“Crypto prices are still tracking our expected cycle trend, and the next big test is whether we see another period of consolidation — or if the breakout we’ve been waiting for is finally near.”

Key Takeaways

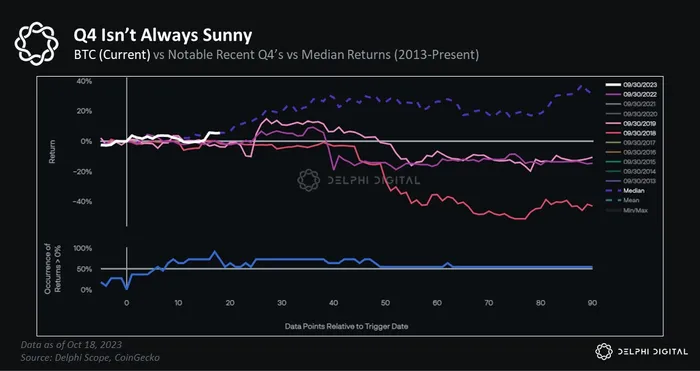

- We’ve written plenty on the bull case for BTC and crypto, and our outlook hasn’t changed. Crypto prices are still tracking our expected cycle trend, and the next big test is whether we see another period of consolidation – or if the breakout we’ve been waiting for is finally near.

- In our latest Global Macro Themes report, “Through the Fire – Will the Rubber Meet the Road?“, we outline a few notable risks in the near term that may stand in the way of the next uptrend, including:

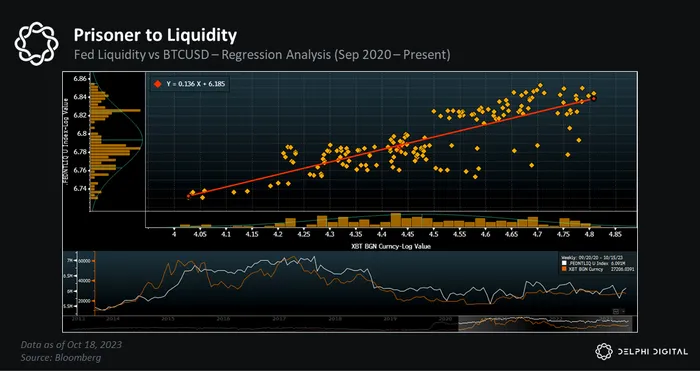

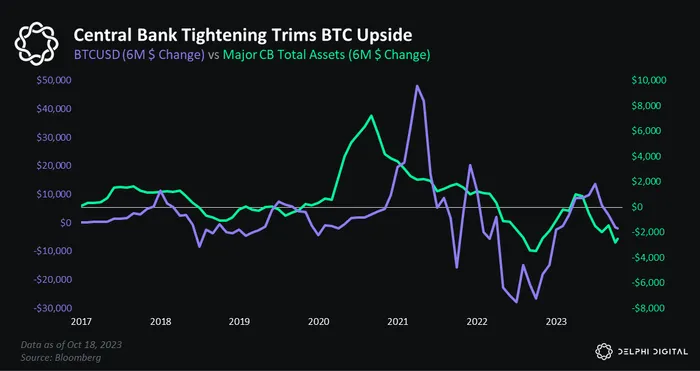

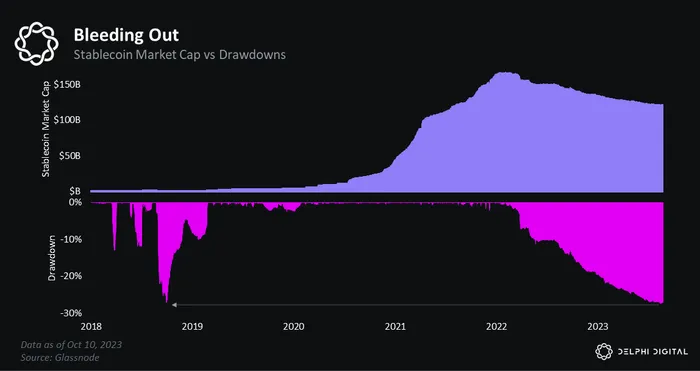

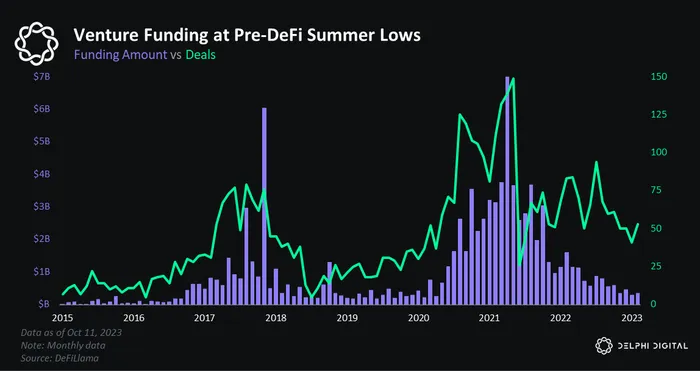

- Stagnant liquidity trends & deterioration of liquidity conditions within the crypto market, including funding conditions

