Perpetual futures — aka perps — are the most popular instrument in crypto. On any given day, perps trade ~7x more size than spot.

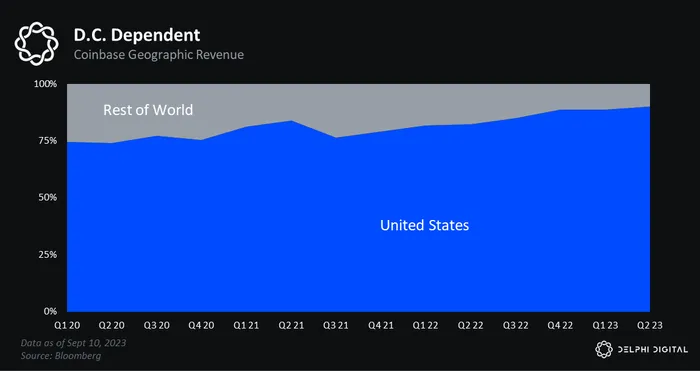

Unfortunately, perps are still illegal in the techno-regressive United States. This forces American exchanges that want to offer these innovative products offshore (see FTX). Companies HQ’d here in the US of A — like Coinbase — are at a distinct disadvantage vs international peers because they don’t offer the industry’s leading product.

For many years, Coinbase tolerated the uneven playing field, betting that the US would eventually see the light. But with Gary Gensler still running the circus, Brian Armstrong and co decided to pivot and go global with the launch of Coinbase International in May 2023.

After starting slow with API-only access, Coinbase International is beginning to move serious size. Just yesterday, it eclipsed $6 billion in daily volume.

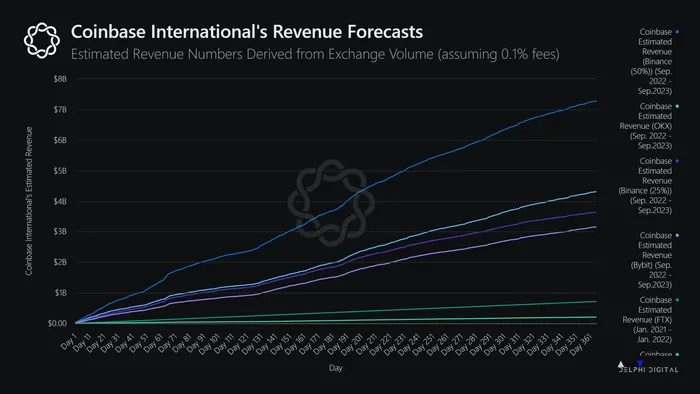

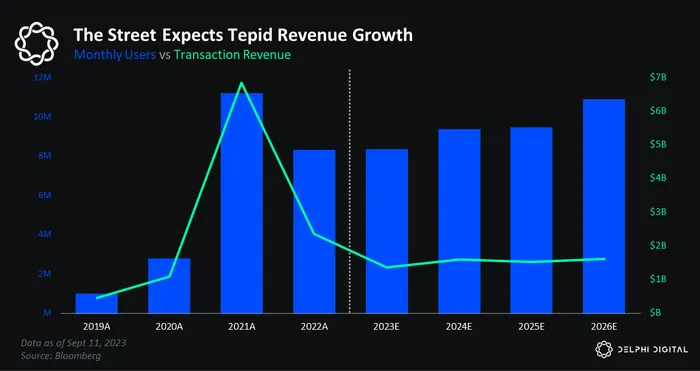

The upshot here is if Coinbase International sees 25% of Binance’s futures volume — even under a lower fee scenario — it would generate ~$1.8 billion in additional revenue, which would almost double its total trading revenue in 2022.

For context, consensus sell-side estimates don’t even expect Coinbase’s *total* trading revenue (US and offshore) to reach $1.8 billion until 2026.

Perps are a massive market and with some of the more established exchanges like Binance and OKX on shaky footing, there’s a huge opportunity for a bald and regulatory-compliant CEX like Coinbase to take market share.