In my pursuit of innovative yield strategies, I’ve come across a delta-neutral strategy utilizing Synthetix perps. For clarity, let’s briefly delve into the mechanics of Synthetix perps:

Synthetix perps operate on a stablecoin margin framework, enabling users to either long or short selected tokens with up to a hefty 50x leverage.

Maintaining equilibrium in open interest (OI) is paramount to reducing risks for Synthetix. Synthetix employs three robust mechanisms to maintain OI balance.

Source: Kwenta

-

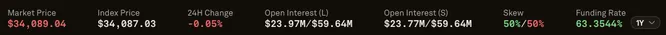

Funding Rates are dictated by two variables – the disparity in OI and for how long time. If BTC’s OI skews towards the long end, the funding rate will be positive over time. The magnitude of this rate’s growth hinges on the degree of OI disparity.

As seen above, the hourly funding rate for BTC is currently 0.0072% hourly, or 63.1% annualized. This is a result for long skewed OI over an extended period of time.

Source: Kwenta

-

Price Impact is similarly driven by OI variance. Trades amplifying the existing skew will face a negative price impact, whereas trades that close the skew will benefit from a positive price impact.

In the graphic above, you can see that Market Price is > Index Price as OI is skewed towards Longs. The Market price will be the execution price for traders, and the Index Price is Synthetix’s oracle price reference.

-

Source: Kwenta

-

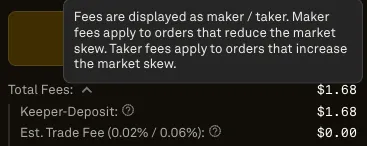

Trading Fees deviate from the conventional maker/taker fee structure. If you enter a position exacerbating the skew, a steeper fee is levied. On the other hand, actions that narrow down the skew incur a reduced fee.

Want to learn more? Do read up on our report on decentralized perps.

STRAGEY TIME!

The strategy for profits here are to arbitrage against not just funding rates, but also market-to-index price impacts from OI skews. Although opportunities might be scarce, in times of volatility, funding rates tend to go wild alongside skews.

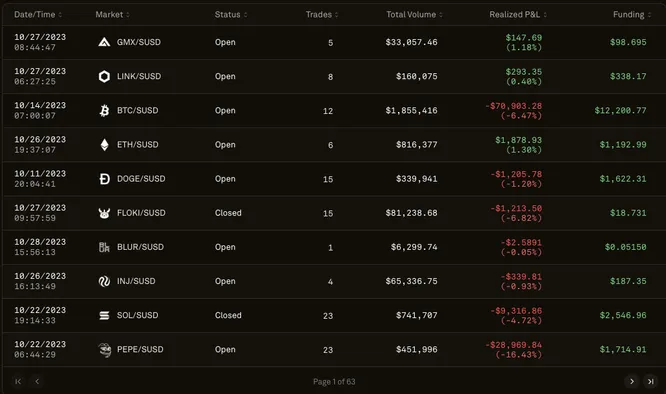

Source: Kwenta

As we can see, when BTC rose to 34K funding rates rose quickly to 0.0177% hourly, or 155% annualized. The first strategy would be to execute a funding rate arbitrage, where you short BTC on Kwenta and Long on another exchange to capture the difference. This provides an opportunity for a delta-neutral stablecoin yield.

Source: Kwenta

Additionally, you can capture a positive price impact, provided your position doesn’t widen the OI skew. The best timing to enter would be to wait for a large entry, which increases the price impact arbitrage. As seen above, a large long position (148.58 BTC) was entered, resulting in a negative price impact of ~$68/BTC for him. The price impact was arbitraged by traders taking the opposite direction.

The best way to execute this trade would be to ensure a significant enough market-index price difference, which minimally covers the trading fees.

The P&L for this strategy is calculated as: Total P&L = Price Impact + Funding Earned – (Trade Fees from entry and exit)

However, this might be competitive, there are already quite a few arbitrageurs taking advantage of this strategy. As we see above, this trader mainly captures funding arbitrages.