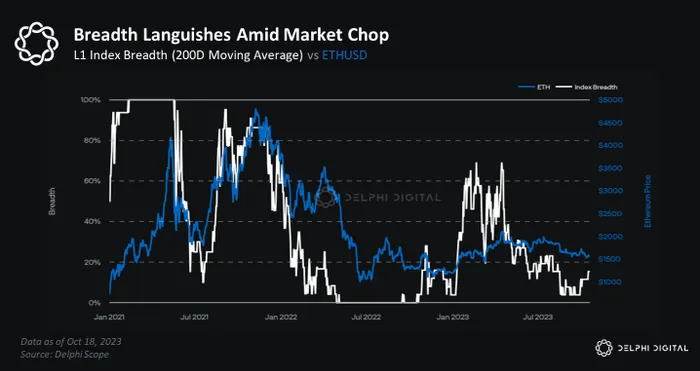

- Market structure degradation and potential buyer exhaustion

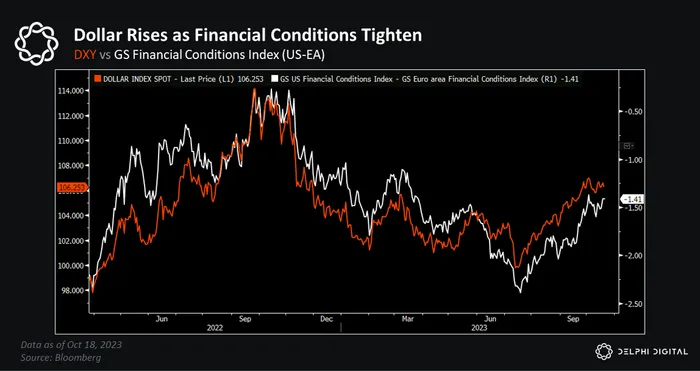

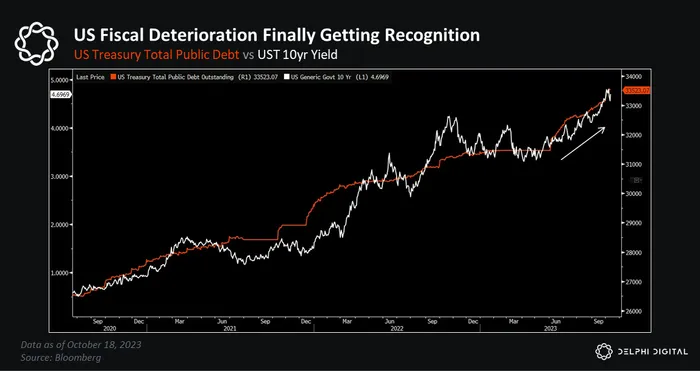

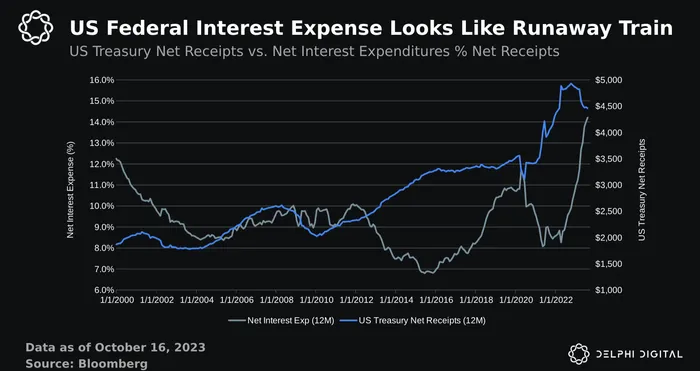

- Further tightening in financial conditions amid sovereign debt market volatility, higher real yields, and a potential near term revival of USD strength

- All of these can be mitigated through active policy intervention, but the risk lies in the uncertainty surrounding when the intervention will occur. We don’t see these risks as long-term trends and view any downside volatility as an opportunity to increase exposure to the best assets at even better entry prices.

