LTR gives his take on the launchpad tug of war and what he thinks the future might look like in this area.

...14th August 2025

13th August 2025

Insights Into China's Largest Digital Entertainment Event

I recently had the pleasure of attending ChinaJoy, China’s largest consumer event focused on digital entertainment. ChinaJoy is known for having a heavy focus on all things gaming-related, but this year, there was also a strong showout from AI, physical goods, and Anime-related businesses. Further ado, here is a brief collection of my tak

...

12th August 2025

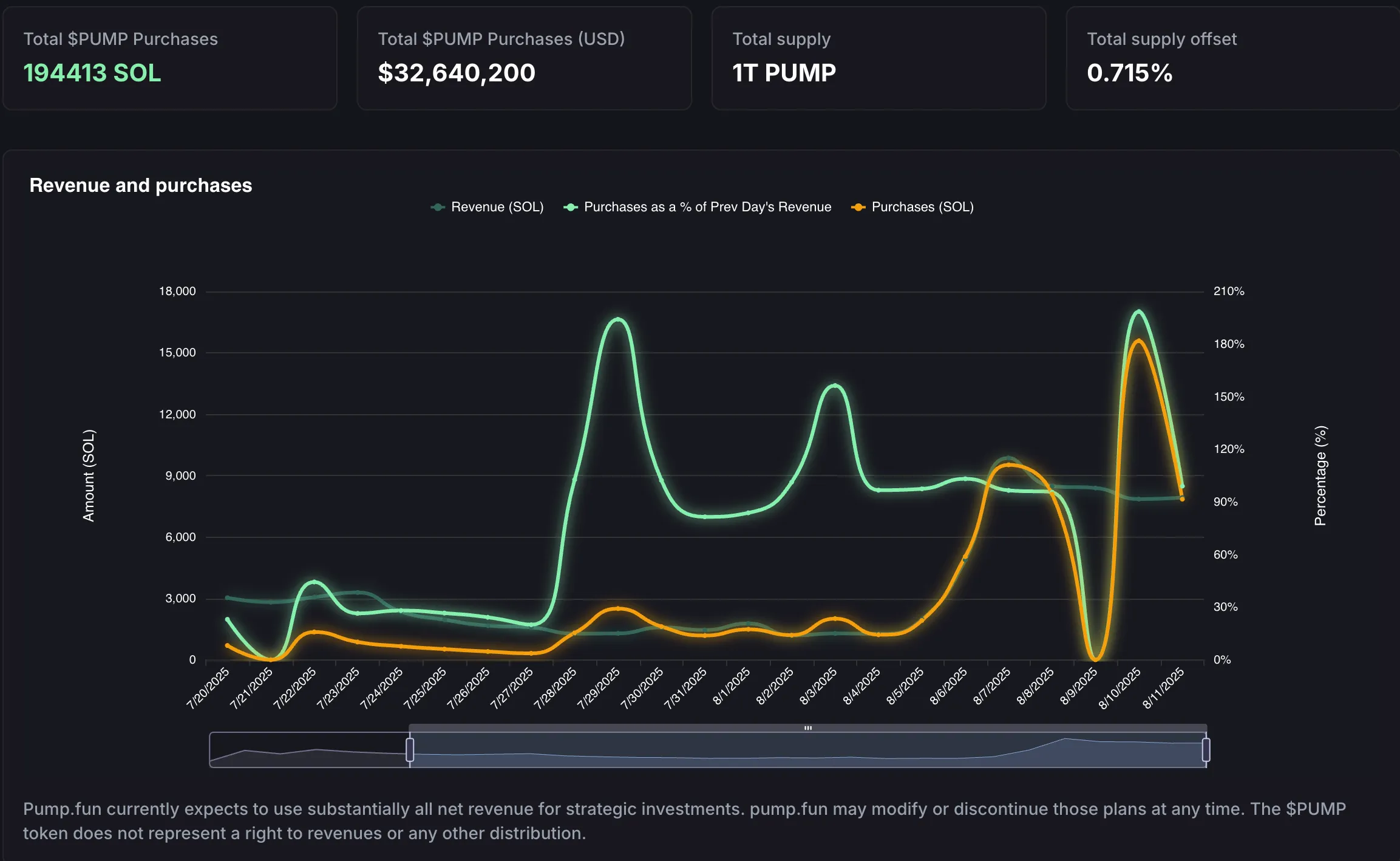

$PUMP Update: The Strategy We Called For is Working (So Far)

