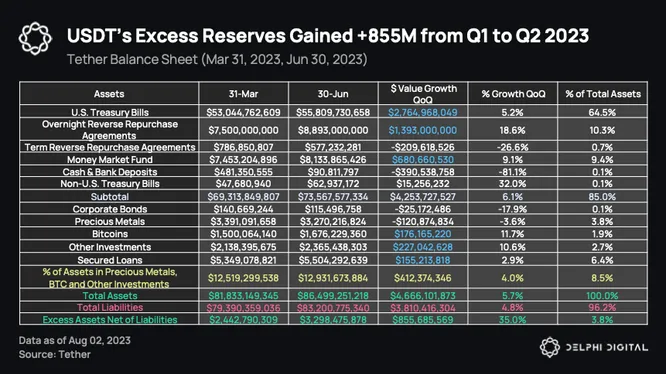

Tether has generated $855M in excess assets net of liabilities and reported operational profits exceeding $1B in Q2 2023. Tether’s straightforward business model leverages USD collateral backing USDT to invest in short-term US Treasury bills or US reverse repos, thereby earning interest yields. These profits are held in excess reserves, providing over-collateralization that can be used as a backstop if needed.

In comparison with USDC, however, USDT’s asset balance carries a higher risk. ~8.5% of its total assets are invested in volatile assets such as precious metals, Bitcoin, and other investments, including renewable energy production and Bitcoin mining. In a worst-case scenario where these assets lose >50% of their value, USDT would be slightly undercollateralized after accounting for surplus assets.

Despite the inherent risks, Tether’s position allows it to take on higher-risk bets, given its annualized revenue generation of approximately $4B, yielding a significant profit margin. However, this strategy is only viable in a high-interest rate environment. As interest rates are anticipated to approach terminal rates, the potential for revenue growth for Tether may be limited.

Also note, previously, USDT’s asset profile included commercial paper — an unsecured debt instrument — from which they likely reaped significant returns. However, they have since removed commercial paper holdings from their balance sheet, replacing them with U.S. T-bills, as reported on October 13th, 2022. This shift may be more than a coincidence, as rising interest rates enabled USDT to pivot to T-bills for profit generation.

In terms of redemption risks, the primary concern arises from the limited cash float held by Tether, comprising only 0.1% of its total assets. Even when including overnight repos, they only have 10.4% of highly liquid cash that can be quickly accessed for redemptions. However, this is unlikely to pose significant problems given that they hold short-term T-bills, which can be liquidated with minimal losses to manage high-volume periods.