Gm! Welcome to our third installment of Charts of the Week. Check out last week’s drop here.

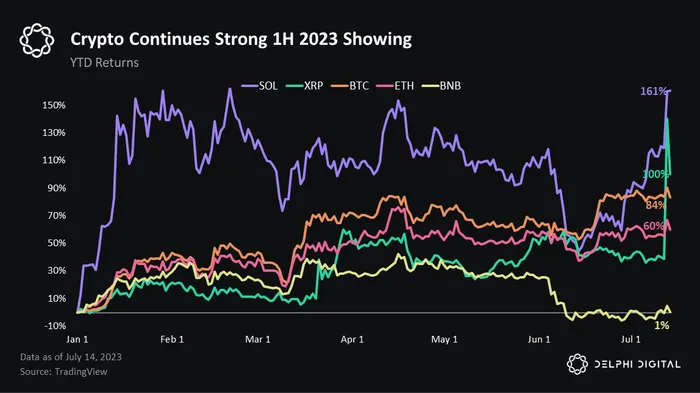

Crypto markets pamped this week after Ripple’s surprising regulatory win, err, ‘not total loss’ to the SEC. Alts ripped the hardest in the aftermath, led by XRP.

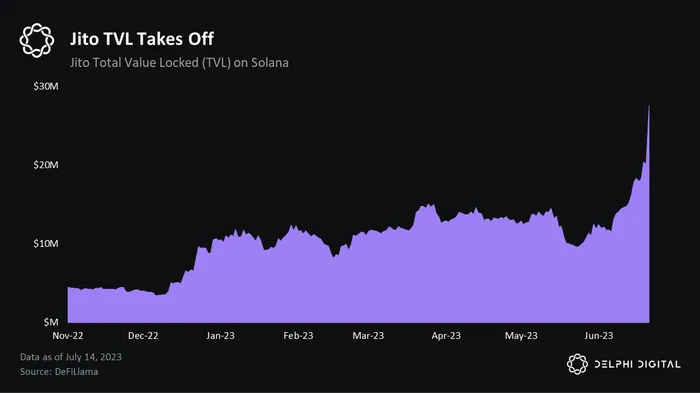

Solana DeFi continues to catch a bid. And Jito — a liquid staking provider — has been a notable outperformer.

Jito is now starting to cut into Lido’s market share on Solana. And as Solana DeFi rises out of the FTX ashes, the community has rallied around Solana-first protocols like Jito — at the expense of multichain projects like Lido.

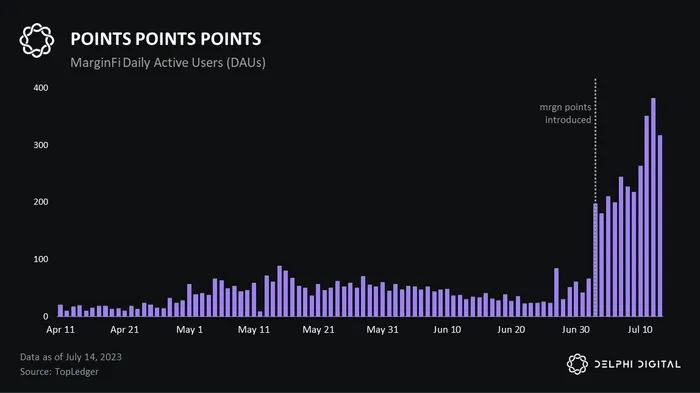

Notably, Jito isn’t the only Solana DeFi protocol putting up numbers. MarginFi — a borrow/lend protocol — has also experienced rapid growth, thanks in part to the launch of “mrgn points,” which appears to be a precursor to a token airdrop.

The “points” trend is (so far) unique to Solana and looks to be catching on as just the other day Cypher — a derivatives protocol — also announced its points program, which is set to kick off on Monday, July 17th.

“Points” now look like the obvious evolution of liquidity mining.

At a high level, they provide a mechanism to iteratively test how users respond to incentives.

Critically, the non-monetary nature of points offers teams more flexibility to tweak parameters without angering users.

