Stanley Druckenmiller — “Druck” — needs no introduction, but we’ll go ahead with one anyways.

Druck is one of the most prolific investors ever. Many young traders consider him to be da GOAT. He’s renowned for his consistent performance, ability to avoid losses, and spectacular gains amid turbulent market conditions.

As a young lad, Druck studied English and economics at Bowdoin College and notably opened a hot dog stand during his collegiate years with Lawrence B. Lindsay, who later became an economic policy advisor to President George W. Bush.

Druck began his illustrious financial career in equity research at Pittsburgh National Bank. He cut his teeth as an oil analyst and, after one short year, was promoted to run the bank’s entire research division. In 1988, he was hired by a guy named George Soros to be the lead portfolio manager of Quantum Fund.

To learn more about the legendary Quantum Fund and its enduring influence on financial markets, check out our Head of Markets, Jason Pagoulatos,’ report on Reflexivity & the Fall of the Efficient Market Hypothesis.

Together, Soros and Druck famously “broke the Bank of England” by shorting the British pound sterling in 1992, a trade that netted them more than $1 billion in profits. This was one of the most lucrative trades of all time and, to this day, is a seminal example of the outsized impact a few prescient risk-takers can have on global markets.

Druck worked for George Soros for 12 years before leaving to start his own hedge fund, Duquesne Capital Management, which he ran for 30 years without a single losing year. He achieved an average annual return of 30% and eventually closed the fund in 2010. Druck’s performance at Duquesne is the stuff of legend and is now widely considered one of the best investing runs of all time.

Like all good macro traders, Druckenmiller historically looked to the bond market for signals about economic conditions — but today, less so. He believes the bond market hasn’t signaled anything over the past decade because the world’s central banks have been manipulating bond prices.

According to Druckenmiller, the 10-year Treasury was the most important signal in the bond market, but it is no longer. Druck has said publicly that the unprecedented QE programs enacted by the world’s central banks have perverted free markets, “manipulated” prices and tainted bond market signals.

Acting out of necessity, Druck had to find other signals and leads to inform trades. His favorite? Trucking.

Druckenmiller likes trucking as an economic indicator because it tracks the business cycle and leads the broader economy. When trucking companies print strong earnings, it usually means the economy is strong and goods are being transported across the country. Conversely, when trucking companies struggle, it signals the economy is weak and demand for goods is low.

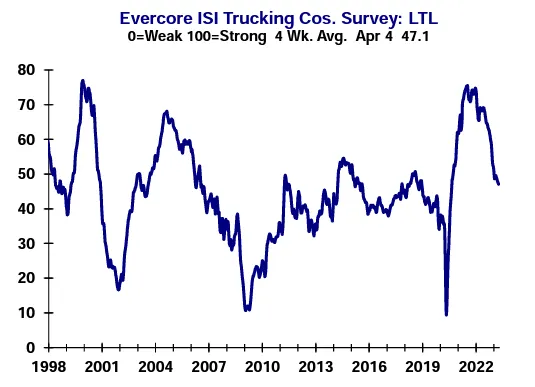

One of Druck’s favorite sources for trucking alpha is his friend and long-time confidante: Ed Hyman. Ed is a legend in the field and highly sought after by investors for his insights and forecasts on the global economy. Through his firm Evercore ISI, Ed publishes a bi-weekly trucking survey.

The survey covers 23 trucking companies that represent a diverse mix of truckload and less-than-truckload carriers, regional and national operators, and dry van and specialized segments. It tracks key metrics such as revenue per mile, tonnage, utilization, pricing, costs, and profitability. It also provides insights into the outlook for freight volumes, capacity, rates, fuel prices, labor availability, and regulatory issues.

Investors widely follow Evercore’s trucking survey as a leading indicator of the health and direction of the U.S. economy. Lately, the survey’s prints have been falling off a cliff, suggesting tepid demand for goods and a rapidly slowing U.S. economy.

The Fed’s rate hikes are playing a role here. While some Fed-favored metrics like CPI have been slow to respond to the “medicine,” Evercore’s trucking survey makes clear that the real economy is slowing and likely already in recession. A higher cost of money is usually felt first in financial markets (stonks go down) and later in the real economy (truckers!). Expect the survey to contract further as the Fed’s restrictive monetary policy dampens consumer demand, business spending, and yes, drucking, err, I mean, trucking.

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/VGG2TXWFVJHHXK7NJGLFFRX6F4)