“DeFi has emerged on the other side of a three year bear market with new faces, new ideas, and a new meta. In this report, we offer you a comprehensive briefing on the themes we believe will dominate the narrative in 2024.”

Top 3 Key Takeaways

- EigenLayer emerges as a protocol reshaping the staking paradigm. Going beyond Ethereum’s security, EigenLayer greatly extends the utility of staked ETH.

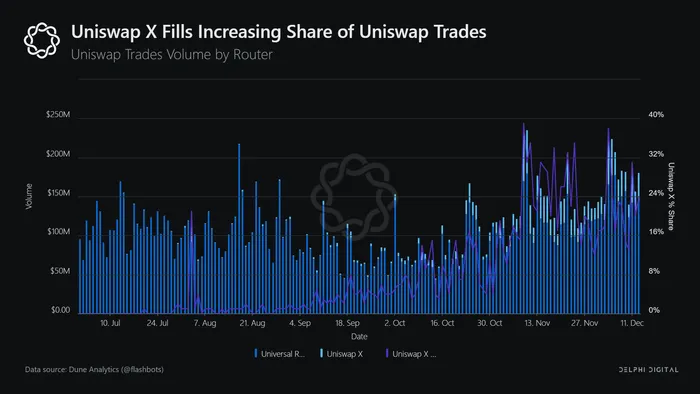

- UniswapX and other intent based apps will break DEXs out of their growth plateau.

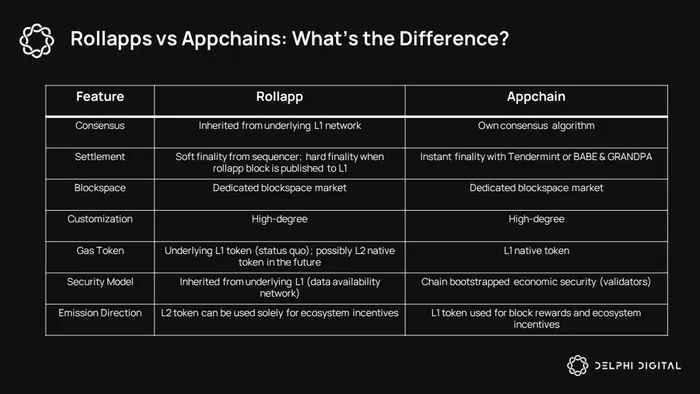

- Scalability advancements through rollapps and UX improvements from next-gen wallets will make DeFi more viable for end users.

Key Takeaways

- The year was plagued by widespread lethargy as rising interest rates muted on-chain activity. New projects, tokens, or designs, struggled to attract fresh capital and generate excitement, and fundamentals were largely disconnected from price. DeFi made significant progress in the decentralized perps sector, but these improvements failed to carve out market share from CEXs. Heading into 2024, the positive energy is palpable. There is volatility on the horizon and a slew of potential catalysts.

- Theme #1: Competition Between LSDs and the Restaking Economy

- Ethereum staking saw significant growth in 2023, primarily driven by the Shapella upgrade, which allowed for withdrawals from the Beacon Chain.

- Lido’s dominant share of the Ethereum LSD market is bolstered by strong network effects via stETH integrations. Lido is unlikely to be challenged by the saturated market of smaller players in the near term.

- EigenLayer leads the biggest staking development of 2024: restaking. EigenLayer extends the utility of staked ETH to actively validate services (AVS), encompassing bridges, appchains, rollup sequencers, and data availability networks.

- Liquid restaked ETH earns higher yield than traditional staked ETH, but opens up potential challenges in managing the risk profiles of additional staking layers.

- The competitive landscape of Solana liquid staking is beginning to heat up. Jito has reached parity with incumbent leader Marinade with an innovative points-based airdrop incentive program.

- Theme #2: All Eyes on Uniswap Liquidity

- Once again, Uniswap found itself shrouded in controversy after revealing its new aggregator, UniswapX, which will leverage intents to take trade execution off-chain.

