current market environment and take a closer look at accumulating NFTs they have a huge interest in. Further, for those looking to gain price exposure to NFTs without holding them, you can also check out NFT perpetual exchanges such as NFTPerp and Tribe3, which are both in beta (NFTPerp is in public beta, while Tribe3 will go into public beta on May 3). Both protocols allow holders to long or short specific NFT collections at a fraction of the underlying asset’s cost, up to 5x leverage, unlocking a new primitive for the NFT sector.

Stay tuned for more in the upcoming NFT Perpetuals report