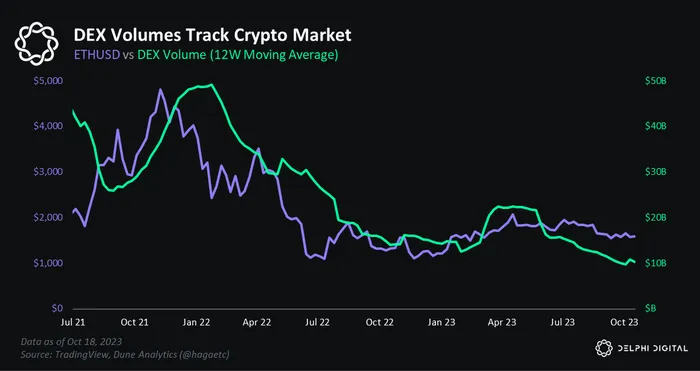

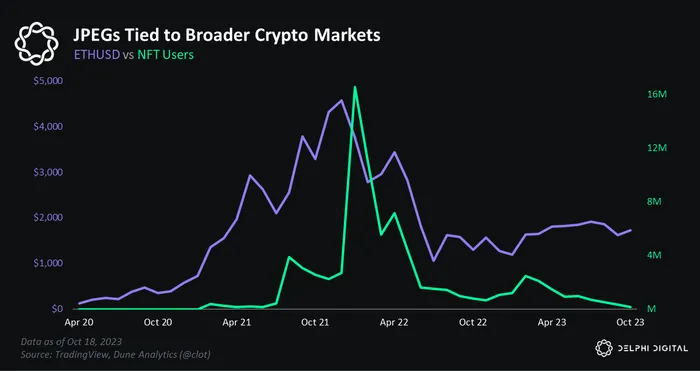

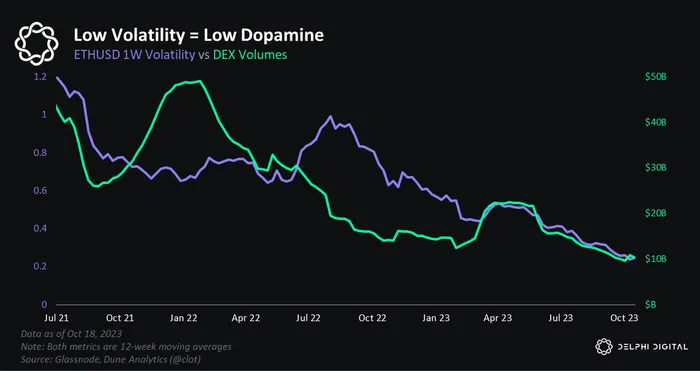

- When looking at crypto markets specifically, it is hard to ignore the tepid investor activity across the industry. As we know, price drives sentiment, and while prices have been better than 2022, there is still a lot to be desired.

- On-chain trading volumes are down.

- CEX trading volumes are down (spot and futures).

- On-chain activity within DeFi apps is down, as are active users.

- NFT trading and active user activity are down.

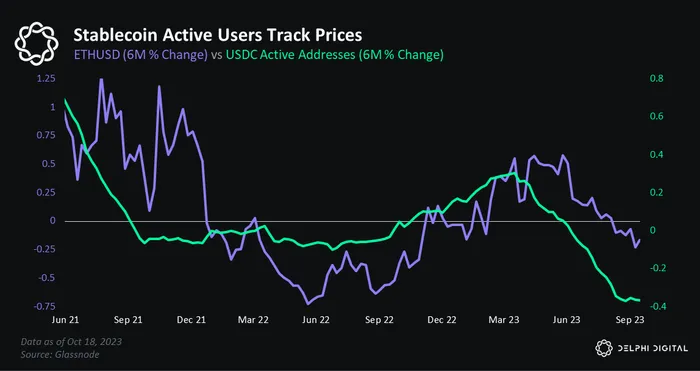

- Stablecoin usage is rolling over as less speculation means less trading and demand for borrowing.

- Retail interest has faded, and many participants have fled to greener pastures (like those surrounding the AI hype). We see signs of general apathy everywhere.

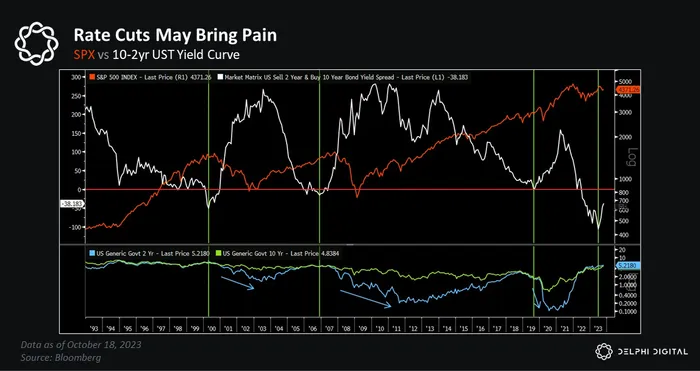

- We’ve always said the Fed will be more reactive than proactive, and officials will only divert from their current policy path if they have the air cover to do so. Market crises are nonlinear events, and the risk of something breaking has risen in recent weeks, which could ultimately force the Fed’s hand before its other mandates are fulfilled.

- We believe the sign posts to pay attention to are further strength in the US dollar, higher Treasury yields (nominal and real), the pace of yield curve steepening, market positioning, as well as liquidity and volatility conditions within the UST market.

- The crypto market has repeatedly proven that it’s not immune to volatility spikes in traditional markets. When the Fed is forced to act, they will likely do so more aggressively than the rate hiking regime we’ve experienced. If this leads to a bull steepener, risk assets will likely struggle as history shows that’s one of the worst environments for risk markets. If risk assets were to sell off, crypto may not escape unscathed.

- As we discussed, we would view this as an opportunistic event, and we don’t expect this window to stick around forever. As we’ve seen in the past, once the engines start firing, crypto markets tend to move quickly.

Catch our full report, “Through the FIre – Will the Rubber Meet the Road?“, today as we dive deeper into the abovementioned.

Additional Charts & Analysis