- With UniswapX, routing is no longer limited to one universal router smart contract. Navigating the vast array of hooks and pockets of liquidity on Uniswap, other DEXs, and CEXs is now (in theory) an altruistic group effort by off-chain entities.

- Intents are a fundamental reimagination of how transactions are structured, allowing for gas free transactions, cross-chain applications, and much more.

- The potential improvements of UniswapX come with a lot of uncertainty around passive liquidity provision. UniswapX will allow off-chain solvers a first look at order flow before routing through the AMM. This could leave passive LPs as a dumpster for toxic flow leading to dangerous trickle-down effects.

- There is also the possibility that as Uniswap resumes its traction against CEXs, Uniswap begins to swallow massive amounts of volume, and LPs end up net positive.

- Theme #3: App-Specific Rollups Will Scale Ethereum DeFi

- Ethereum’s entire scaling vision revolves around rollups. The core premise is that the Ethereum L1 layer will gradually become a settlement and data availability layer for an ecosystem of rollups.

- Users of rollups benefit from the economic security of Ethereum while also enjoying reduced transaction costs. The use of native ETH for gas in rollups simplifies the process for users and aligns these chains closely with Ethereum.

- Aevo, a derivatives rollapp built on the OP stack, and dYdX, a perps DEX that recently migrated from rollup to Cosmos based appchain, offer a strong case study of the trade-offs involved with rollapps and appchains.

- Interoperability between rollups and decentralization of sequencers are the most important issues that must be addressed for rollups to flourish.

- We believe rollups will be core to further scaling out DeFi applications while giving app developers a larger degree of control over the infrastructure.

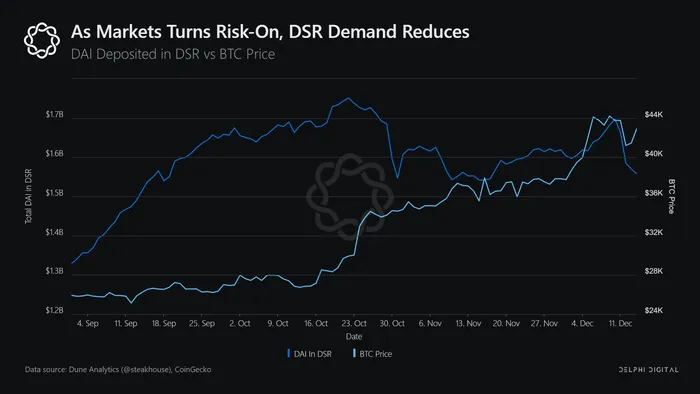

- Theme #4: RWA Design Space Opens Up

- Real world assets were quietly one of crypto’s most successful sectors in 2023. The rising interest rate environment that proved harmful to broader DeFi helped onboard ~$800M in tokenized treasuries.

- RWAs have been a polarizing topic in crypto, as they represent the promise of institutional adoption, as well as many of the trade-offs necessary to onboard them, such as KYC, trust assumptions, and permissioned usage.

- Many RWA projects, such as Ondo Finance, exist in a siloed vault available to accredited investors. This model can be useful for onboarding capital to DeFi, but is unlikely to make a big picture impact on the space.

- Backed Finance and Superstate offer an exciting future of a more permissionless RWA ecosystem, with tokenized treasuries based on the USDC model.

- We expect cyclical momentum and regulatory clarity to open up the design space for permissionless and composable RWA projects.

- Theme #5: New Use Cases Spark Traction for Interest Rate Derivatives

- Interest Rate derivatives struggled in 2024, with fixed rates and interest rate swaps performing poorly. Pendle was the lone bright spot of the sector. Pendle’s token surged 2000% and it has become the first platform to make yield trading ‘click’ for users.