In our last $PUMP update on July 24, Jason, Yan and I went on Unchained with Laura Shin where we discussed what it would take for Pump to turn things around. We outlined how the platform needed to take back crypto-native flow and market share before focusing on their grander visions. This would not only help support the bleeding $PUMP pri

...

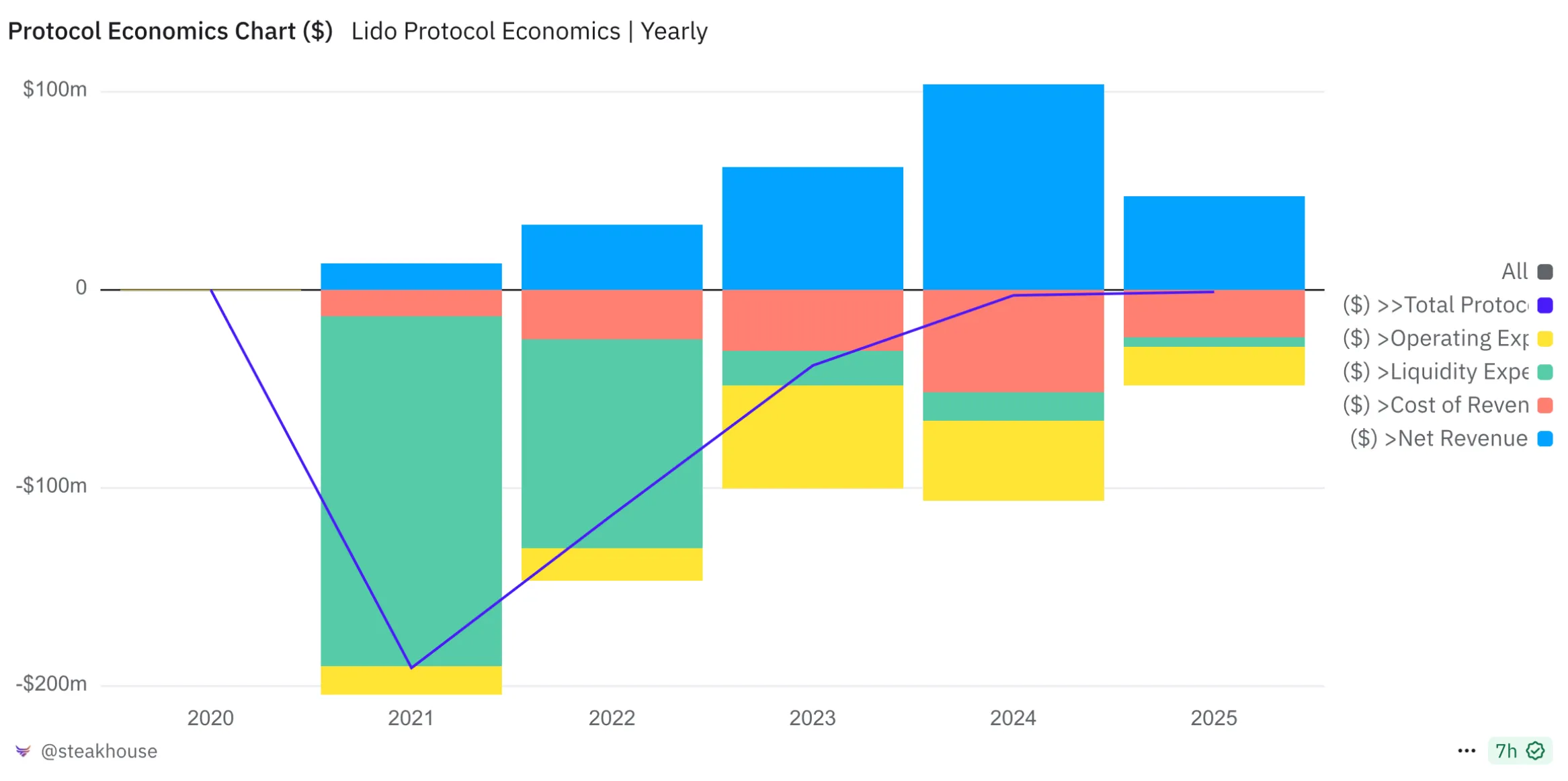

What's going on with Lido?

Lido has recently seen signs of outperformance compared to many other alts. This post will briefly go through the potential reasons behind the momentum and look into if this is just hype or something more.

Stabilizing Financials

Overall, Lido has made major strides in profitability and is projected to break even or be profitable in 2025.

...

