Love them or hate them, inscriptions have become an important part of Bitcoin’s transactional landscape. BRC-20s and Ordinals have accounted for much of Bitcoin’s recent mempool fees. However, some events have transpired which put the future of the BRC-20 standard in doubt and have reduced their fee pressure. As Bitcoin is so important to the market, I recommend people stay abreast of these developments, even if they never touch an inscription.

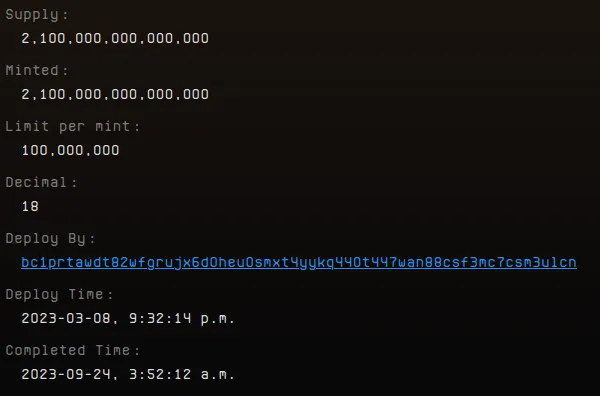

First, as Dataalways (excellent account, give them a follow) pointed out on Twitter, $SATS, a BRC-20 with a supply of 2.1 Quadrillion, was minted out on September 24, 2023. It took somewhere around 21M transactions for $SATs to mint out. Now that minters have minted the entire supply, there has been a noticeable drop in BRC-20 transactions and text-based inscriptions and fees around the same time.

Secondly, the BRC-20 standard has hit another milestone – Bitcoin MEV. BRC-20s are controversial. Many Bitcoiners view them as nothing more than shitcoins poisoning the golden chain – and one has moved to bring the whole edifice down with an MEV bot. The bot is pretty simple. It watches the mempool, and whenever it detects a newly created token, it front-runs the transaction and sets the token amount to 1. Essentially, this bot has halted the creation of all new BRC-20 tokens. The bot went live around October 2, 2023 – where we see another significant drop in mempool fees. Interestingly, this may make existing BRC-20s more valuable as the bot has strangled the supply. I don’t know the end result of this, but watching how it plays out will be critical.

Thirdly, and finally, Ordinals creator Casey Rodarmor has released a competing Bitcoin token standard called Runes. Runes have come at a perfect time. BRC-20s have been the far and away most popular inscription token standard, but with the MEV bot and $SATS minting out, it seems like BRC-20 fever has died down – opening the way for a competing token standard to make some waves. The big difference between Runes and BRC-20s is storage. BRC-20s store data in the SegWit section of the Bitcoin transaction and require a lot of transactions to work, which creates chain bloat.

Meanwhile, Runes – which are based on existing UTXO models – keep data in the OP_RETURN, making them less cumbersome than BRC-20s. Runes are still new, but given that the Ordinals creator is behind them, they probably stand a good chance at adoption. The release of Runes has perhaps taken some focus away from BRC-20s, especially as BRC-20s are blocked for the moment by the MEV bot.

It was a wild few weeks for Ordinals and BRC-20s. My stance remains the same, however. BRC-20s and Ordinals benefit from Bitcoin because of the increased fees, showing that people want to use Bitcoin for more than BTC transfers. More than anything, I think inscriptions have shown that Bitcoin needs some scaling solutions, as inscriptions have caused chain bloat and fee pressure to the point where transaction fees became onerous. Regardless, if you are following the inscription space, this was a big week – and because of the importance of Bitcoin to the broader market, I recommend readers keep tabs on these developments.