Going to run some napkin math here on USDC. As a disclaimer, this is napkin math. There is stuff I don’t know, and there are potential hidden risks elsewhere. This is my best estimate of the current situation.

First, there’s been ~$3b drawndown from march 9 balance of $43.5b. I assume most was processed with cash balances but they will have also sold usts as well. With $3.3b reported at SVB, this would give ~$0.92/USDC excluding svb assets and $0.98/USDC assuming 80% recovery. Since Circle’s balances are cash they are more senior than equities and bonds but still bear risk.

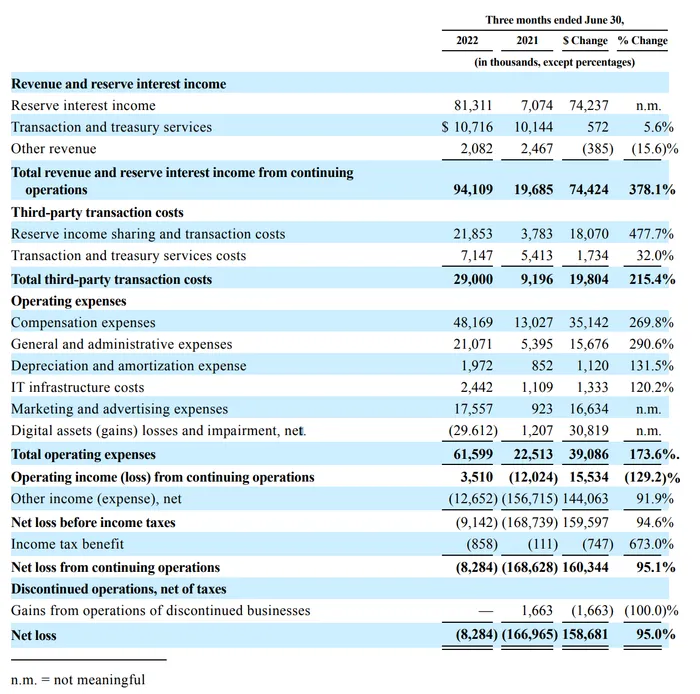

Estimating trailing 13 month income we get $771M. The latest financials we have from Circle are from June 2022 where they made $81.3M in interest income. This lines up with my estimates below and so feel confident in my numbers.

Circle of course has expenses, and their June 2022 income was still not enough to be profitable. However, it is likely they have started to operate at a profit more recently with monthly income exceeding $100m (more than their entire Q2 2022).

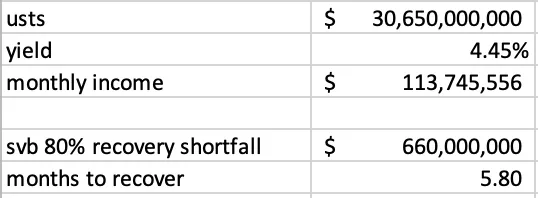

For the shortfall, if we assume 80% recovery on SVB assets (which I hope is being conservative), it would be ~equal to their trailing 7 month interest income and could be recouped in ~5.8 months on their current treasury holdings.

The risk, of course, is that redemptions pick up and that ust pile starts to shrink, both reducing go-forward income and increasing the socialized losses to current holders (every redemption at 1:1 leaves less for remaining USDC holders). The other risk here is knock on effects to other banks like Signature, although we don’t know how much Circle holds there at this time.

Ideally, we get word this weekend of a bank like JPM acquiring the assets or depositors being made whole. If not, Circle may need to do a raise or get a bridge loan to cover the time to recovery and instill confidence in the market. Another factor here is that as of June 2022 they had ~$500M cash on their balance sheet, most of which is from their April 2022 $400M raise, which could potentially also be used to bridge the gap.

Wrapping it up – it’s possible there’s a 10-20% haircut on SVB deposits which would be a $330-660M hole on USDC, valuing it at ~0.98-0.99c. This would take 3-6 months to recover from income. The risk is that redemptions keep processing and losses start to get socialized. If no SVB deal or bailout, I could see Circle doing an equity or debt financing to backstop this over the coming months. Circle not honoring the peg 1:1 on redemptions would be a big blow to their reputation and so I don’t see that as likely, although it is possible redemptions become more restricted in the short-term to avoid a run. If no bailout of SVB, a debt facility would make the most sense to get them through this period.

This is mostly a liquidity issue right now with some solvency concerns (i.e. svb recoverable amount). Circle won’t take a 0 on the $3.3b, but that’s not accessible for the time being. The SVB process with no bailout could take months to get back the recoverable amount, and so there’s a time element to this besides pure solvency risk. Even if we assume 100% recovery, the $3.3b could be locked up for months. We should know more by Sunday (hopefully) and can better assess then. Again, if no SVB acquisition or bailout I would look to Circle doing some sort of debt/equity raise.

*Update (3/11 10:50am est): Just want to reiterate here that if there is no SVB resolution by Monday there is a high risk of redemptions lining up for USDC. Circle knows this, and I would expect (hope) that they are planning for this outcome and trying to line up financing for this potential scenario right now.