The Open Network (TON) presents itself as the crypto layer for Telegram, one of the world’s largest social media platforms. With easy access to Telegram’s 800M monthly active users (MAU) but only ~1M active wallets currently using the platform, TON represents a large and untapped growth opportunity for blockchain gaming.

There are currently less than 100 active blockchain games on the platform, but with Web3 facing an imminent fight for player liquidity, I predict this will change over the next 12 to 24 months. Customer acquisition costs are extremely high for blockchain games, and there are currently only ~1.2M unique gaming-inclined wallets that teams will inevitably end up fighting over.

Player liquidity and distribution will increasingly become in demand, and those best positioned can leverage this to gain a significant competitive advantage. We have already seen this play out with Ronin and how taking the blockchain game Pixels from 1k wallets to over 100k sent their token pumping over 300% in the last month (partly due to hype and speculation but also because RON was — and still is — relatively undervalued).

Animoca Brands, one of crypto’s largest gaming developers, publishers, and investors, has already recognized an opportunity in TON, recently becoming the network’s largest validator.

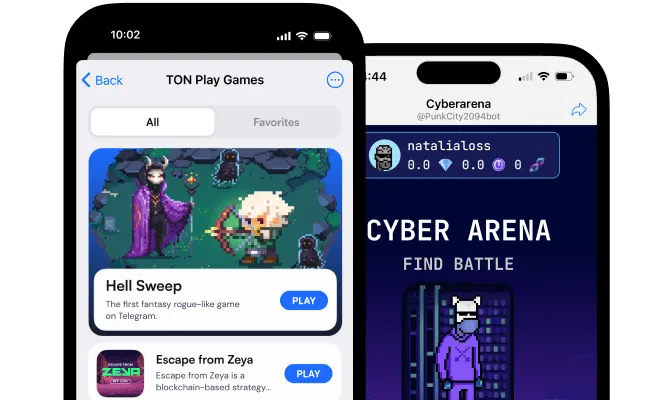

Here are some projects to keep an eye on if/when we see a narrative form around TON gaming:

GAMEE, a subsidiary of Animoca Brands, is one of the largest developers of Telegram games. The GMEE token went from a price of $0.0037 in October to a peak of $0.65 in late November. Arc8, a hypercasual P2E gaming platform, and GAMEE’s flagship Web3 product was behind the majority of this growth. GMEE’s recent price correction started when Arc8’s November Gamefest tournament, with a combined prize pool of $120k, ended.

It is likely too early, for reasons I will highlight at the end, for GAMEE’s connection to TON to be a catalyst for further price appreciation. However, I will be keeping a close eye on the token to see how it performs nearer the time of the next Gamefest in Q1/Q2.

Another developer and publisher of hypercasual crypto games that recently integrated with TON is Nakamoto Games. The platform recently released a multi-coin gaming wallet for TON and bridged 50 of its current selection of games to the platform. Somewhat unrelated but worth noting is that the NAKA token has been one of the best-performing tokens of 2023, appreciating in price by over 2700% YTD.

Although few and far between, there are some independent blockchain games on TON worth noting. Games such as Fanton Fantasy Football, which has reported hundreds of thousands of MAU, and high-stakes games of chance that include wagering seem to perform relatively well. Other genres that perform particularly well in Central Europe and Eastern Europe have also seen considerable traction.

Capital is still relatively limited, slowing down the growth of the applications layer. However, there are a number of toolkits available to developers. 8XR, for example, has a low/no-code HTML5 game engine well suited for simplistic Telegram games. Additonally, TonPlay offers a number of services to assist in on-chain integrations, publishing, and monetization.

Speaking of monetization, this is by far TON gaming’s biggest challenge. As it stands, games on TON are essentially limited to selling IAPs (either traditional power-ups or Web3 assets, such tokens and NFT sales), which is not ideal for most hypercasual games with very short play sessions. It should be noted here that there are some mid-core titles on the platform that are more easily monetized via IAPs. However, they would undoubtedly still prefer to add additional revenue sources.

This, in my opinion, is the biggest roadblock in the way of mass scale. Without a true monetary incentive for teams to launch on TON, the platform will struggle to attract the best talent. Platforms like Nakamoto Games or GAMEE will still benefit, but only as a distribution channel that funnels users off the platform to their web portal.

Furthermore, integrating targeted ads onto Telegram will not be easy. The core premise of a privacy-preserving social network is the polar opposite of how Facebook became one of the world’s largest ad networks.

That said, I view this as an opportunity for TON to innovate in the way of opt-in reward-based data sharing. Allowing users to select what data is shared with advertisers and rewarding them for it may not only appeal to a large percentage of their current stakeholders but also set a new standard for how certain game genres monetize in a post-IDFA/fingerprinting era.