As someone who loves Bitcoin and thinks fiat is always doomed to fail, I find myself in the odd position of defending the dollar – at least in the short term. As mentioned a few times in these feed posts, I think the ‘Death of the Dollar’ narrative is overblown. Many market participants, macro commentators, and BTC/Gold maxis think the dollar system is in imminent danger of collapse and will take the dollar down. Of course, the reality is that the dollar is here to stay.

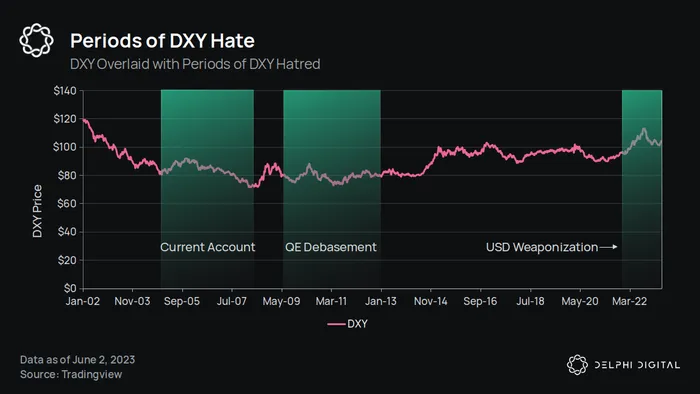

Interestingly enough, the ‘Death of the Dollar’ is not new. According to Jens Nordvig in this great little article, there have been two prior periods of dollar hatred in the last twenty years, on top of the current trend.

Here are the periods in order:

- Current Account: This wave of dollar hatred occurred around 2004 – 2008. Strong non-US economies and optimism around emerging markets caused investors to sell their dollars for other currencies. Concerns around the current account and energy prices also drove the dollar down. Weirdly, however, the GFC of 2008 saw investors fleeing to the dollar as a safe haven asset, buoying up the dollar.

- QE Debasement: Between 2009-2013, the dollar experienced a new round of hatred brought on by concerns around monetary expansion and QE. However, this period ended when the euro crisis ended EUR strength, China’s credit crisis ended CNY strength, and the Fed started hiking rates.

- Weaponization: Finally, the current crisis revolves around the US leveraging its financial system through sanctions, which some think will cause other nations to instantly drop their USD (and the US system) for alternative systems and currencies. As the article mentions, there is still no viable alternative system, so the dollar is here to stay in the short term.

As you can see from the above chart, despite the periods of hatred, the dollar is still here and has performed well. This history of dollar hatred is crucial because people still champion BTC as an alternative to the dollar and the US financial system. BTC isn’t there yet. It may be in the future. But not yet. Although, Ethereum and other smart contract chains could strengthen the dominance of the USD through popular stablecoins like USDC, USDT, and DAI.

Dollar sentiment seems at an all-time low – which to me looks dangerous for risk assets. In the prior two periods of dollar hatred, the DXY reversed when sentiment was negative and showed surprising strength. If sentiment changes and the DXY continues its rally, it could mean risk assets like BTC face some headwinds.

Thankfully, crypto assets have a lot of other factors which affect their price – like adoption, speculative fever, and new technological developments. So there is the potential for crypto assets to weather DXY’s strength. But for now, the negative sentiment towards the DXY, and its recent rally, makes me cautious about crypto markets. The DXY could show some strength and ruin the party.