9th August 2025

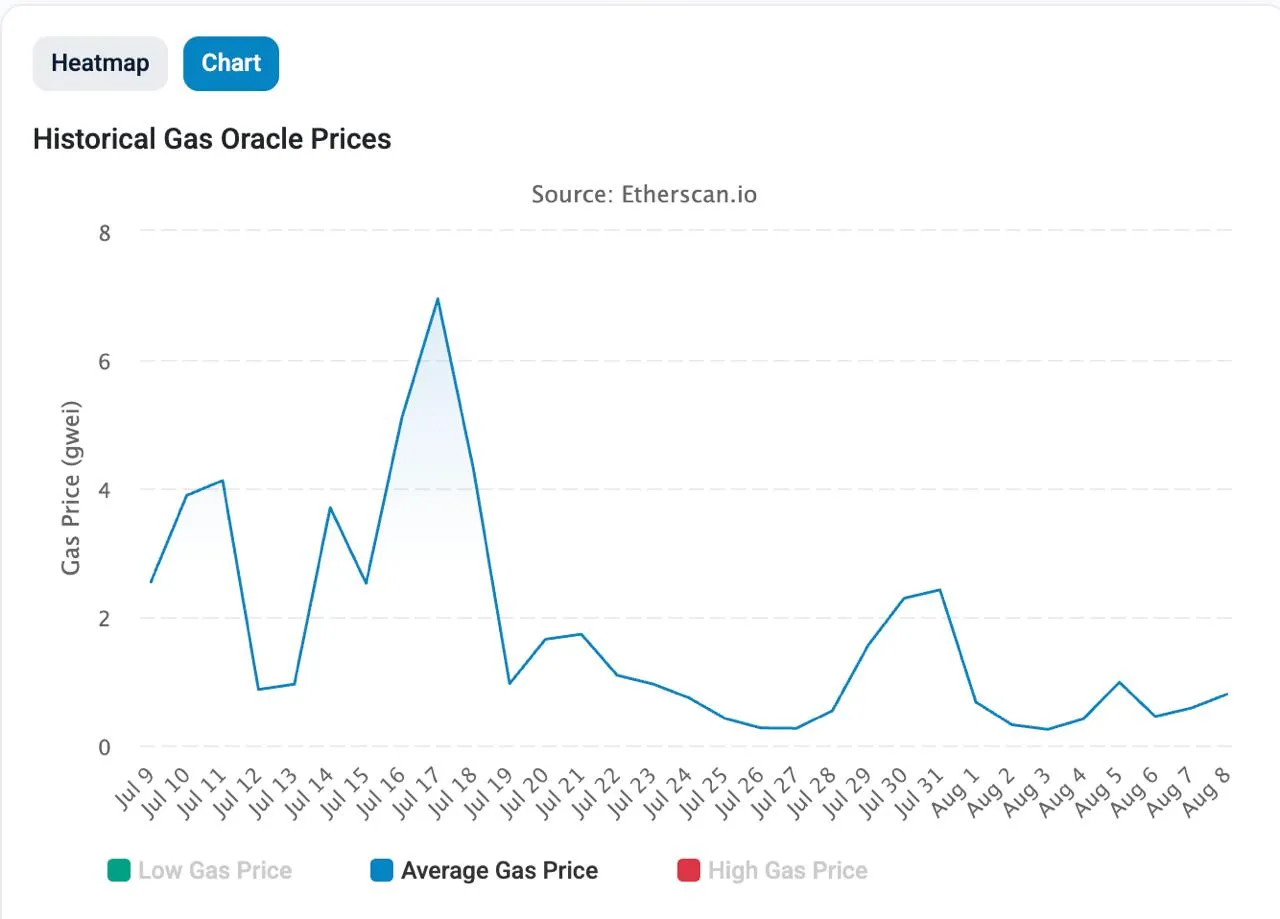

It's DAT Szn for ETH

Sign up to Delphi Pro to view.

ETH is purely in DAT szn right now and the recent rally is unlike ones we’ve seen in the past. In 2020-21, ETH rallies were correlated with onchain activity. Whether DeFi summer or NFT szn, these were what drove prices. This time, not so much.

Gas prices aren’t moving. This is very strange to me because at a minimum you would expect a lot

...

