With the CFTC claiming BTC, ETH, LTC, USDT, and BUSD as commodities, I wondered what the declaration could mean for digital assets. Disregarding the stablecoins, BTC, ETH, and LTC correlate to the broader market and tech stocks. For example, we can see Bitcoin is heavily correlated to the Nasdaq. But, I am now wondering if some digital assets will trade more in line with commodities.

On the surface, it makes sense. BTC and ETH are more like commodities than securities. I don’t hold Bitcoin in expectations of someone else’s efforts driving value to it. I have it because I can transact P2P value across a highly secure network. I hold ETH, so I can pay miners to update the information on my portion of the world computer. Many digital assets seem more like the oil and copper of a digital world – the foundational building blocks of digital economies.

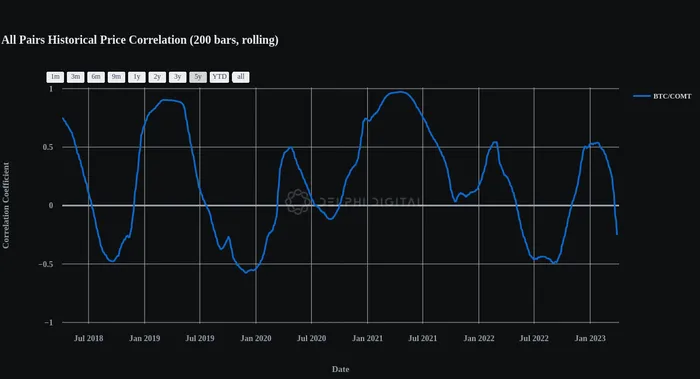

This leads me to believe that large-cap digital assets will begin to trade more like commodities. Bitcoin has been somewhat inversely correlated with commodities in the last two years. But looking at the previous five years, we see that Bitcoin and commodities are more correlated than not – although the trend is weak and could be more due to liquidity than any fundamental similarity. But, if my hypothesis is correct, some digital assets may start to positively correlate to commodities. As such, I will be watching this correlation closely.

This leads me to believe that large-cap digital assets will begin to trade more like commodities. Bitcoin has been somewhat inversely correlated with commodities in the last two years. But looking at the previous five years, we see that Bitcoin and commodities are more correlated than not – although the trend is weak and could be more due to liquidity than any fundamental similarity. But, if my hypothesis is correct, some digital assets may start to positively correlate to commodities. As such, I will be watching this correlation closely.

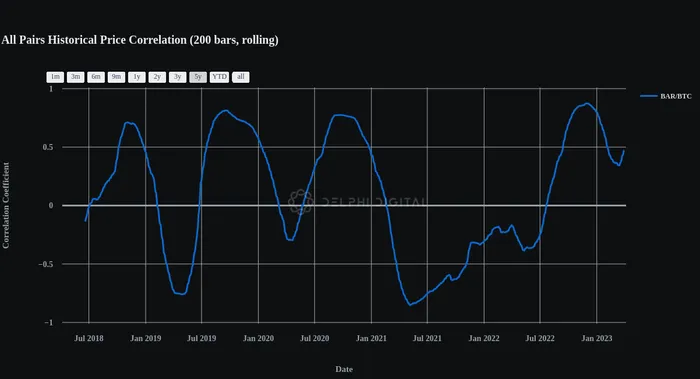

The other correlation I am watching is Bitcoin and gold. In the last year, we have seen spot gold and BTC prices become positively correlated – which makes sense if Bitcoin’s digital gold narrative starts to stick. And as the closest digital manifestation to gold, I would like to know if this trend continues and if Bitcoin becomes the reserve commodity of the digital era.

The other correlation I am watching is Bitcoin and gold. In the last year, we have seen spot gold and BTC prices become positively correlated – which makes sense if Bitcoin’s digital gold narrative starts to stick. And as the closest digital manifestation to gold, I would like to know if this trend continues and if Bitcoin becomes the reserve commodity of the digital era.