Over the weekends, Twitter user @CurveCap spotted some activity on Curve’s deployer address. It seems like Curve has started their on-chain tests for crvUSD, signaling that crvUSD could be deployed soon.

Source: https://curve.substack.com/p/april-24-2023-i-got-you-0xbabe?r=br6us&utm_campaign=4-24

Additionally, an intriguing discovery by Twitter user @MarsotP reveals that Curve’s Github has a commit potentially using sfrxETH as collateral for crvUSD. This development introduces a much-needed utility for sfrxETH, allowing it to compete with Lido and Rocketpool in DeFi integrations.

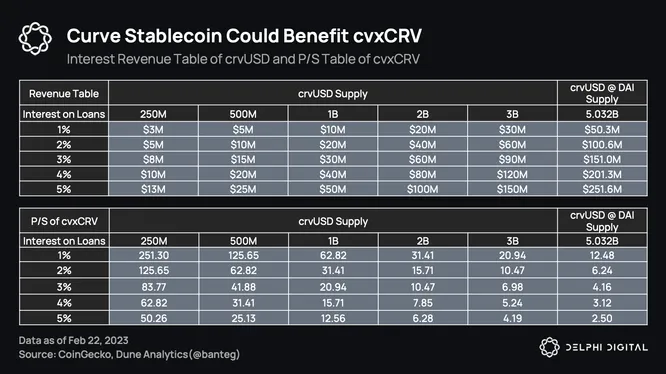

Note: P/S of cvxCRV has been adjusted by its discount on cvxCRV/CRV of 0.877. P/S is calculated on cvxCRV, assuming crvUSD as an isolated product.

With crvUSD in sight, one of the biggest beneficiaries will be Convex, the go-to yield optimizer for Curve. As written in our Convex report:

”As a CDP model, interest is accrued on every crvUSD minted, which will likely be directed back to veCRV holders. In the revenue table above, we estimate the potential interest revenue based on the amount of crvUSD minted. As the official borrowing rate for crvUSD has not yet surfaced, we projected annual interest revenue of 1-5%. If crvUSD achieves 40-60% of DAI’s supply, it could potentially generate a significant $20M-$150M for veCRV. With a conservative stance, at a 2% interest rate and 2B-3B in crvUSD, cvxCRV will have a P/S ratio between 15.71 and 10.47.”

This could further spread to benefit other Curve ecosystem players like Conic and StakeDAO.