8th August 2025

6th August 2025

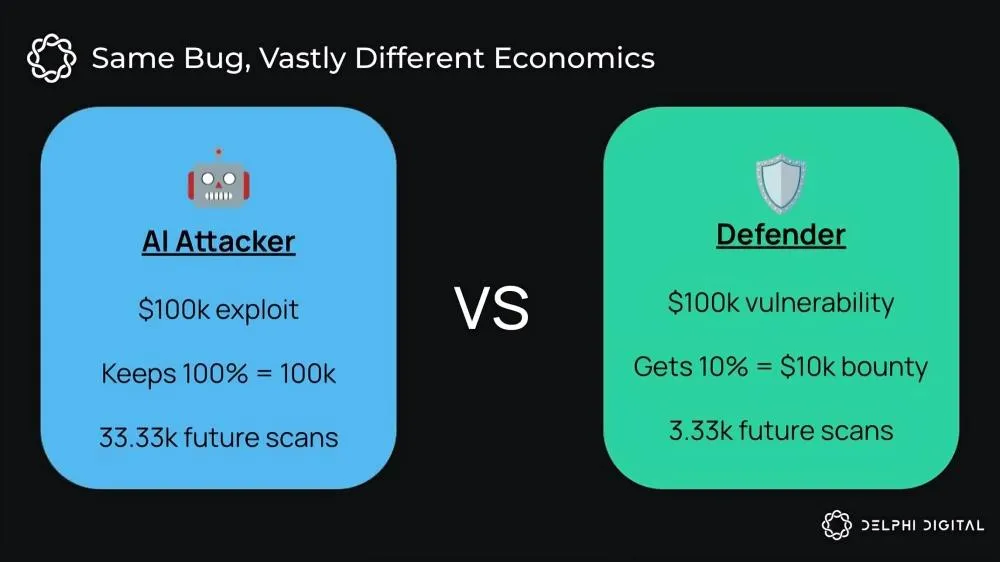

AI Just Automated DeFi Exploits

Remember when we worried about AI taking programming jobs? Turns out the bots went straight for the lucrative stuff first.

Researchers at the University of Sydney and University College London just dropped a paper on A1, an AI agent that hunts smart contract bugs and writes working exploits. Not vulnerability reports, but actual attack co

...

