Last Friday marked one year since Russia’s full-scale invasion of its neighbor, Ukraine. In short, the war has unleashed devastation across Ukraine, displaced millions, contributed to global inflation, and cast a shadow on financial markets.

The conflict has dampened investors’ appetite for risk assets as inflation and uncertainty remain high.

The conflict has dampened investors’ appetite for risk assets as inflation and uncertainty remain high.

Crypto will likely face headwinds as long as the conflict persists; however, the war offers crypto a notable opening.

As Albert Einstein once said: “In the midst of every crisis, lies great opportunity.”

So far, Russia’s nuclear arsenal has served its purpose: deterring the west (NATO) from entering the war kinetically. Nevertheless, the U.S. and its allies have entered the war financially.

Over the past year, the west unleashed an onslaught of foreign exchange (FX) seizures and export controls on Russia.

The sanctions are unprecedented in magnitude and scope and have effectively severed the Russian economy from global markets.

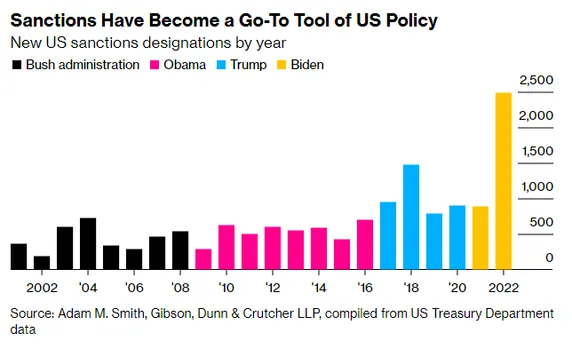

Notably, financial sanctions are not a new tool. Successive U.S. administrations have learned that keyboard warfare is cheaper and carries less political risk than bombs or troops.

Aside from their political expediency, sanctions have emerged as a critical tool of modern U.S. statecraft due to their potency, which derives from America’s control over the global financial system’s plumbing.

In today’s globalized economy, it’s nearly impossible for countries to do (legitimate) business without touching the U.S. financial system. This reliance leaves non-aligned and hostile countries in a bind. By using the U.S.-led financial system, their assets are perpetually at risk of arbitrary seizure — a risk Russia ran and now regrets.

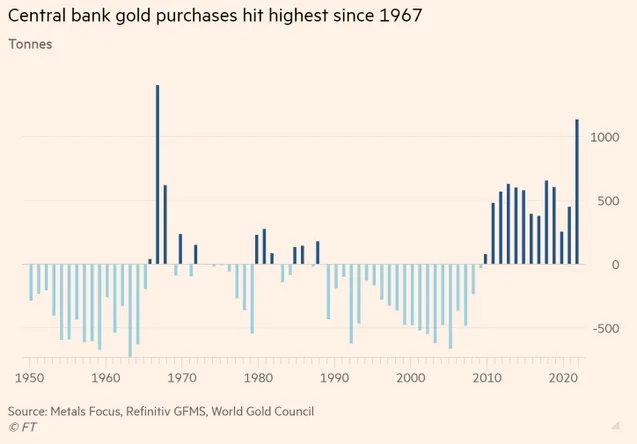

Undoubtedly, countries big and small, nuclear and non-nuclear powers, have watched with alarm as Russian assets were frozen and resolved to limit their own exposure.

