Longer duration US Treasuries are now expected to be more volatile than the SPX in the coming months. The spread between the three-month implied volatility on the TLT relative to the SPY is now at its highest level since at least 2005.

The sizable rally we’ve seen in longer duration Treasury yields is one of the signals we’ve been waiting for as an indication the market is starting to sniff out something’s amiss.

The real trouble isn’t so much the sizable drawdown we’ve seen in riskier assets. The real problem lies in the record value destruction and increased volatility we’re seeing in sovereign debt markets, particularly for longer duration debt.

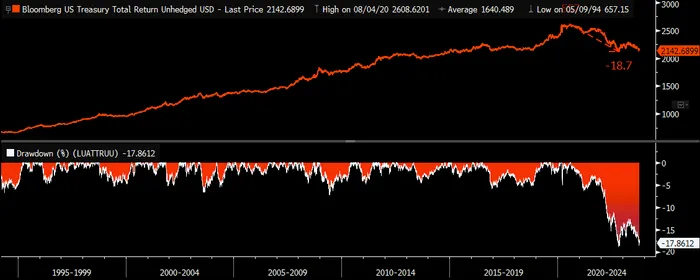

Sovereign bond markets are in the midst of one of the worst drawdowns on record – suffering even greater losses than global equity markets.

Meanwhile, longer duration US Treasuries (USTs) have now experienced a nearly 20% drawdown – quite an extreme move for the world’s “risk-free” safe haven.

Price stability in these markets is crucial given their widespread use as preferred collateral. Selloffs in sovereign bond markets drag on global liquidity, so when volatility rises, it triggers alarm bells.

The shift away from longer duration USTs to shorter duration alternatives (i.e. T-bills) and yield-bearish cash accounts could start to get problematic. If demand for longer duration USTs dries up, the deterioration in liquidity will start to cause major disruptions, especially given an already fragile Treasury market.

When the most widely-used collateral assets suffer substantial losses, and heightened volatility forces liquidity providers out of the market, that’s when things start to break.

We’re not quite there yet, but the risk is rising…