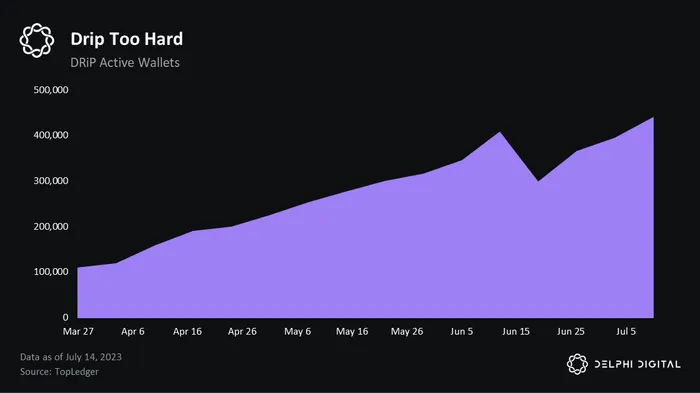

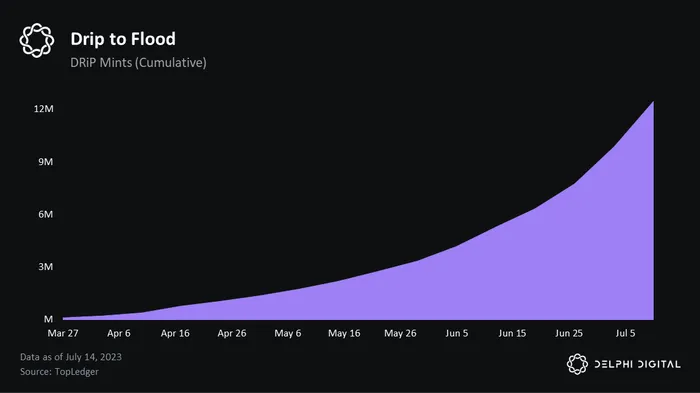

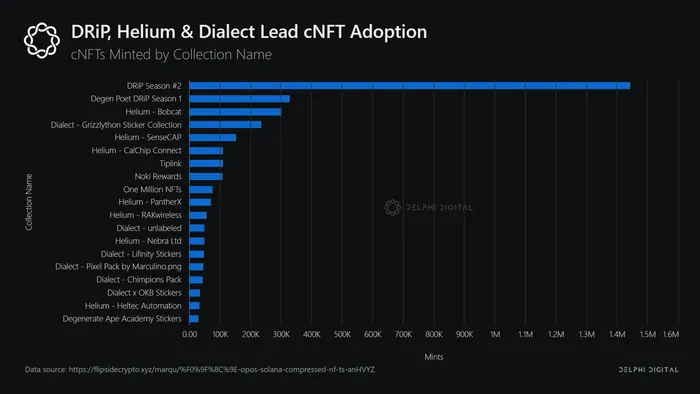

In other Solana-related news, DRiP Haus is slowly emerging as a breakout consumer application. For the uninitiated, DRiP offers free weekly NFT drops to its users. Top Solana artists create the NFTs, which can be used to unlock rewards, merchandise, whitelists, and even other NFTs.

The app is a notable example of the “only possible on Solana” narrative, as DRiP leverages Solana’s “state compression” to make the mass mints economically feasible.

Check out Ceteris‘ Solana the Monolith report for the technical details on how this is possible.

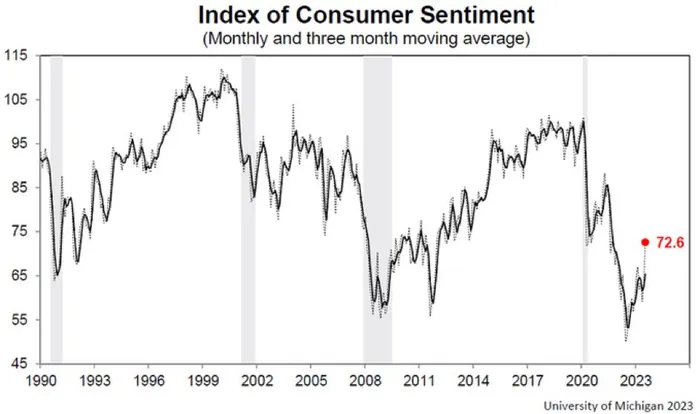

Over in macro land, the mood continues to brighten.

UMich’s consumer sentiment survey jumped way more than expected — its largest gain in sentiment since 2006.