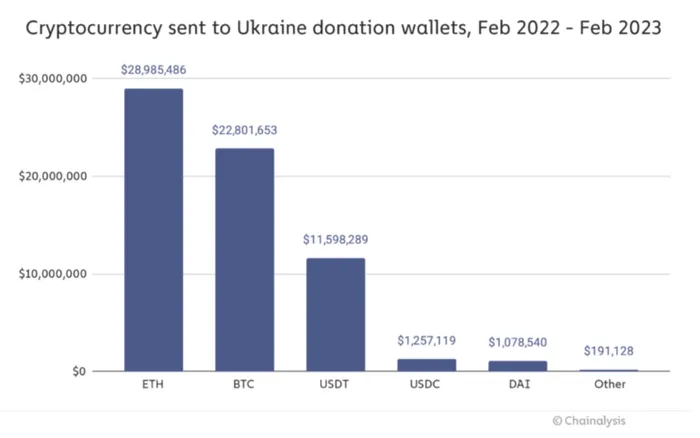

Third-party countries are also watching crypto’s role in the war, in ways good and bad. For instance, donations to Russian militia groups spiked immediately following the invasion (Feb. 2022). Perhaps driven by sanctions on Russian war-affiliated groups, crypto offered a way to transfer value quickly.

Ukraine is also leveraging crypto as a crowdfunding tool, with much more success. As of February 2023, donations total nearly $70 million.

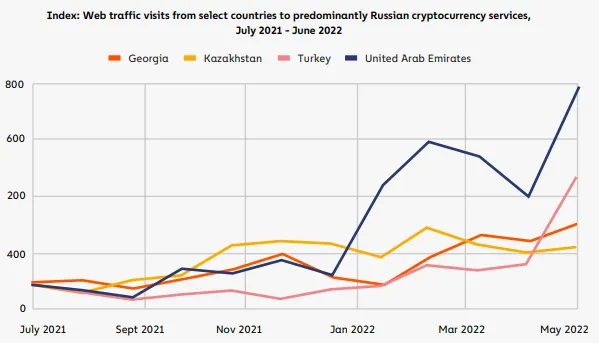

Crypto is making an impact on an individual level as well. After Vladimir Putin declared his “special military operation,” thousands of Russians fled to neighboring countries. These Russian citizens desperately needed a way to store their wealth and transport it across borders. For many, crypto was a lifeline.

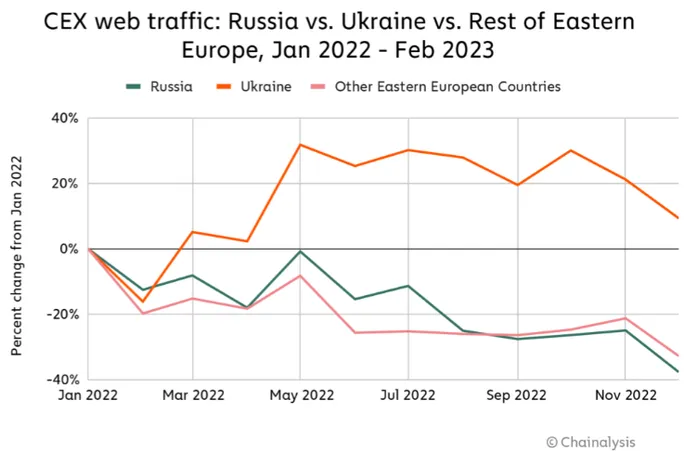

On the other side of the conflict, Ukrainian civilians have adopted crypto en-masse, helping to propel the country to #3 on the Chainalysis 2022 Adoption Index.

Facing high inflation and domestic capital controls, crypto has offered Ukrainians a reliable store of value, enabled cross-border transactions, and boosted financial independence.

On a meta-level, the Russo-Ukraine war has shattered global norms of how countries treat each other. Neighbors should not invade neighbors, and law-abiding countries should not freeze (steal) another sovereign country’s assets unilaterally. Going forward, countries will treat each other more suspiciously and take steps to protect themselves. One potential repercussion is countries will adopt “outside money” (gold + crypto) over “inside money” (U.S. Treasuries).

Inside money is money created inside the banking system. In contrast, outside money is money created outside the financial system. Inside money is ultimately at the whims of whoever controls the global financial system’s plumbing, while outside money is theoretically more censorship-resistant.

A global embrace of outside money will likely boost credibly neutral, autonomous financial rails (blockchains) over today’s politically weaponized financial rails (SWIFT). As time progresses, it will be interesting to watch the trends of outside money adoption and usage, especially during times of conflict.