As the crypto market looks to cap off its fourth straight week of gains, we’re starting to see more bullish price breakouts.

Bitcoin continues to slay through resistance levels seemingly without a care, but momentum has also been picking up for other crypto assets outside of BTC.

We see this in the total market cap ex-megacaps (BTC, ETH) index, which looks to have turned the corner.

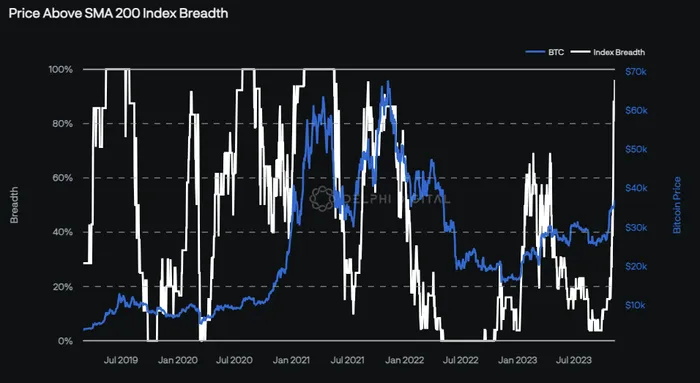

We’re seeing a broadening in participation across more names.

And we’re finally seeing ETH catch a bid after weeks of underperformance, setting up its own breakout as its momentum starts to turn.

Some of the recent outperformers – like INJ and LINK – haven’t lost steam yet either. And neither has SOL, which is up over 110% since we called its breakout.

SOL is on pace for its highest weekly close in almost 18 months, and capital continues to flow into SOL-based funds.

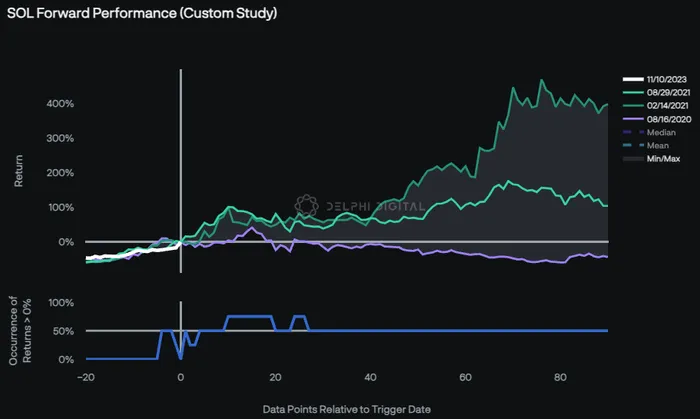

SOL’s price momentum has only gotten stronger the last several days, so much so that it’s pushed SOL’s 14-week RSI above 80 for the first time in over two years.

Interestingly enough, SOL tends to see further gains even after these overbought levels are hit.

Outside crypto, stocks are also rebounding. The Nasdaq 100 (NDX) appears to be breaking out after its latest consolidation.

Meanwhile, BTC is on the verge of breaking out against the NDX…

…which would follow its trend against other notable assets, like Gold.

Even COIN is getting in the mix (despite how bearish the Street still remains).

Given its strong correlation with crypto prices, it’s due to play some catch up.

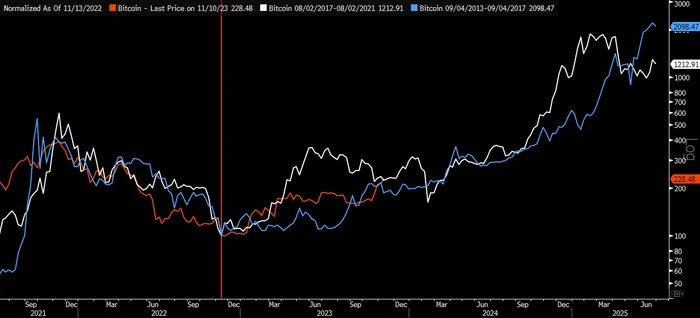

Especially if BTC continues to track its typical price action following prior cycle bottoms – the king still has a lot more room to run.

Especially if BTC continues to track its typical price action following prior cycle bottoms – the king still has a lot more room to run.

Long story short, momentum is building. Every bull market has its fair share of pullbacks, but if risk continues to outperform, crypto should lead the way.