Leverage is a double-edged sword, and is frequently misunderstood in the realm of crypto trading. While it can act as a profit multiplier for disciplined traders, it simultaneously serves as the harbinger of liquidation emails for those who do not respect it. However, this perspective alone is rather shortsighted, as it overlooks the key advantage of leverage: the reduction of counterparty risk.

By employing leverage, traders can take normal position sizes while reducing counterparty risk, as they need to hold less collateral on the exchange to achieve their desired position size. This proves particularly beneficial in scenarios involving exit scams or bankruptcy declarations by exchanges — occurrences that are, unfortunately, not uncommon in the cryptocurrency space. When such events transpire, the trader only loses the amount on the exchange, safeguarding most of their bankroll while still retaining the capacity to trade at their desired position size.

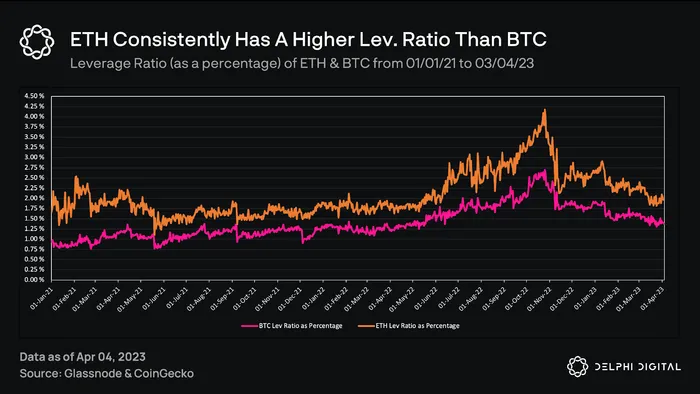

Nonetheless, a majority of market participants primarily perceive and utilize leverage as a mere potential profit multiplier, when in practice, it is much more likely to act as a loss multiplier. This approach paves the way for intriguing price action, and is often exploited by more sophisticated market participants. Given the significant influence that leveraged products wield in terms of price action and price discovery, this is well worth examining in greater depth. Specifically, one can analyze the amount of leverage exerted on an asset relative to its market capitalization. The analysis can be further contextualized with the help of funding rates among other metrics. Without further ado, let’s jump in!