Since the peak of the BTC bull market in late 2017 (when we saw over 2.8 million BTC transactions confirmed in a single week) the network has yet to reach a higher weekly total.

That was until two weeks ago when nearly 3 million transactions were confirmed by the network. Now add in last week’s new record total of over 3.7 million, it’s clear the demand for BTC block space is in full send mode.

For reference, the Bitcoin network has averaged ~1.96 million confirmed transactions (per week), since the beginning of 2017. Last week’s record-breaking total was nearly 90% above the 6-year average, and 33% above the peak mania week in 2017.

So is this a new bull market for BTC? Is the banking crisis a catalyst for the recent spike in demand for block space? At least from a raw transaction count perspective- the answer is simple, Ordinals.

Over the past 7 days, BRC-20 transactions have accounted for 52% of all transactions on the Bitcoin network. This new demand provides the Bitcoin ecosystem with a bit of a double-edged sword.

On the positive side, as Aaron points out in his timely post from last week, “The growth of BRC-20s is a boon to Bitcoin – it brings tx fees and users to Bitcoin who would otherwise go elsewhere. Additionally, new projects and teams are building apps directly on Bitcoin to leverage this new tech. For the first time in a while, Bitcoin has exciting new apps with actual users.

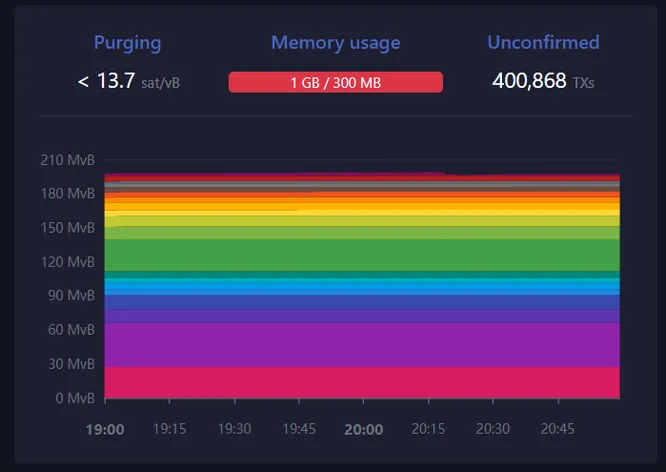

However, transaction costs for typical users have skyrocketed, with the network also seeing massive backlogs in the mempool alongside unconfirmed transaction counts consistently above 400k.

The future implications of Ordinal inscriptions and BRC-20 tokens are far too complex for a short post (maybe this is a topic in need of a deep-dive Pro report). But for now, Jpegs and text inscriptions are driving the massive usage spikes in the Bitcoin network.