1inch Shielding

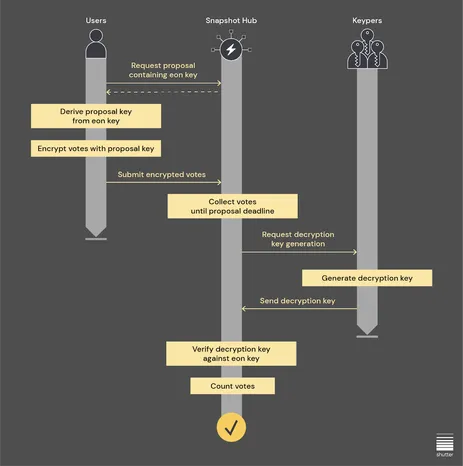

1inch has received a proposal from DAOplomats.eth to upgrade 1inch’s voting with shielding. The shielded voting upgrade is a Shutter implementation on Snapshot and would help protect voters from front running and MEV. Shutter protects the vote by hiding the results of the vote until it is over. Shutter hides the votes by encrypting users’ votes with a Proposal and EON key from Snapshot. The encryption hides the user’s vote until the vote ends, at which point the votes are decrypted.

As users know, the vast majority of voting in DAOs is public throughout the entire vote. Public voting is not ideal as it can lead to voter apathy or vote front running. Private voting can allow DAO voters to enact a more equitable approach to voting on proposals. Shutter’s approach to shielded voting is still very new and relatively untested in the industry. Still, we are interested to see how it unfolds with 1inch if adopted and if it will change voting habits.

MakerDAO’s Stablecoin Basket

Due to the counter-party risk in stablecoins during the fall of SVB, MakerDAO’s strategic finance unit recommends adopting a framework to reduce risk to the protocol. As readers know, a large portion of DAI is backed by centralized stablecoins like USDC and GUSD. Centralized stablecoins are collateralized by funds held across traditional banks – banks whose risks were highlighted during the SVB crisis. The Stablecoin Allocation Framework Unified [SAFU] framework contains a set of criteria by which Maker can score each stablecoin. The criteria include things like liquidity, backing assets, and regulatory coverage. MakerDAO will then aggregate these scores to create stablecoin exposure targets to back DAI. Readers can find the requirements here and an example scoring below.

SVB’s failure and USDC’s short depeg was a wake-up call for many in the space. We often forget that centralized stablecoins have some level of counter-party risk – a risk that could be more acute given the current state of banking. It is a smart move for entities that use stablecoins to begin assessing their level of risk and controlling for it. As DAI is used throughout the space, I am pleased to see MakerDAO considering these risks.

Safe’s New Grants

Safe DAO, the Gnosis SubDAO that governs their Gnosis multisig contracts, has proposed a new grant program for the DAO. Like most grant programs, this will focus on projects, integrations, and ideas that build on top of Safe and which grow the ecosystem.

The proposal recommends two waves, each running for 6 months, with the second wave depending on the success of the first. The first wave will comprise 500K of grants, paid out in 5K – 50K allocations.

I always recommend following grant programs as they can be an excellent source of new projects or teams to follow.