In Nov. 2023, I published an AF post titled, “Resuscitating Ethereum.” This was right after the ETH spot ETF filing by BlackRock and the resulting PA.

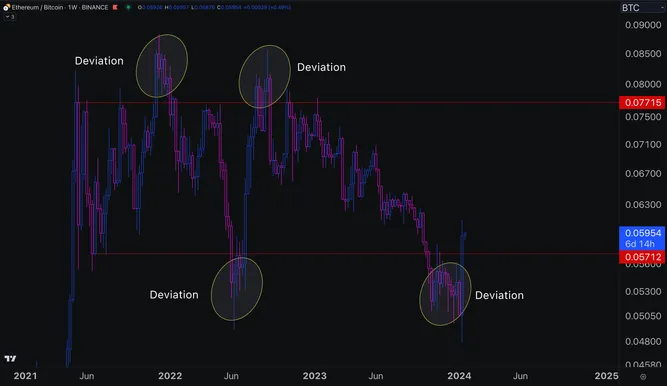

This was the chart I used in the Nov. AF post. Following BTC’s spot ETF approval, we saw ETH taking charge and thus confirming the deviation.

Although it took some time, the way ETH acted post BTC’s spot ETF approval is exactly what we pitched in our Markets Year Ahead Report which you can read here.

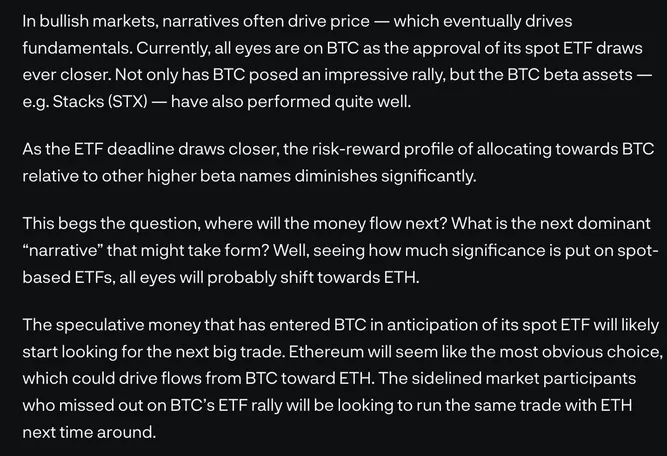

(Following is an excerpt from Markets YA Report)

Like we said, the bulls will now target the range highs on ETH/BTC at around 0.07. But for that to happen, any retest of the range lows around 0.057 needs to be held. Failing to do so would invalidate the deviation and we can expect a retest of 0.048 at the very least.

On the USD pair, ETH has broken out of an 18-month-long consolidation and has confirmed its previous range highs as support. Currently, ETH is expanding and as long as the previous range highs hold, bulls will be targetting the HTF resistance cluster around $3500.

Now, if you aren’t a giga whale and market liquidity is not a constraint for you, you are much better off playing ETH beta assets such as LDO, OP, ARB, SSV, RPL, etc. just like most market participants did during BTC’s rally by bidding assets such as STX and ORDI.

Now, given that the market finds itself in a rather muddy situation, being fully risk-on might not be for everyone. For those who fall into this camp, a good way to express your opinion (if you are bullish on ETH and thus its beta) would be by spreading out ETH beta vs. BTC beta. This is because if ETH is to take charge of the market in the near future, then it stands to reason that its beta assets will outperform BTC’s beta assets irrespective of overall market direction.

Lastly, given the overall sentiment towards ETH in recent times, a brief (or not) resurgence of an ETH-led market wouldn’t be surprising, especially when the CEO of BlackRock is saying that he “sees value” in an ETH ETF on CNBC.