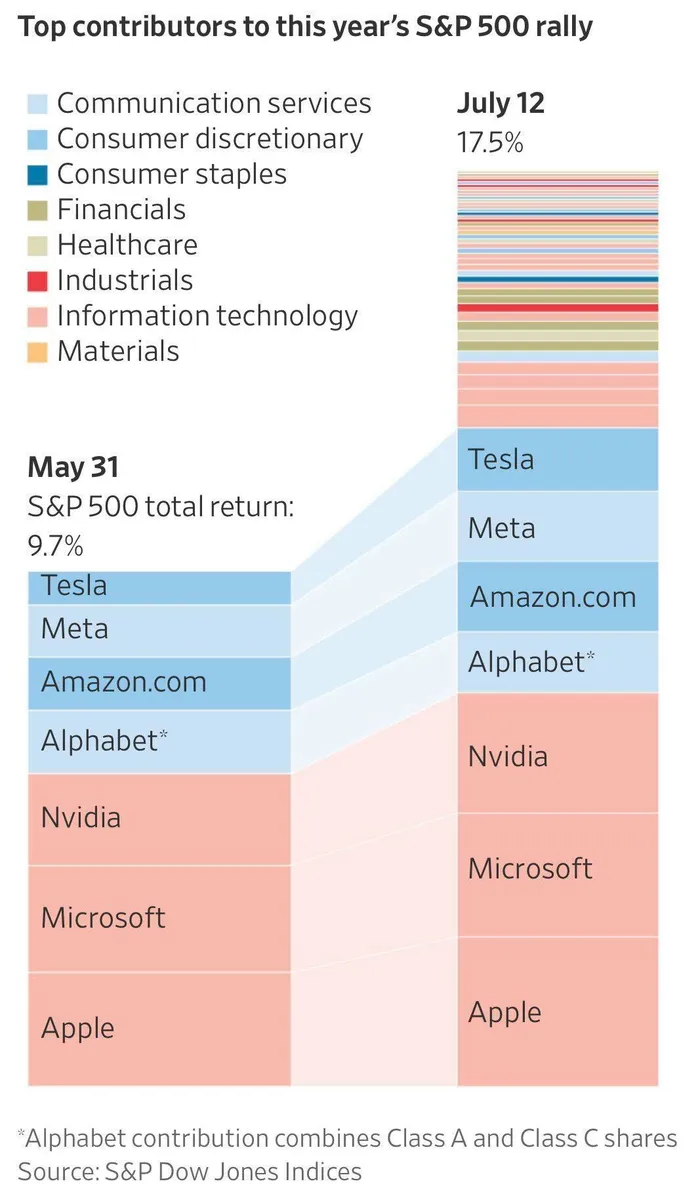

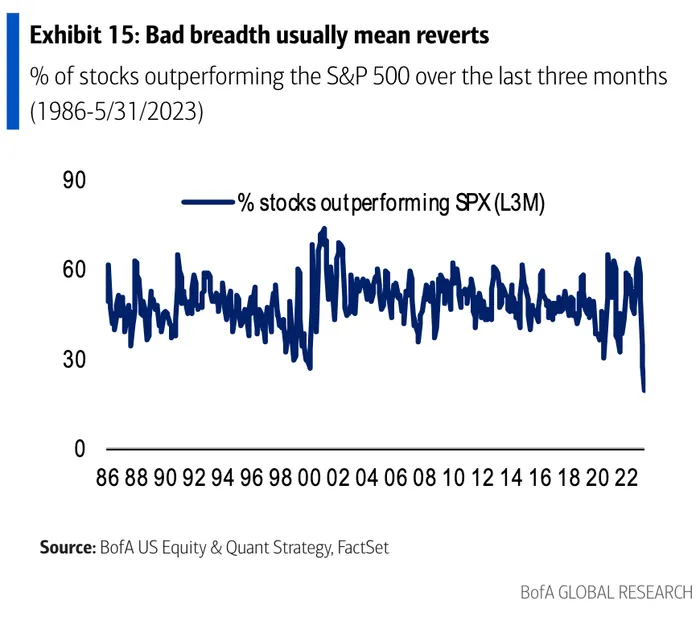

Equity breadth is finally starting to broaden…

…after experiencing a historic bout of narrow leadership.

