Ever since OpenAI dropped chatGPT’s Code Interpreter, I’ve been playing around with it pretty much non-stop. It’s an awesome and powerful tool. And I highly recommend every analyst pay the $20/month to familiarize yo-self with the competition :)))

Anyways, manipulating data and creating visualizations is cool and all, but making money is, uh, ice cold. And Code Interpreter got me thinking: How can I make money off this thing?

One obvious idea is to point it at the stonk market and say: “go make me some schmoney!” I indeed tried this, and, well, we’re not quite there yet…

“Humanoid robot using a Bloomberg Terminal” — DALL-E

Another idea is to, like, buy OpenAI stonk — yanno the company behind Code Interpreter that stands to benefit the most from its prenatural abilities. But here, I ran into some problems again. For one, I don’t know Sam Altman. And even if I did, I don’t think he would give me any OpenAI allocation right now since they just raised a cool $300M from the likes of Sequoia, a16z and Founders Fund.

Fun fact: @sama carries around a sentient AGI at all times in his backpack

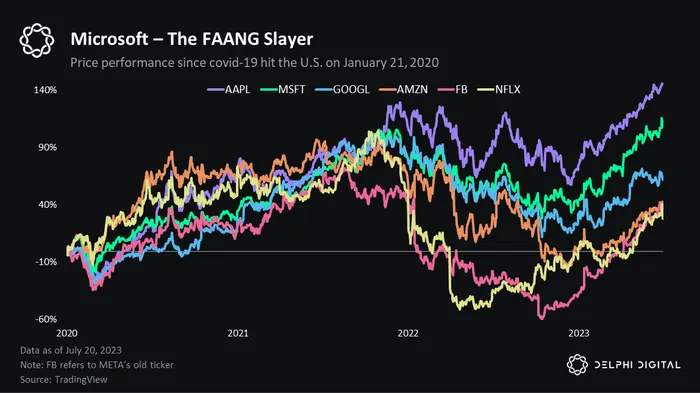

So, wat do? Obviously, getting some sorta direct alloc to OpenAI equity would be ideal. But that’s not feasible for me. I need a more noob way to gain exposure. So, I started digging into OpenAI’s financial backers, and one name kept coming up: Microsoft. The stodgy boomer Office 365 Microsoft?! Yes, that Microsoft. The same Microsoft that’s crushing nearly all the FAANG stonks.

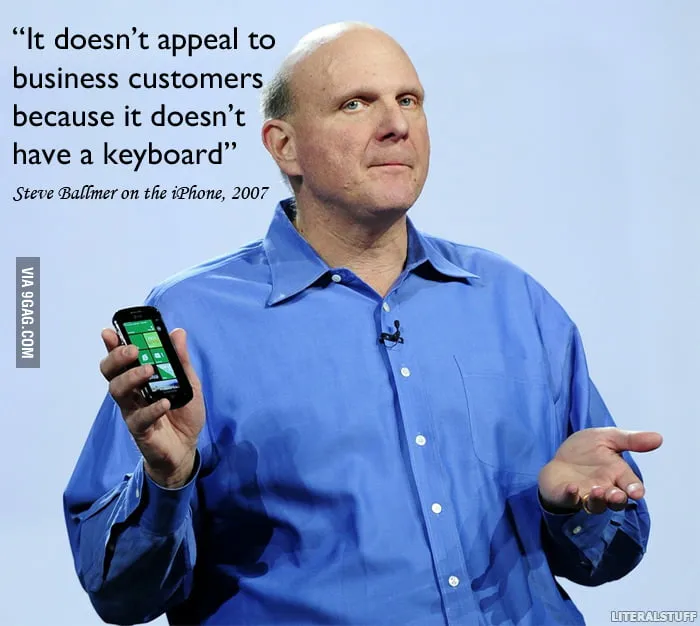

If you’re surprised by Microsoft’s outperformance, you’re not alone. For years, MSFT was clowned for missing out on the mobile wave.

Microsoft’s Kin phone was (shockingly) a complete bust

It was years before Microsoft’s CEO, Steve Ballmer, finally admitted that the company had “fallen behind.”

However, things have since changed a lot.

After being predominately a closed-source, Windows-led company for much of its history, current CEO Satya Nadella has slowly transformed the software giant into a leading open-source firm. The 2018 acquisition of Github for $7.5 billion was the most obvious push in this direction.

