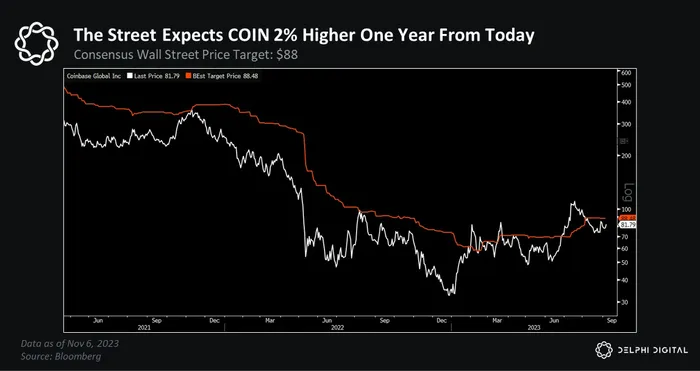

How should we think about Coinbase? Is it a stodgy stonk with risk-averse management? Or an innovative crypto juggernaut that serves as an index play on the entire space?

Wall Street believes the former; we believe the latter.

In our recent report — Coinbase: From Sleeping Giant To Industry Leader — we make the case that Wall Street is wrong to value $COIN like a bank and argue that Coinbase is crypto’s leading “everything app.” The following post is an excerpt from the deep dive report.

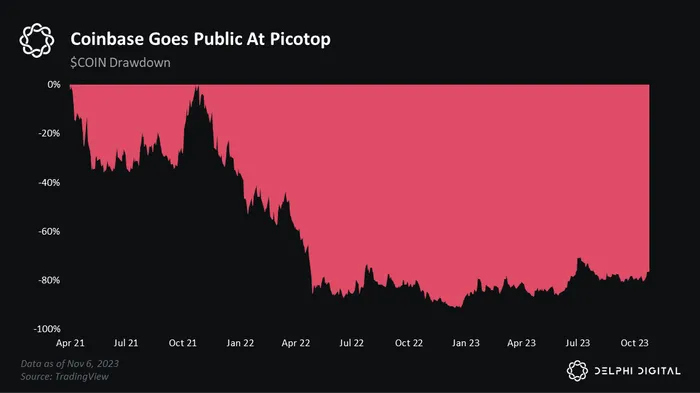

But first, some context. Coinbase went public — via direct listing — on April 14, 2021. Since then, the stonk has gone downonly.

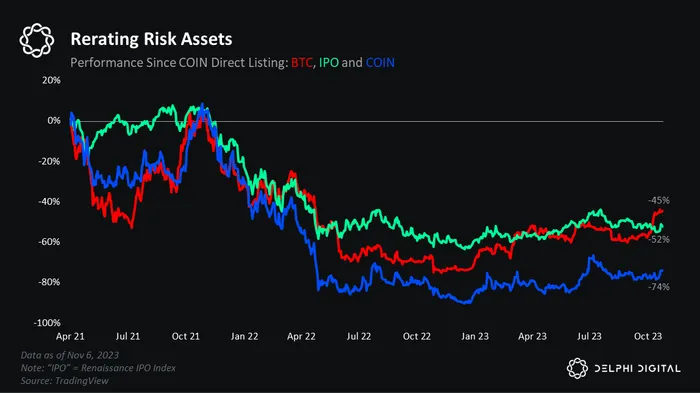

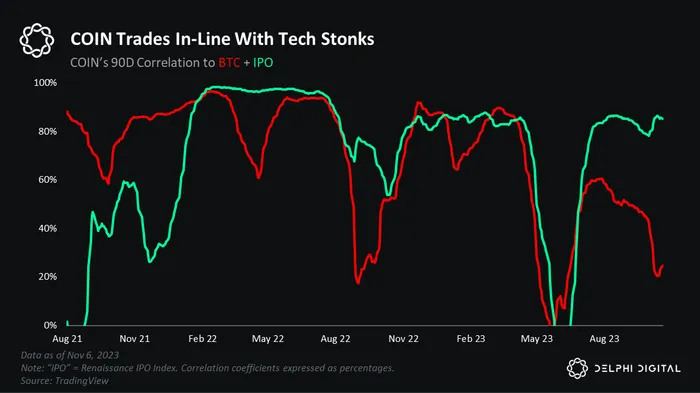

The macro climate is to blame for COIN’s dismal price action. High interest rates and restrictive monetary policy have not been kind to computer coins or high-flying tech stonks.