- Pendle’s growth has been heavily supported by token incentives, and it is unclear if the yield stripping model is capable of supporting a future-proof IRD ecosystem. IPOR Labs v2, once fully released, looks well positioned to do so.

- High rate spreads from the utilization model and a non-existent fixed rate lending ecosystem are currently holding back any significant IRD progress.

- Theme #6: Decentralized Stablecoins’ Tough Path Ahead

- Decentralized stablecoins offer clear value over centralized solutions, but have struggled to find product market fit beyond stores of value and units of account.

- Centralized stablecoins, such as USDC and USDT, are much more convenient due to being widely accepted by CEXs and in payments.

- Capital efficiency, on/off-ramp limitations, and regulatory uncertainty are significant obstacles limiting decentralized stablecoins growth.

- Theme #7: Payments, Crypto’s Largest and Oldest Challenge

- We expect large-scale penetration of Fintech companies using stablecoins as payment facilitators in 2024.

- Financial services businesses can remain a walled garden while tapping into stable stablecoins for faster confirmation times, cheaper transaction costs, frictionless cross border remittances, and improved economics for the end user. Compared to legacy rails, these improvements are becoming too substantial to ignore.

- Paypal’s pyUSD marks the beginning in a shift towards this thinking, more closely aligning blockchain infra with the fintech core services.

- SolanaPay, Coinbase Commerce, and Crypto.com offer easy to integrate solutions for crypto payments.

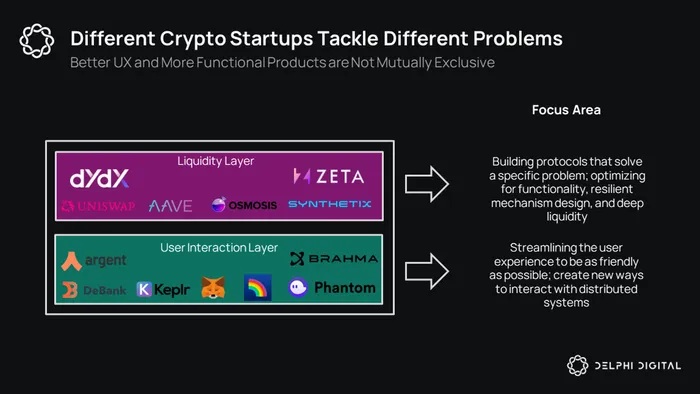

- Theme #8: Wallets Make Drastic UX Strides and Become “Consumer Apps”

- Wallets are beginning to shoulder the UX burden of connecting users to smart contracts. This niche was previously dominated by UX aggregators like Zapper, Zerion, DeFiLlama, and DeBank.

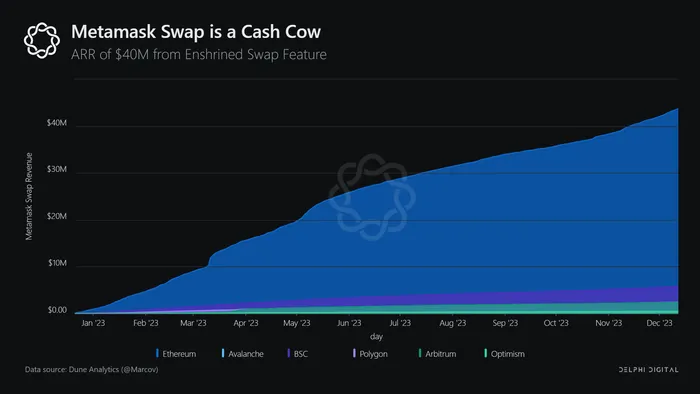

- The sustained use of Metamask Swaps in spite of its predatory fee structure demonstrates the willingness of users to pay for UX, and the ability for wallets to monetize by owning the user layer.

- Metamask Snaps, though in an early stage, offer insight into how wallets will continue to evolve into more robust platforms in the future.

