Not to be overshadowed by Powell and the FOMC announcement today, here are some governance threads I recommend you follow.

As I have said, DAOs should be better at posting financial statements. Expecting users and token holders to dig on-chain for protocol earnings is unreasonable. Thankfully, DAOs and platforms like Token Terminal are getting better at presenting consistent financial statements.

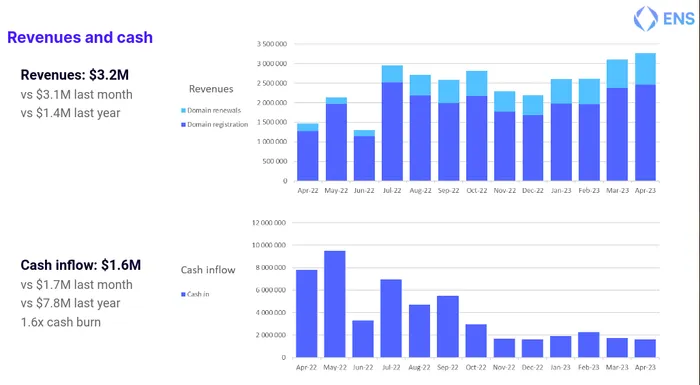

I want to draw attention to ENS’ April financial statements. As readers are aware, ENS is a fundamental piece of Ethereum infrastructure. Dot-Eth names are trendy and carry the prestige that other Dot-names lack. For their part, the ENS DAO has been leveraging this prestige to post impressive revenue.

In April 2023, ENS reported $3.2M in revenue, with a cash burn rate of $800K. $2.5M of their income comes from new domain registrations. Additionally, they have a treasury reserve of 51M ETH and 28M USDC – giving ENS an 82-month runway. ENS’s performance is impressive. I hope to see more of the same when their next group of financials comes out.

Polygon has proposed that Synapse deploy a bridge to their Polygon zkEVM for USDC and ETH. The proposal asks that Synapse incentivize both pools with 800 SYN per week and target 15% APY.

Launching a new bridge is hardly noteworthy, in my opinion. But, what is memorable, and something that readers should follow, is that Synapse passed a governance proposal a few weeks ago, signaling their desire to reduce SYN emissions by onboarding liquidity partners. Liquidity partners will actively manage liquidity in pools to be more efficient and, in return, will receive a portion of pool fees – while SYN inflation stays stable.

This experimental approach has ramifications for how Synapse will add new bridges, new pools, and token supply. As such, I recommend following it.

Uniswap is celebrating the launch of its Uniswap Agora beta. Agora is a dedicated delegate and governance portal which Uniswap adopted to improve the governance experience. Representatives can easily manage their platform and vote on Agora. Meanwhile, delegators can use Agora to manage their delegations and track delegate actions.

To celebrate the launch of Agora, Uniswap is organizing a Delegate Race. The race is a month-long election-like process where delegates can build an Agora profile, present their platform and advocate for delegations. Delegators, meanwhile, can shift their UNI delegations around. Finally, the Uniswap Foundation has set aside 8M UNI, which delegates can apply to have delegated to them.

Uniswap governance has always been controversial – mostly because smallholders have felt they lack the means to participate. Agora could offer smaller holders a better governance experience and potentially even pool their support behind a delegate with their interests. I am excited to see if this changes how Uniswap governance proceeds in the future.