As a public company, COIN is beholden to boomer metrics like revenue and earnings. Crazy stuff, I know…

But despite the macro headwinds, COIN ripped this year. It’s up 154% YTD.

Nevertheless, we believe COIN remains compelling at these levels (-76% from ATH) and is fundamentally misunderstood by many investors, including the so-called experts on Wall Street. This report aims to fix that.

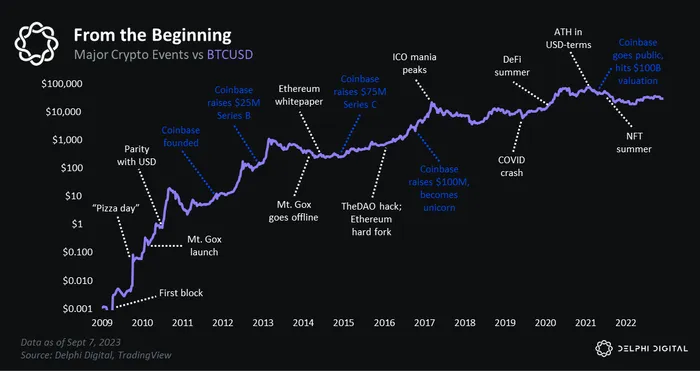

A Certified OG

Coinbase was founded on June 20, 2012. That same day, the price of BTC hit $6.65. It would be another year and a half before the Ethereum whitepaper was published. At the time, much of “crypto” still lived on Mt. Gox. Coinbase was that early. It’s a certified OG.

Over the years, Coinbase’s OG bona fides have meant different things. In the beginning, Coinbase was a disrupter—a brash startup operating at the bounds of legality. But things have changed. Today, Coinbase is a well-run, highly regulated, and very traditional corporation. Part of this is by design: it’s a public company! But mostly, it’s due to deliberate operational conservatism.

Until this year, Coinbase was the Apple of crypto. It had the best UX and the most trusted brand – for which it charged a premium. In true Cupertino fashion, Coinbase was happy to be the second or third-mover and let competitors enjoy the highs and suffer the lows associated with life at the bleeding edge.

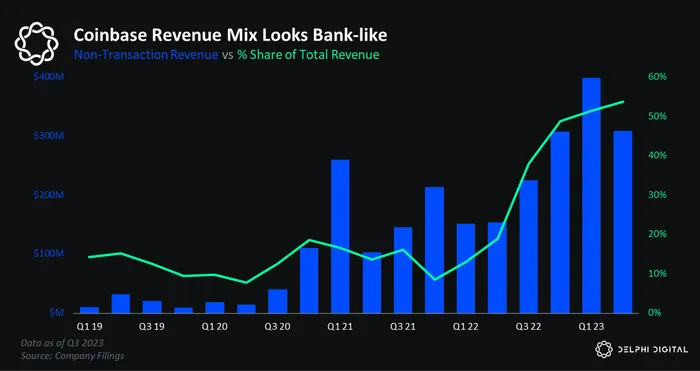

We can actually see Coinbase’s conservatism reflected in its financials. For many years, COIN was criticized for its reliance on volatile trading volume. Around the time it went public, trading fees — “transaction revenue” in Wall St. terms — accounted for over 90% of Coinbase’s total revenue. Today, trading fees make up less than 50%, a remarkable feat of revenue diversification over two short years.

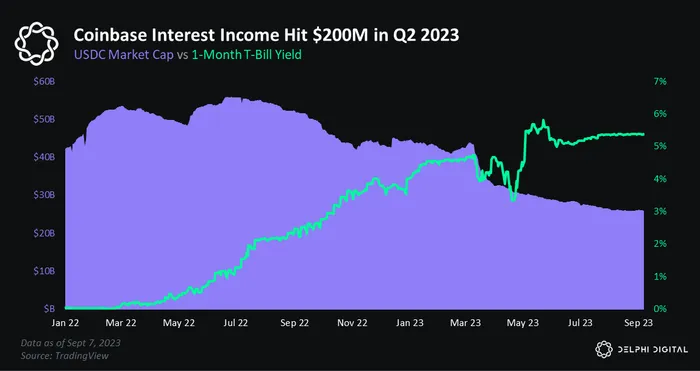

A big driver behind Coinbase’s “non-transaction revenue” — everything outside of trading fees — is Mr. Jerome Powell. We’re, of course, referring to Coinbase’s interest income, which is derived from investing USDC deposits into short-term T-bills.

