Here are this week’s forum threads I recommend you follow:

L2Beat Makes a Move

L2Beat, a website, and a team dedicated to analyzing layer 2 blockchains, has surprisingly reached out to MakerDAO to support their multichain developments, including Maker Chain. The proposal is mostly for non-technical L2 and multichain consulting and research work. This interests me, mainly because L2Beat is expanding to DAO services and becoming a team to watch.

To the unaware, a handful of service providers, like Gauntlet, GFX Labs, and Bored Ghost Labs, get grants or funding from protocols to develop or consult for them. These entities are often pretty opaque but are responsible for much of the space’s development. For example, Bored Ghost Labs helps maintain Aave and Gauntlet tinkers with Compound Finance’s lending parameters. These entities will often apply to DAOs for funding or building projects and, as such, are essential actors to watch. L2Beat is now in the same realm as these entities and should be on your list.

Lido Staking Proposal

Re-posted to Twitter soon after being published, Lidomaxi has proposed that Lido DAO introduce a $LDO staking and buyback program. The program would allow users to stake LDO to earn a portion of Lido DAO’s revenue via a LDO buyback and redistribution program. According to the proposal, LDO holders don’t benefit from the success of Lido as the token has no utility beyond governance. The proposal seeks to create this utility by creating a staking program. The proposal highlights Lido’s $280M treasury and $16M per year operating costs as a reason to begin the program. In their estimation, the protocol is an excellent place to start paying out some revenue to token holders as Lido has a 17.5 year runway. They recommend re-directing 20% – 50% of Lido’s revenue to stakers.

Lido took in about $110K per day in the last 365 days ($40M ). Annualized, Token Terminal puts Lido’s 2023 revenue at an estimated $74M – meaning, if passed the program would pay out $15M – $37M to Lido stakers. However, not everyone thinks a revenue share would help the token at this time.

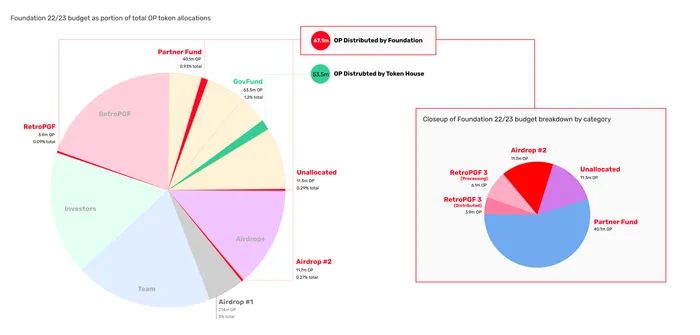

Optimism’s 1 OP Budget

The Optimism Foundation has submitted its yearly budget request to the Token House. This year, the Optimism Foundation requests a single OP token for its 2023-2024 budget. This symbolic budget request is because Optimism has only spent 5.21% of its first-year budget and does not need additional funds. As a refresher, in year 1, the Foundation was given 30% of the OP token supply to manage. The Optimism Foundation has distributed 67M OP of their allocation. The graphic below provides a detailed breakdown of how they spent their tokens.

However, not everyone is pleased with these results. Twitter notable Polyna has pointed out that the Foundation has significantly under-distributed the OP tokens and has created a large supply overhang. The overhang, lack of distribution, and clarity surrounding the supply have caused people to lose confidence in the token. In response, they recommend that the Foundation provide detailed projections for how the Foundation will emit OP tokens in year 2.