5th August 2025

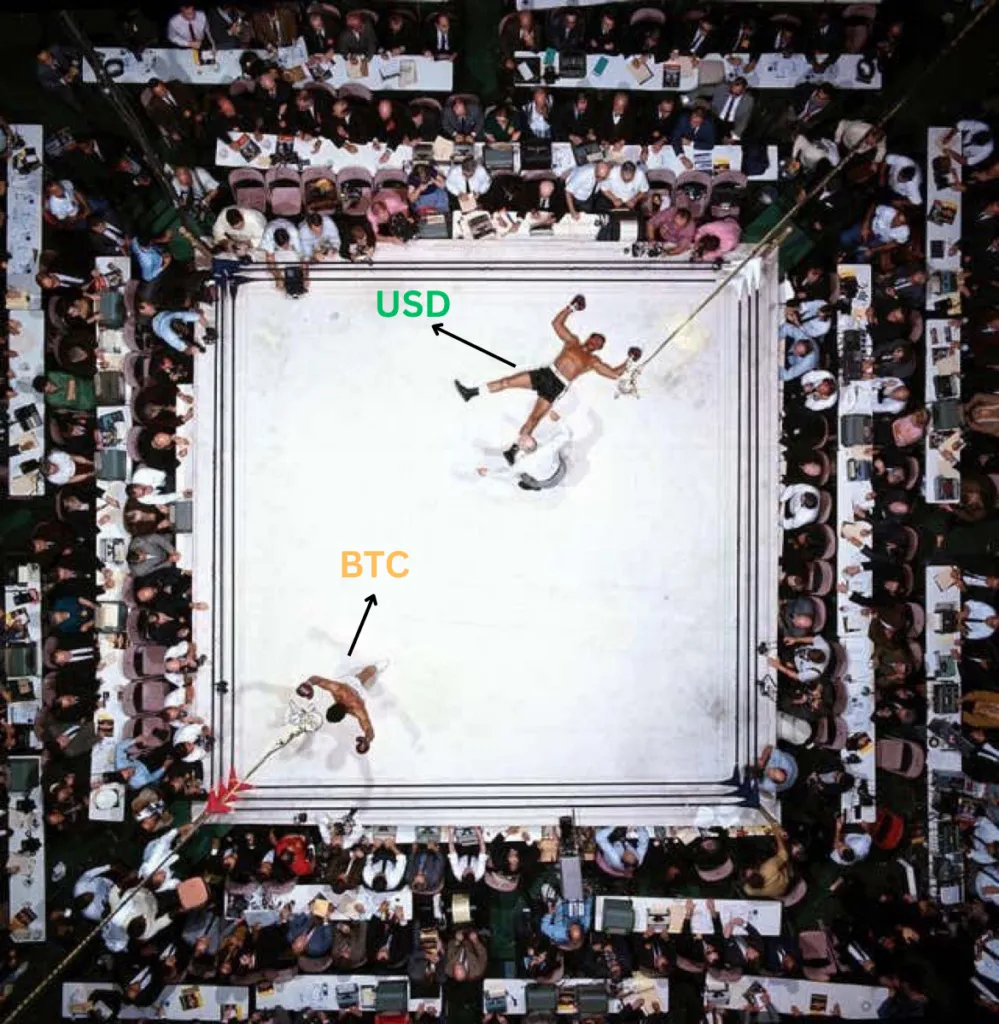

BTC vs USD - Three Charts, One Winner

BTC vs USD. 5th round TKO?

BTC is showing signs of reverting back to its inverse correlation with the US dollar. While most are watching equities or ETF flows, not many are tracking BTC’s relationship to the Inverse DXY and that’s where I think the signal is right now. The dollar is struggling to reclaim the key 100 level which has histor

...

1st August 2025

New Delphi Pro feature: Ideas

Today we’re launching a new beta product on the portal!

“Ideas” lets you share and discover crypto trade ideas within our Pro community. You can:

-

Submit your own trade ideas (Long, Short, or Neutral positions)

-

Track trade performances

-

Browse ideas from other Pro members

-

Get inspiration for your own strategies

-

Climb to the top of