The nice thing about non-transaction revenue is it’s less cyclical and more resilient during bear markets than trading volumes and transaction-based revenues. The stable, recurring cash flows Coinbase’s interest income provides is like a siren call for Wall Street. And it’s led to COIN being valued more like a bank than a diversified crypto juggernaut. While these sticky revenue streams are great, we believe they undersell and perhaps even distract investors from the stonk-pamping revenue growth COIN could soon see.

Outside of Coinbase’s existing revenue streams — trading fees, interest income, etc — we see three main areas for growth:

- International perps

- BTC ETF

- Base chain

Pushin Perps

Right now, Coinbase’s business is heavily concentrated in the United States.

As the SEC v Coinbase lawsuit reveals, the regulatory climate in the U.S. is quite hostile. Coinbase would like to derisk its business by attracting users and revenue beyond the reach of Gary G and his band of overzealous protectors. Coinbase’s international perps exchange, available today via API trading, is key to this effort.

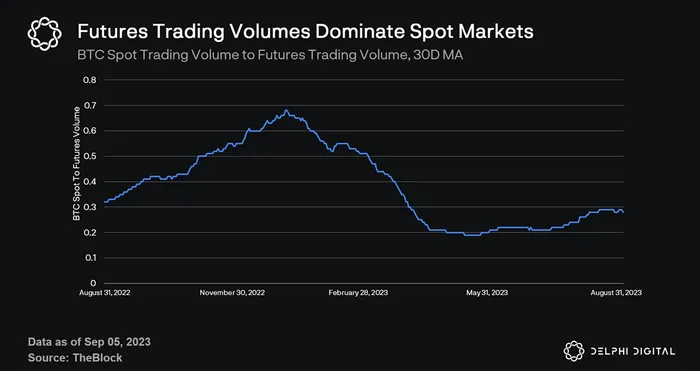

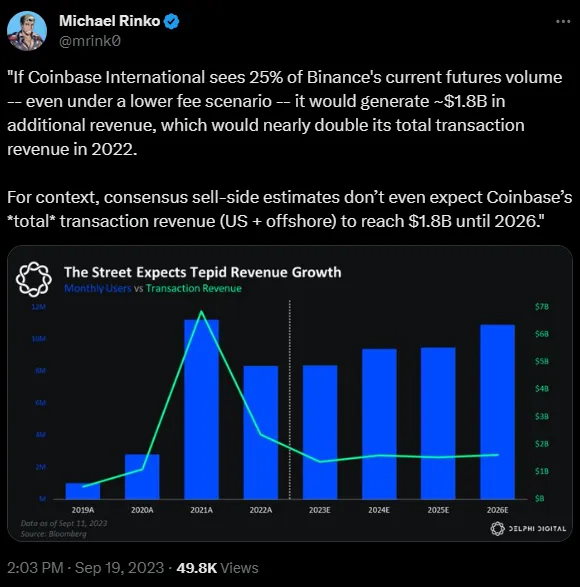

It also helps that the perps market is massive. It’s orders of magnitude larger than the spot crypto market.

In our report, we outline projections for the offshore perps market share Coinbase could acquire and then back into what that could mean for Coinbase’s top and bottom lines. Hint: offshore perps could become Coinbase’s largest revenue line item within three years.

Custody is Cool

To most, custody super boring. To us, it’s yugely interesting. Partly because crypto’s track record of centralized custody is sketchy, to say the least. See: Mt. Gox, FTX, etc. But also because custody in and of itself could mean big business for Coinbase.

