It’s that time of the cycle again, when the initial hype of a recovery rally fades and the hopes of an uponly bull market dissolve into general apathy.

Adding insult to injury, BTC’s price just triggered an official “death cross” as its 50d SMA crossed below its 200d equivalent.

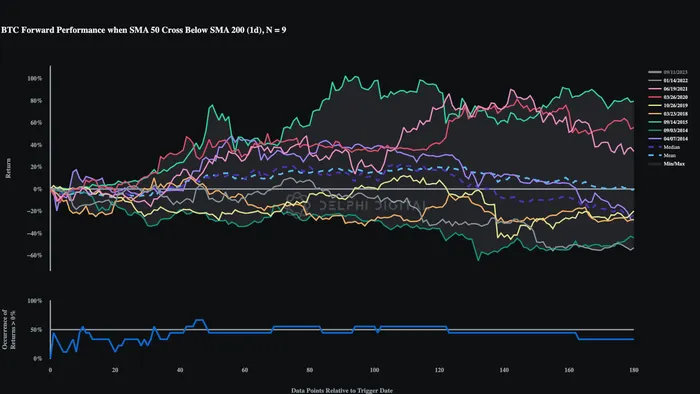

Some may be quick to point to BTC’s mixed performance after prior death crosses, casting doubt on its reliability as a predictive indicator. And that’s true – if we include every prior instance, BTC’s average returns post-event are more noise than signal.

But this includes every technical crossover going back to 2014, including periods where BTC’s price action looked drastically different than what we’ve seen so far this year.

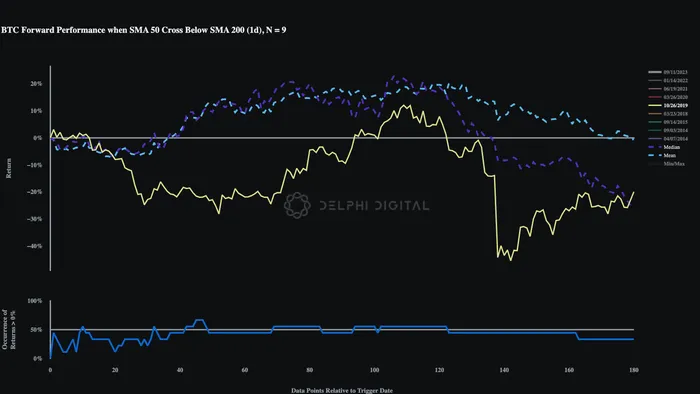

One period that does look strikingly similar though: 2H 2019.

We’ve been drawing parallels to this period since early this year because, in my view, that period is the one that most closely tracks BTC’s price action over the last 9-10 months.

For starters, the strength and timing of their post-bottom price recoveries have been pretty comparable.

As fate would have it, BTC also experienced a similar bearish crossover at almost the exact same point it did last cycle – after the excitement of its strong initial post-recovery price move faded.

BTC’s price continued to trend lower for ~6-8 weeks, and remained choppy overall for a few months.

For context, here’s where both experienced infamous death crosses in their respective cycles. Roughly 8 months after price started showing signs of life post-bottom, and a few months after their post-recovery local tops.

Death crosses are typically interpreted as fodder for the bears. But there’s something for the bulls here, too. One could argue that subsequent 6-8 week period of price consolidation would’ve marked the bottom of BTC’s 2H 2019 slide, as a global pandemic was ultimately the culprit behind the violent selloff in March 2020.

Viewed through that lens, the next local bottom may not be as far away as some think. Without a major catalyst though, it’s feasible prices will continue to consolidate, at least for the foreseeable future.