Today on our research team call I asked the team what they see are the strongest narratives right now in crypto. In no particular order I will go over them briefly here.

-

Solana: memecoins are still booming with WIF >$4B but DeFi tokens JUP and JTO are both showing strength in recent weeks as well. With Kamino, Parcl, Tensor and Magic Eden having announced airdrops, along with MarginFi speculation, there’s still a lot of positive momentum here. Is the ever anticipated memecoin -> DeFi rotation coming (heavily debated on our last retreat with strong opinions on both sides).

-

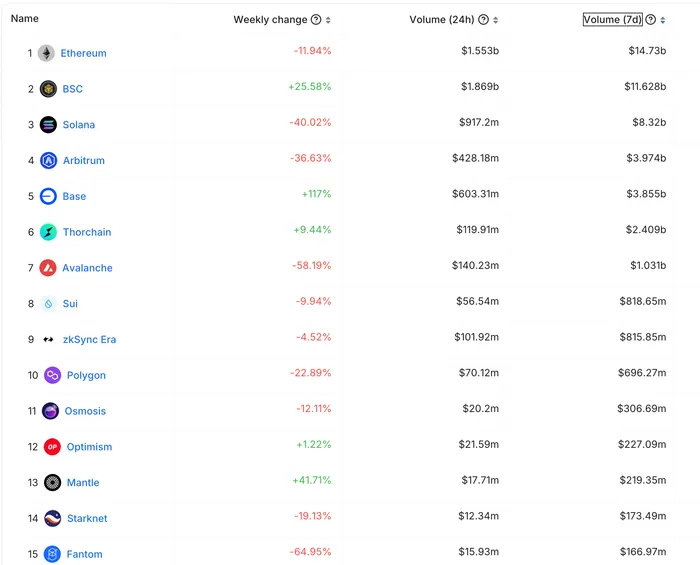

Base: We highlighted Base’s momentum a couple weeks ago and it doesn’t seem to be slowing down. Base TVL has now flipped Optimism and volumes for the past week are #5 overall. The recent launch of Degen Chain and upcoming FriendTech v2 (end of April) suggest the momentum will continue.

3. Ethena: Ethena has been the hottest farm recently and has altered funding and stablecoin yields across crypto. The TGE is tomorrow and Mo put out a great explainer on it today. Be on the lookout for a deeper dive soon. Ethena is now the 5th largest stablecoin/synthetic dollar (it is more accurate to categorize it as a synthetic dollar).

4. Restaking: Restaking has altered the LST race and has caused Lido to drop below 30% of total ETH stake. The main beneficiary has been Ether.Fi, who have benefitted by creating their own liquid LRT along with the caps that Eigen put on Lido. EigenDA is likely to launch in the next 6 months which should allow this trend to continue.

5. Bitcoin: Ordinals, Runes, and Bitcoin L2s are all in vogue. The top BTC ordinals NodeMonkeys and Puppets are already in the top 10 by market cap in relatively short order. The Bitcoin ecosystem continues to progress beyond orange coin.

6. ETFs: Lastly, all of this is driven by the top, and that is the ETF flows. Without them, the above narratives would not be as strong. BTC has surpassed everyone’s expectations and with the halving coming up there’s another narrative here. ETH is the one to watch now with the market leaning pessimistic. In my opinion, a delay and early 2025 approval would be the best outcome as it gives the market more time to allocate to BTC ETFs without overwhelming and keeps a strong catalyst to look forward to.

Disclosure: I have exposure to BTC, ETH, SOL, Ethena & upcoming airdrops.