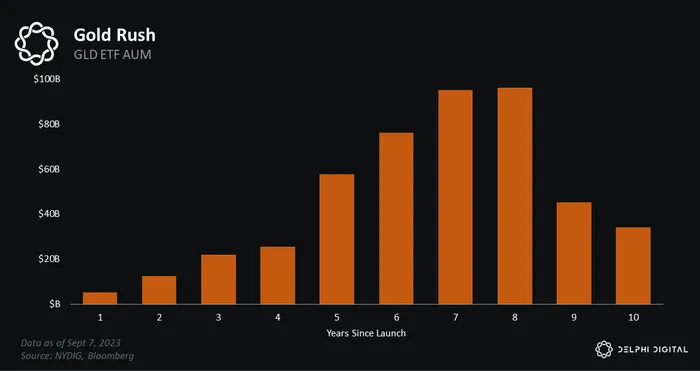

Bloomberg’s ETF experts now put the odds of a BTC ETF approval at 90%.

Coinbase is listed as the custodian for nearly all the ETF applicants. This means that when (not if) a spot BTC ETF is approved, Coinbase will enjoy a new revenue driver. In the report, we estimate the demand a spot BTC ETF might see, the fees Coinbase might charge, and the impact on COIN’s top and bottom lines. Hint: this is also a big deal. Custody is cool!

Stay BASE’d

For over a decade, Coinbase struggled with a paradox. It’s been a vocal backer of decentralization, but it’s also one of the world’s largest centralized crypto companies. There’s a certain tension between the two. On one hand, Coinbase’s philosophical ideals, and on the other, the practical demands of making money as a public company.

In February 2023, Coinbase finally conquered its founding contradiction. With the launch of Base – an Ethereum L2 built on the OP Stack – Coinbase is insulated from a “decentralization eats the world” scenario, while also massively expanding its reach onchain.

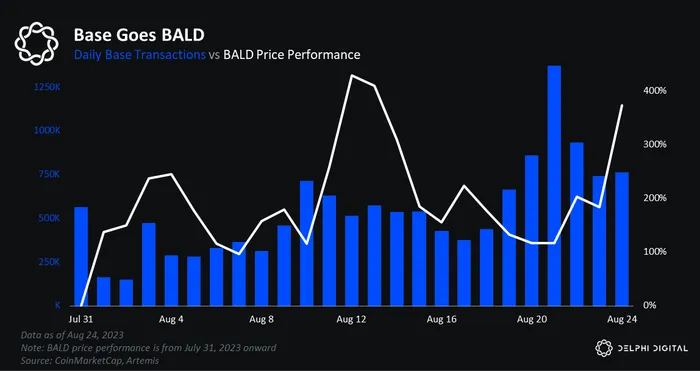

In just a few months post-launch, Base already boasts a leading memecoin…

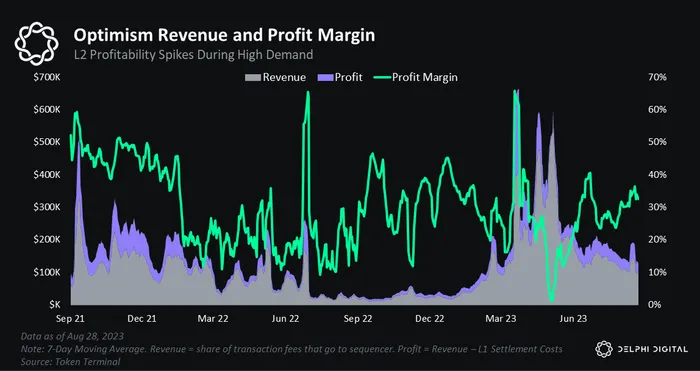

…and a novel application for speculation (friend.tech). These are the two ingredients needed for any successful crypto ecosystem. If we use Arbitrum and Optimism as comps, we can project Base’s future revenue (transaction fees) and profit (transaction fees – L1 settlement costs).

We outline a bear, base, and bull case for Base and its value accrual for COIN. While the opportunity isn’t as large nor as immediate as perps or an ETF, Base may be the most critical part of Coinbase’s long-term vision. To find out why, check out the report.

In summary and summation, we believe Coinbase is primed to explode. Its legacy business is rock solid and profitable. And its new ventures may prove to be even bigger and more profitable. Best of all, Wall Street is asleep at the wheel. Its projections assume we never see another bull run, and they also overlook COIN’s new driver drivers entirely.

The gap between expectations and reality will not last forever. The opportunity is now and the ticker is $COIN. We like the stonk.

Bonus Points:

What do you think about Coinbase?

What new products are you most excited about?

Have you noticed a vibe shift w/r/t the company’s strategy over the past year?

Are you bullish on bald founders?

Let us know in the comments below!