The weird thing about financial markets is sometimes they’re totally out of sync with the day-to-day reality you and I experience.

While unintuitive, this is natural as markets reflect not only the present, but also the future. Markets are a discounting mechanism — a way to price in the future, today.

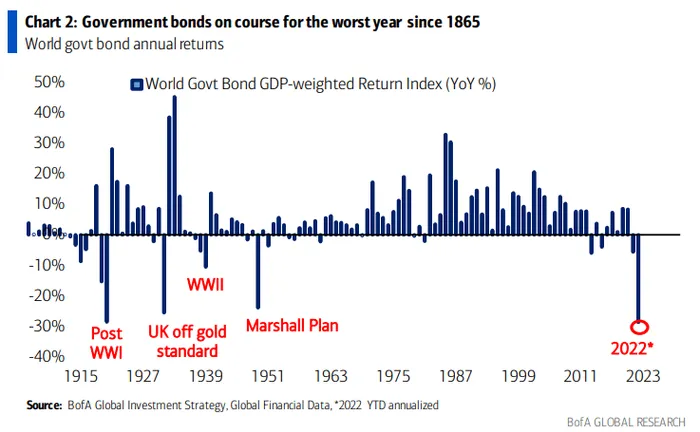

In 2022, markets were looking ahead to, well, today with considerable fear. The market saw inflation, tightening financial conditions, and slowing growth on the horizon, and was understandably spooked. Despite the real economy kinda chillin for much of last year, the financial economy ricocheted from crisis to crisis.

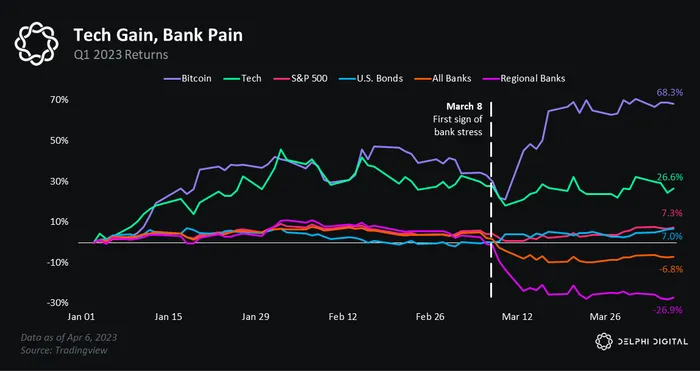

In 2023, the dynamic has reversed. It’s been the real economy that’s ricocheted from crisis to crisis: mass job losses, banking crisis, and earnings recession. At the same time, the financial economy has performed well. Stonks, bonds, and magic internet money are all up YTD.

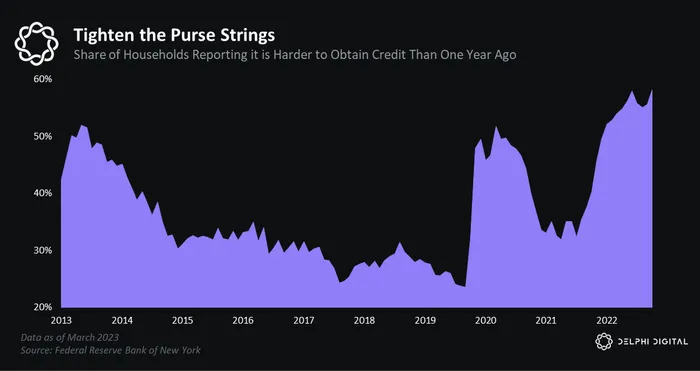

Despite risk assets finally gettin le pamp treatment, real people are hurting, real bad, in the real world. Credit markets offer a case in point.

The economy is now staring down the barrel of a severe credit crunch. Banks were already pulling back leading up to the bank runs — the crisis just accelerated the previously-slow motion credit contraction.

New data from the New York Fed is the latest alarming datapoint. A March survey found that the share of U.S. households that say it’s “harder to obtain credit today versus one year ago” is at a 9-year high.

Perversely, it’s been the little guy and gal — the individual consumer and small business owner — that have suffered the most. That’s because the bulk of the credit contraction is occurring at the small, regional bank level. And these banks account for a whopping 90% of small business lending and 45% of consumer lending.

For more in-depth analysis of the credit crunch, check out our latest research and thoughts in the March Chartbook – Spring Crossroads.