There’s a lot of threads floating around that explain crvUSD in a lot of words, when a few words will do the trick. So here’s crvUSD in 260 words:

crvUSD is a CDP stablecoin like DAI or LUSD. Its key feature is the use of soft liquidations. When nearing liquidation, a user’s collateral is converted into an LP position on Curve’s LLAMA AMM.

The LP position is broken up into bands – essentially Curve’s take on liquidity bins, but no constant-sum formula. A user can choose between more bands/wider range/softer liquidations, or less bands/tighter range/harder liquidation.

LLAMA can make liquidations significantly less painful for users. Early data suggest the cost of a crvUSD liquidation is generally between 0%-2%; much lower than the standard liquidation penalty of 5%.

Having a CDP converted into an LP position presents risks: Can’t adjust CDP during soft liquidation, can only repay or close. Due to the LLAMA algorithm’s the convex nature, users are vulnerable to repeatedly buying high and selling low during choppy price action.

crvUSD borrow rates are a function of crvUSD price and pegkeeper balances. Rates have been highly volatile since launch, fluctuating between 0%-10% on a daily basis.

The pegkeeper profits from mispricing by minting crvUSD above when price is above $1, and burning crvUSD below $1. Curve has already earned $59K in revenue from the pegkeeper. When considering the additional $394K in fees from lending markets, crvUSD’s potential as a cash cow is clear.

Curve has become more of a liquidity moat than a swapping venue. Capital efficiency lags far behind Uniswap and Maverick. A successful crvUSD could bring much needed volume and revenue to Curve. If crvUSD grows beyond 1B supply, it could make up the majority of protocol revenue.

Commentary

Liquidations are one of the biggest design obstacles faced by DeFi protocols. You may wonder why LTV has never approached, say, 95-98%. Gas fees, the reliance on oracles to trigger liquidations, and liquidity to unwind the position are areas of concern for lending markets.

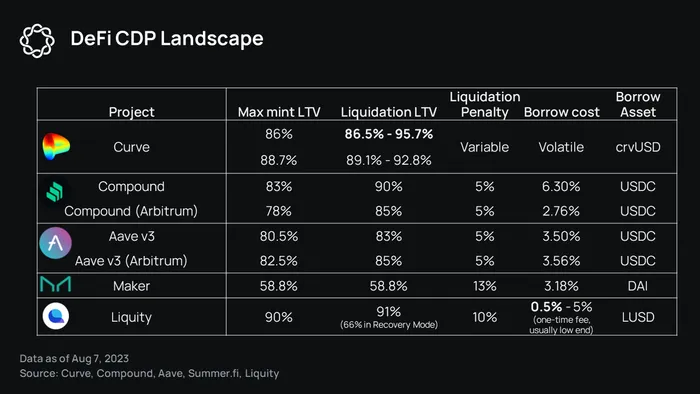

Soft liquidating a CDP over a range allows the protocol to amortize the total risk across more manageable chunks. As a result, the position will not be fully liquidated until the underlying asset’s price is above 95% original LTV threshold, a seriously impressive feat. The figures shown above for Curve are not set in stone, they are just what I was able to generate from playing with the number of bands.

When I initially heard of LLAMA, I kind of wrote it off, as it seemed the users might be providing a service to the protocol rather than vice versa. And this would have some merit if the soft liquidation range was, for instance, 80% – 90% LTV, when the industry standard hard liquidation is 85%. After all, as a user borrowing against ETH (theoretically seeking prolonged exposure to ETH), I would likely prefer the hard liquidation at 85% LTV, given these choices.

However, crvUSD’s LLAMA is a win-win for all parties. Users can originate a loan at an LTV that is potentially liquidatable on leading competitors Aave and Compound. That loan can stay partially in tact at up to 96% LTV, making this the most capital efficient lending/borrowing method to date (excluding like-for-like borrows through Aave e-mode).

I’m not quite sold on crvUSD’s viability as a stablecoin. As a lending mechanism, though, it is very cool, and feels as significant as Liquity and Euler in terms of new lending/borrowing designs.