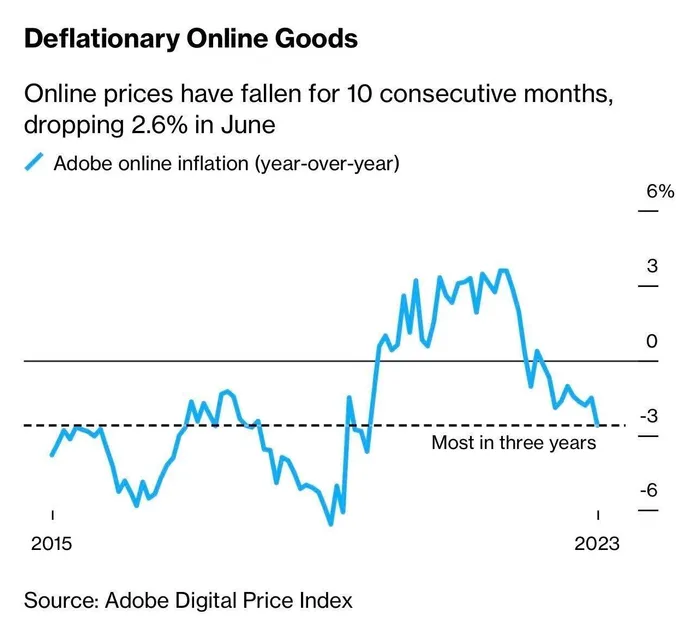

And perhaps most important: inflation continues to go downonly.

On July 12th, we got another CPI print that landed cooler than expected.

- Headline CPI hit 3% YoY (consensus: 3%)

- Core CPI dropped to 4.7% YoY (consensus: 4.8% YoY)

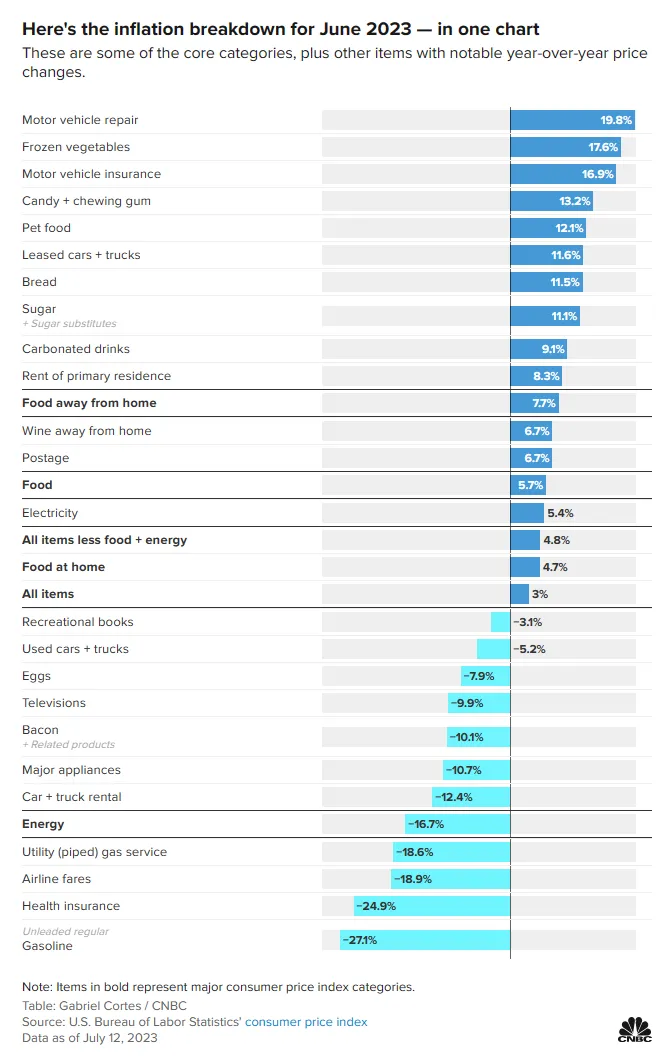

A smattering of internal components drove the June decrease, but none more juicy than BACON.

To end with some hopium — the current BTC drawdown is now the longest bear market ever.

Until next week, stay steady lads.