As always, here are some forum threads I recommend you follow:

BitDAO’s One Brand, One Token Movement

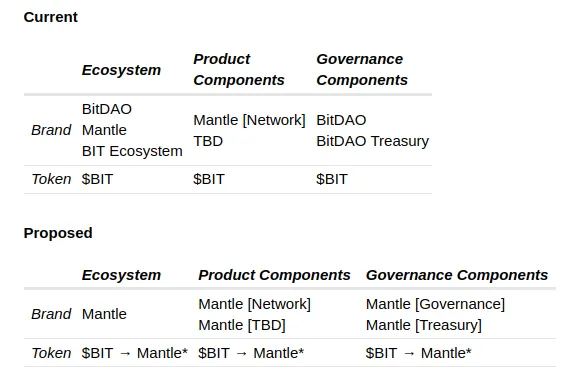

According to the proposal, BitDAO suffers from fragmentation of its community, brand, and messaging due to a split between BitDAO and Mantle. BitDAO governs the BitDAO ecosystem, while Mantle is BitDAO’s Ethereum L2. The proposal recommends transitioning BitDAO’s branding and token to Mantle. The Mantle token would also govern the ecosystem and BitDAOs massive treasury ($2.4B), while BitDAO as a brand and token would be phased out.

The proposal has strong support in the forum, so I expect $BIT and BitDAO to be phased out in favor of Mantle soon.

Gnosis Gets a Rocket

The second forum thread I want to highlight is the proposal for Gnosis DAO to add rETH to its treasury. Gnosis DAO has one of the largest treasuries in space. According to the proposal, the treasury currently holds 64K wstETH, 5.7K stETH, and 18.6K ETH. The submission highlights that the treasury composition concentrates much risk in Lido DAO and its validators. As such, this proposal recommends directing Karpatkey (Gnosis’ treasury management team) to reduce their stETH exposure in favor of accumulating Rocket Pool’s rETH.

The proposal outlines some advantages Rocket Pool has to Lido, including Rocket Pools insurance, rETH’s solid peg performance, and different tail risks. According to an informal poll in the forum, the proposal has some solid support. I think this is an important thread to highlight as Rocket Pool is gaining market share against Lido, and as a massive holder of ETH, Gnosis adopting rETH is a strong signal in the market.

Uniswap’s Fee Saga Continues

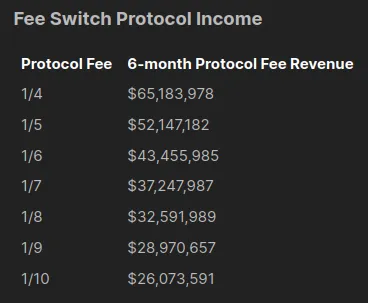

GFX Labs proposes implementing a 1/5th pool fee across all Uni v3 and Uni v2 pools. The proposal recommends flipping the fee switch for all pools with more than 10K volume per year and starting with the pools on Polygon. The proposal predicts that in the first 6 months, Uniswap could earn $52M at the proposed 1/5 fee level based on Uniswap’s volume.

The proposal goes through the technical process of creating and managing the fee switch on Uniswap pools. It includes a method for claiming and selling accrued tokens to send to their treasury. Additionally, they recommend that discussions around taxes and regulatory issues be deferred to a later proposal.

Uniswap’s fee is a long-running debate in the protocol. As the dex with the most volume and arguably the best brand, turning on a fee switch could be remarkably profitable. Their DAO has been debating turning fees on for years with little movement. Critics of the fee switch point out the lack of regulatory clarity and tax issues as reasons to avoid it for now – but at some point, it seems likely that a Uniswap fees will happen. For now, though, the debate rages on.

Honorable Mentions:

- Bancor proposes sunsetting Bancor V3.

- Merit Circle proposes transitioning its Investment Committee to a Treasury Committee.

- [Redacted] proposes their year 2 rlBTRFLY incentive scheme.