Nadella’s core thesis behind Microsoft’s transformation is the idea that technology is moving way too fast for any one company to go at it alone. Securing partnerships and working with everyone is the more lucrative bet in such exponential times.

Google had used its open-source, developer-friendly Android operating system to eat Microsoft’s lunch during the mobile computing era. Mr. Nadella bet Microsoft could do the same, but with AI.

In late 2016 Microsoft began its relationship with OpenAI. At the time, they announced a vague-sounding “strategic partnership.” In practice, this meant OpenAI would only buy compute from Microsoft Azure — its “primary cloud platform” in corporate speak. In the years since Microsoft has grown to become OpenAI’s largest financial backer and sole provider of compute. Thus far, it’s been an incredibly fruitful relationship for both sides.

It’s safe to say that without Microsoft, there would be no chatGPT.

As Roon — a well-followed anon and rumored OpenAI employee — makes note of, the OpenAI <> Microsoft tie-up may be the most unusual corporate partnership/venture deal ever.

Here are the rough details (there are still a lotta unknowns) on what makes this collab so bizarre:

- In 2019, Microsoft invested $1 billion in OpenAI, roughly half in the form of Azure credits. Microsoft received a 9.5% stake

- At some point between 2019 and 2023, Microsoft invested another $2 billion

- In 2023, Microsoft invested $10 billion in OpenAI, valuing OpenAI at ~$29 billion

- Microsoft received a 49% stake in OpenAI

- Microsoft will receive 75% of OpenAI’s profits until it recoups its $10 billion investment

- After that, Microsoft will receive a 49% share of OpenAI’s profits.

- Other investors, including Khosla Ventures, account for another 49%

- And the remaining 2% of OpenAI’s profits will be donated to charity

- Importantly, despite all the money Microsoft pumped into OpenAI, it will be subject to a profit cap like all other investors

Dripped Out Technology Brothers

A dumb but not entirely wrong way to think about the MSFT <> OpenAI relationship is as a debt deal with defined equity upside. Most of the money MSFT venmos over to OpenAI is promptly venmo’d right back in the form of Azure credits. So we can confidently say that most (if not all) of the $13 billion Microsoft plowed into OpenAI will end up roundtripping.

the roundtripooor

On top of that, Microsoft has secured itself a senior claim on OpenAI’s cashflows — to the tune of 75%. It’s not unreasonable to say that Microsoft effectively owns OpenAI (financially, not legally) until it fully recoups its $10 billy wop outlay.

“I solemnly swear to pay you back, Satya” — sama, probably

The real question — the one that all the big bucks turn on — is what Microsoft’s profit cap looks like. As a “capped” for-profit institution, OpenAI is a hybrid organization with a dual-class share structure. The nonprofit OpenAI Inc. is the sole controlling shareholder of OpenAI LP, the for-profit company that owns and operates OpenAI’s research and development activities. When OpenAI sells equity to investors like Microsoft, it sells OpenAI LP shares, which are totally controlled by the non-profit OpenAI Inc.

The profit cap for OpenAI LP is 100x the amount of any investment. This means that investors and employees can only earn a maximum of 100 times their initial investment in OpenAI LP. Any profits above the cap are returned to the nonprofit OpenAI Inc.

Semafor reports that “profit caps vary for each set of investors.” So we can say with high confidence that a 100x on Microsoft’s $13 billion investment is the absolute best-case scenario. And if we’re looking to underwrite an investment in MSFT on the basis of perceived OpenAI upside, we can assume that most of the $13B is returned to MSFT via Azure revenue and then model the potential outcomes for capped profits.

- bear case: MSFT is subject to 20x profit cap: $13B x 20 = $260 billion (9.7% of current mkt cap)

- base case: MSFT is subject to 50x profit cap: $13B x 50 = $650 billion (24% of mkt cap)

- bull case: MSFT is subject to 100x profit cap: $13B x 100 = $1.3 trillion (48% of mkt cap)

Fwiw, this is a super simplistic set of financial projections and does not constitute financial advice! I do not own any MSFT stonk, but I am thinking about it… MSFT seems to offer the best exposure to OpenAI, which at this point, looks like the fastest horse in the Singularity race.