First: mandatory disclaimer that I am not a banking expert and this is meant to distill my personal thoughts around the USDC situation.

Risk avoidance in crypto has been at an astoundingly high level for the past 10 months. And understandably so. The implications and fallout from Terra, Celsius, and FTX have created market participants with much less tolerance for tail risk.

At the moment, USDC trades at $0.88, which is a bit unreasonable per the current scenario. $0.88 assumes 0% recovery from Circle’s assets with SVB, and maybe even prices in a 0% (or low) recovery from Silvergate and Signature Bank.

(Image above: USDC Market cap via Coingecko)

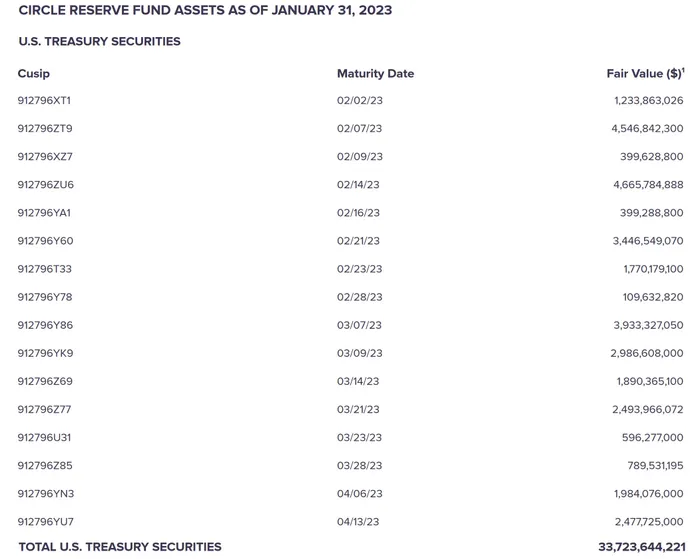

Circle keeps most of its treasury bills in short-term notes; it’s furthest dated t-bills per the Jan. 2023 attestation expire about four months out. So duration mismatch is not as big of a concern, and their remaining assets are held at banks and likely other money market funds.

(Image Above: Composition of Circle’s direct exposure to treasuries matched with maturity of bills)

But if arbitrageurs continue to buy low on liquid venues and redeem their USDC for USD with Circle, it will force Circle to liquidate treasuries for cash to meet market demand. And this loop could end with a lower worst case estimate for USDC if they have to realize losses while selling those treasuries.

So while many see the disconnect in reality and believe there’s an opportunity to make money by buying USDC or longing the perpetual contract, there are an equal number of people keen to purge their tail risk no matter what the cost may be.

Overall, liquid venues can detach from recovery estimates even further as panic takes hold of crypto markets. It would not be surprising to see this further escalate in the short-term.

Circle likely has a decent equity cushion from their accumulated interest income. And they’ve been a solid business, so one would imagine raising capital wouldn’t be a huge obstacle if the losses are containable. A small loss from SVB (and Signature Bank) could be absorbed and normalcy would resume. But the scale of panic selling will also be a key factor in determining what the worst case outcome looks like.

Again, a potential silver lining is that Circle is not sitting in a ton of low yield, long maturity bonds — which have been beaten down. And that seems to work in their favor with this situation, because it means they may be able to process redemptions without realizing too much in losses.

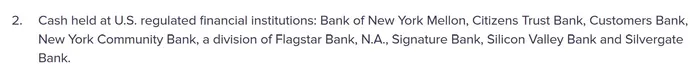

(Image above: As of Jan. 31, 2022, Circle held cash at 7 banks including Silvergate, SVB, and Signature)

One area of concern for many does seem to be what losses outside of SVB — specifically with Silvergate and Signature Bank — could look like. And that’s something I’m flying not too familiar with right now.

TL;DR – the scale of panic seems overblown right now and liquid markets can further detach from reality. But if redemptions kick in at scale and force Circle to liquidate their treasuries for a loss, the situation could spiral.