A short analysis on the state of Friend Tech now that we’ve seen a second weekend of big USD inflows

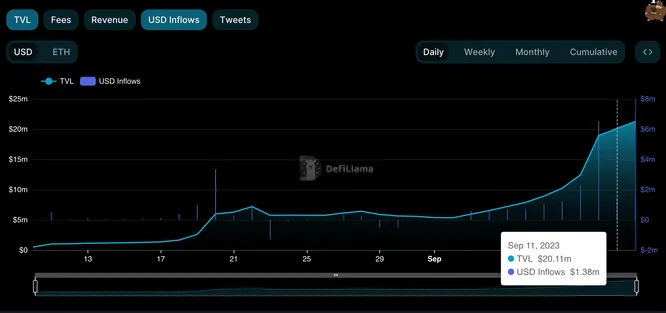

Friend tech’s TVL surged over the past weekend. Currently sitting at $21M. USD inflows over the weekend peaked at $6.5m on Saturday. Subsequently inflows eased the following 2 days, but remained positive with about $1.5m of fresh USD onboarded. TVL is also still steadily increasing, indicating deposits far outweigh withdrawals. Considering the stickiness of FT due to the expected airdrop and steep fees paid when trading, I suspect this will likely continue for a few more months. Once ppl start planning their exit strategies around the airdrop this might shift.

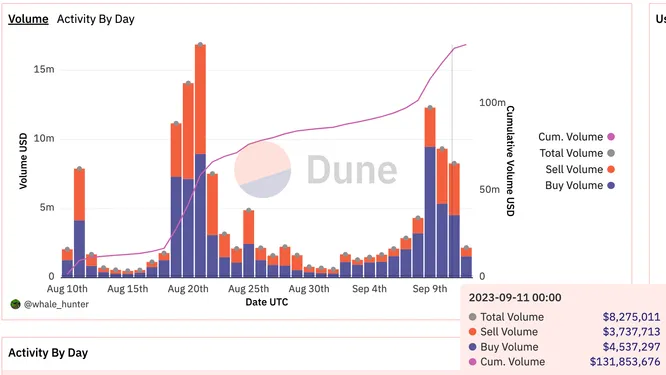

As seen on the chart below, volumes over the last weekend approached the highest peak thus far around the weekend of the 20th of Aug. What’s interesting to note is that selling pressure was lower this weekend compared to the weekend of the 20th. Buyers dominated volume by a significant margin. Be aware though, following the past peak on the Tuesday after the weekend selling volume was nearly 2x of the buying volume. It’d be wise to keep an eye out if this potentially repeats again, to either sell some unwanted keys in time or take the opportunity to scoop up ‘cheap’ keys. So far it seems like buyers remain in control and we won’t see a big sell-off today.

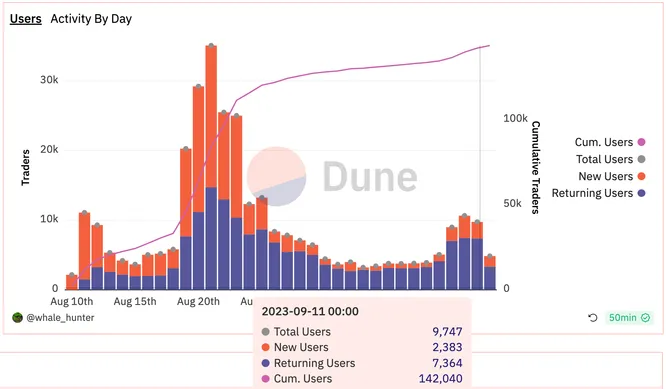

Now things get interesting. There’s a clear distinction between the source of the volume between the weekend of the 20th of Aug and last weekend. As seen on the chart below, user activity stalled at 10k, only 1/3rd compared to the 20th. In addition, around the 20th the majority (~60%) of users were new, whereas previous weekend only 25% of the users were new to FT.

To wrap things up; the most notable observations between the weekend of the 20th of Aug vs the last weekend of the 9th of Sept:

-

Amount of users decreased

-

Ratio of existing users : new users increased

-

Volume decreased only slightly

-

Ratio of buy volume : sell volume increased

This leads me to believe a core user group is forming, who’s conviction is steadily increasing. Last weekend they doubled down on FT. This core user group is likely responsible for the increased buy:sell ratio and for the increased volumes/user.

It remains to be seen if FT manages to improve the product significantly and is able to onboard new users sustainably. Or if onboarding will slow down further, turning FT into a niche social platform for crypto degens. Whatever the outcome, the potential airdrop buys FT several more months to iterate.