Bloomberg just ran back-to-back pieces on Hong Kong’s slow but steady reunion with crypto — offering a lonely glimmer of hope amid regulatory hell here in the U.S. of Free Markets-A!

The first:

And the second:

The TLDR — a bunch of Chinese state-owned banks — read: banks doing Daddy Xi’s bidding — in Hong Kong are starting to service crypto companies (again). The banks reportedly received the green light directly from Beijing to court the degens.

The move sends a clear signal, but what?

It could reflect Beijing’s realization that crypto — despite the, uhh, sh!t$torm of the past year — is here to stay. Or, more cynically, the mandarins within the CCP may view a potential Hong Kong x crypto collab as a hedge against the mainland’s strict zero-crypto policy,

Geopolitically, Beijing could be looking to scoop up cheap market share while the west misguidedly chokes the crypto industry with litigation.

On a macro level, Hong Kong’s reapproach with the crypto industry may be a sign it’s encountering headwinds in its attempt to reassert itself as the premier hub for international finance. A title many believe Singapore took from Hong Kong following the Umbrella Movement, new national security law, and strict zero-covid measures.

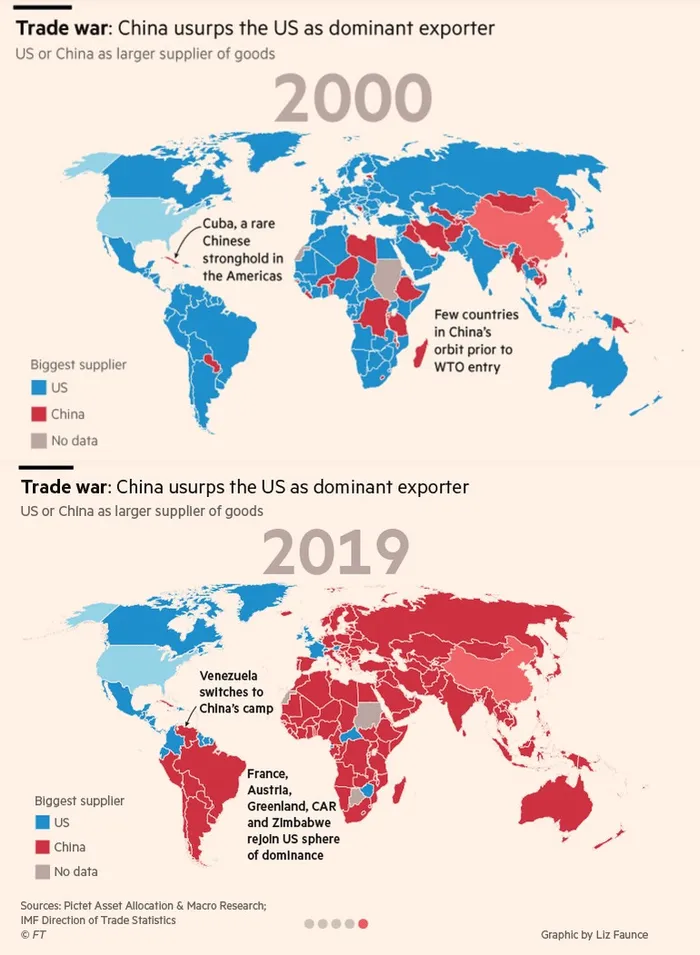

Whatever the signal in the noise ends up being, the moves by Hong Kong ensure Beijing will have a say in the future of the crypto industry. Crypto now joins a long list of other vital technologies the United States has, at least partially, fumbled to China. They include 5G, shipbuilding, solar, and drones. In each case, myopic policy ceded initial American advantages to China, injecting a dose of multipolarity into the international arena.

We can only pray to our Lord Satoshi that American policymakers treat crypto similarly to how they now treat industrial policy: as a central pillar of U.S. national security. Until then, control over the future of money and digital infrastructure lies in the balance.