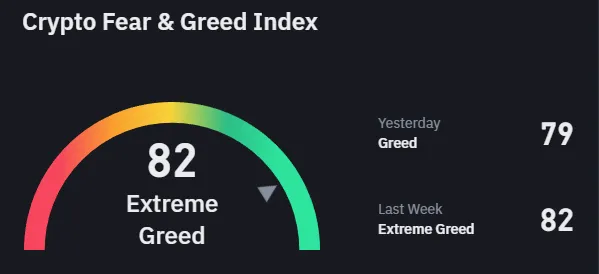

There’s a lot of chatter on CT right now about where we are at in the cycle. Within crypto circles, there is a state of exuberance with BTC finally breaching $70K and few potential headwinds in sight. While normies appear to be slowly trickling in, most agree that ‘retail’ is not back yet. We don’t have celebrities launching NFT collections and tweeting (3,3), family members bombarding us with inquiries, etc.

There are indeed some legitimate signs of mania: memecoin traction (largely confined to CT), lack of significant pullbacks, persistently expensive funding rates, and isolated examples of Uber driver experiences. On the other hand, alt season hasn’t arrived yet, and there is an abundance of good looking charts for beat down tokens. CT influencers are quick to point out that these charts contradict the notion of a frothy market. I agree with the overall sentiment here, but I think there is some important context missing.

Many of the tokens starting to show strength were not in an “accumulation phase.” They were being punished for their low float and high emissions during a bear market. While price is just now bouncing off cycle lows, market caps are in the neighborhood of all-time high. This isn’t necessarily bearish, there are still other important variables at play – inflation adjustments, higher % of supply outstanding (lower FDV), liquidity conditions, etc.

These tokens could certainly go much higher and I’ll let our markets team weigh the relative importance of these variables more rigorously. I think it is important to add proper context to some of these charts that are being fed to us. This isn’t a frothy top, nor is it just the beginning of a huge rally, in my opinion.