- Other themes to pay attention to in 2024

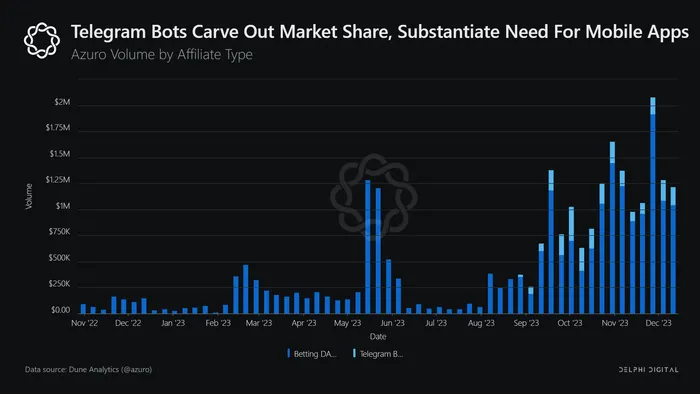

- Surprise 1: Lack of Traction for On-Chain Gambling – On-chain gambling did not succeed to the extent we expected in 2023, but is far closer to parity with CEXs the options, perps, or spot DEXs at this time. Adoption for on-chain sportsbooks remains a high conviction thesis for us moving forward.

- Futuristic Idea 1: The Personal Finance DeFi Stack – DeFi for personal finance still isn’t quite there yet, but the components are there.

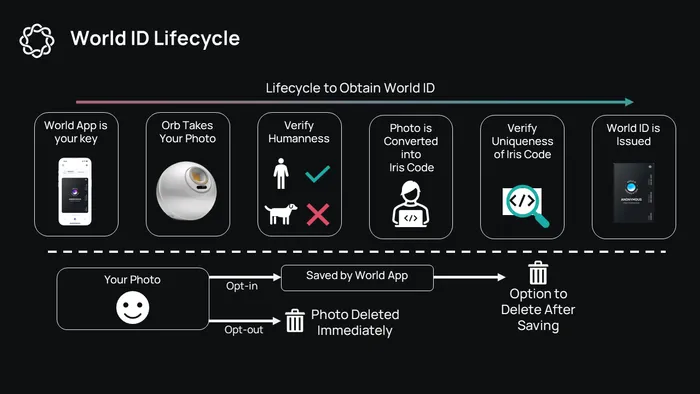

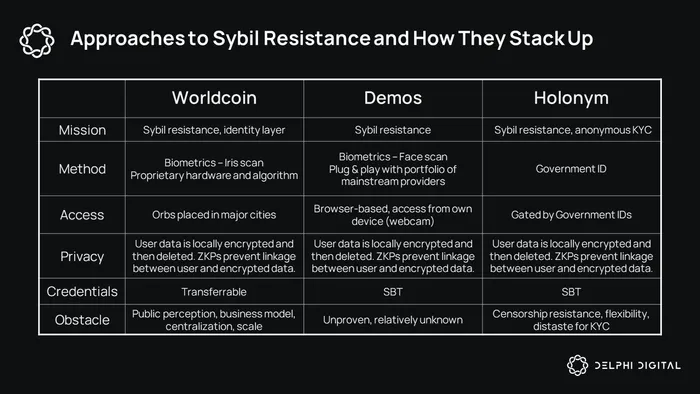

- Futuristic Idea 2: Worldcoin’s Role in Decentralized Identity – Worldcoin is an extremely polarizing crypto project. It features impressive tech and seeks to solve an important problem, but has an incompatible business model and a disastrous go-to-market. Perhaps Worldcoin’s biggest contribution is galvanizing the crypto community to more decentralized solutions.

- In summary, DeFi is at a vital inflection point. We are simultaneously on the verge on making significant strides in eating at CeFi’s market share, but there are certain friction points that currently hold back the adoption of these systems en masse. Redefining how we interact with blockchain-based apps and unlocking new use cases will be key in breaking down these points of friction.

Additional Charts & Analysis