Arbitrum Budget and Foundation

Given the fiasco around Arbitrum’s first governance vote, I want to highlight two recent posts in the governance forum. The first proposal, AIP 1.1, proposes a lockup, budget, and transparency reporting for the Arbitrum Foundation. The second, AIP 1.2, proposes amendments to the Arbitrums Constitution and other related documents.

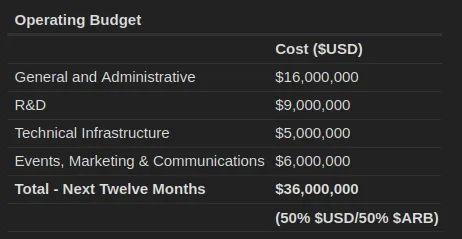

The first proposal lays out Arbitrum’s yearly operating budget and would add new quarterly reporting requirements for the Foundation. First, as part of the budget, 7% of the ARB supply will be locked in a four-year vesting schedule – although governance can change it. The Foundation will use these ARB tokens for expenses as outlined in the image below, with additional funds being used by the Foundation for an ecosystem fund. Finally, the proposal also recommends that the Arbitrum Foundation provide the DAO with quarterly financial reports to ensure transparency.

The second proposal is much smaller and proposes to amend a group of statements in the Arbitrum’s various founding documents. The amended terms generally open Arbitrum governance up to smaller entities – for example, by lowering the on-chain vote threshold from 5M ARB to 1M. After the first vote, the proposals are clearly an olive branch to a frustrated community. It remains to be seen if this is enough.

As everyone knows, a hacker exploited Euler Finance in March for around $196M. A strange back and forth between the hacker, the Ronin exploiters, Euler Finance, and individuals caught in the middle followed. In the end, however, the Euler team managed to negotiate the return of the funds to the DAO – 95K ETH and 43M DAI. This forum thread outlines a proposed process for Euler to return funds to affected users.

Euler plans to create a smart contract containing funds lost by EOAs and multisig wallets. Users can claim lost funds from the smart contract when it is deployed. Meanwhile, Euler will handle smart contract accounts that lost money from the hack on a case-by-case basis. This is just the first part of the redemption process, and it will take time to calculate redemption amounts and create the contract, but funds should be returned to users soon. Of course, there is some disagreement about how redemptions will be calculated, but the discussion is ongoing.

Gearbox has proposed a range of potential changes to help drive some utility to their token in preparation for the launch of their V3. Gearbox’s V3 allows users to deposit more exotic and low-liquidity assets for collateral. These new assets require flexible rates and limits to be used safely. As such, the proposal recommends Gearbox adopts a quota system wherein GEAR holders can distribute votes among assets to change their weekly rates. To make the quota system work, Gearbox will require a GEAR staking contract where users can stake their tokens for voting power.

The staking contract can then form the foundation of other GEAR utilities. The proposal discusses ve mechanics, liquid wrappers, revenue share, an Aave-like safety module, and even staking for enhanced features as possibilities. The proposal is still in the pre-GIP phase – so the ideas here are very early, but we recommend people follow updates and changes to tokenomics.