There was a consensus view that Shanghai would be a “sell-the-news” event. And although that didn’t catalyze immediately, the market is starting to move lower. Some people believed we would see a large swathe of validators unstake and sell their ETH. Others noted the limits on network staking withdrawals and used that as fuel for a mid-term bullish thesis.

It’s really, really difficult to predict what markets are going to do. But thanks to Hildobby’s Dune dashboard, we can get a sense of the financial position of stakers right now.

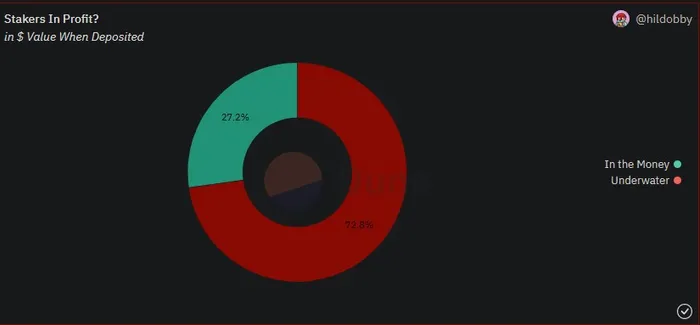

Over 72% of stakers are down on their ETH positions in USD since they deposited it into the network (not since they purchased the ETH).

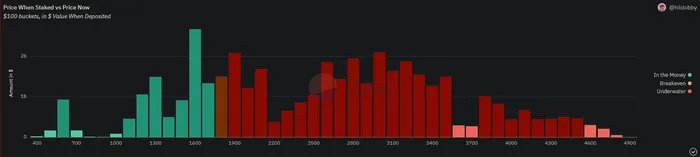

Most ETH staking occurred between $1,600 and $3,500. There was approximately 830K ETH staked above $4,000 (oof).

Liquid stakers and CEX stakers who cared about this have probably already purged their positions (secondary market sales for liquid staking; direct redemptions for both). Some solo stakers who felt the same way would probably still have some ETH queued to withdraw and sell. But if you’re a solo staker who cares enough to run your own validator, chances are you don’t really care about ETH/USD volatility. In fact, you’re probably someone who has seen much worse volatility than the last eight months.

As noted, the dashboard looks at who is underwater based on price when the ETH was staked versus price now. It doesn’t reflect cost basis, which is uh…pretty important. So we don’t really have the full picture here.

Nevertheless, we have to account for all possibilities. And so a gradual but constant flow of ETH out of the network from solo stakers would not be out of the blue. Furthermore, if ETH’s price drops harder, we would see more price-sensitive stakers withdraw their stake and sell their ETH.

But that’s only side of the equation. We also have to account for network inflows.

Over the three months from Feb – Apr. 2023, over 3M ETH ($5.5B) was staked in the network. With Shanghai removing a large chunk of technical risk, stemming from the inability to withdraw, investors seem to be more comfortable staking their ETH.

Apr. 2023 boasts the largest amount of ETH staked in a single month. Shanghai opens the door to more ETH holders depositing their assets into the network.

Overall, one would expect a sharp price drop in ETH to cause a decent chunk of ETH to unstake. It’s human nature to panic at moments like that. In that situation, you would also likely a see massive inflows to staking when price does recover. So does staking really affect ETH’s market dynamics?

Sellers are going to sell anyway — whether its liquid or staked only accounts for a timing difference, not necessarily a change in behavior. The nature of this delay does have some impact on market structure and could affect LSD pegs. But as far as changing the dynamic of the way ETH trades, I don’t foresee staking having a massive impact besides reducing the immediately-liquid float for the asset. But I wouldn’t rule out this changing in the future.

The data in this post was sourced from Dune Analytics.