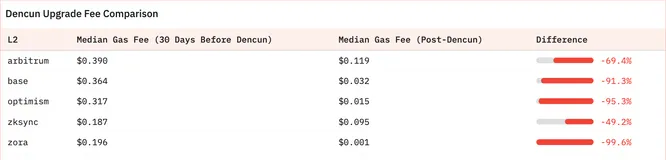

As more L2s start to adopt blobs we are seeing more real data come in. The dashboard from my tweet is by far the best one I have seen so far and gives a good picture on cost reductions for users & L2s.

Overall, rollups are seeing a 50 to 95% decrease. The ORUs see more of a benefit because they don’t need to post proofs.

The data costs for rollups is also down significantly as they adopt the cheaper fee market. These will rise but will still be substantially lower than calldata ever was.

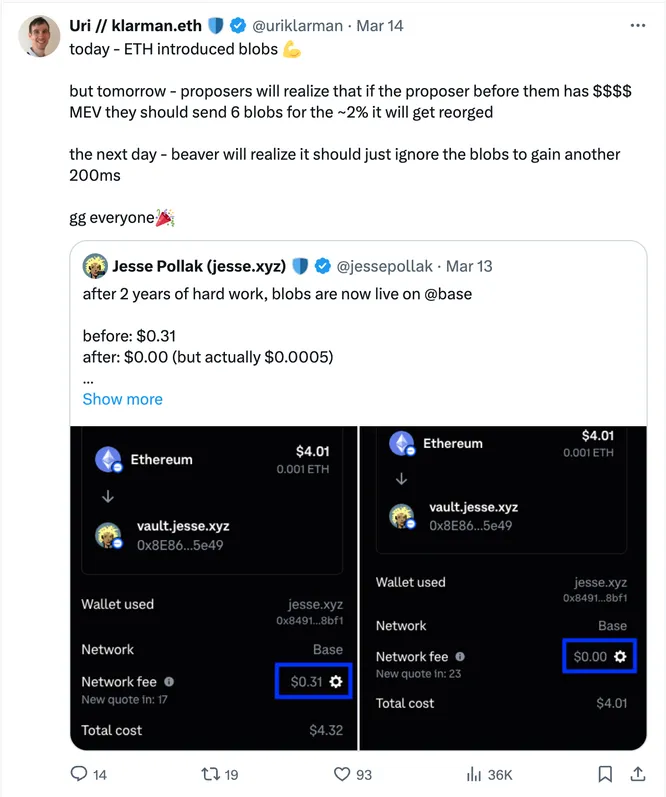

In the coming weeks we’ll start to see how blobs start to be affected by MEV/builder dynamics and where their equilibrium costs settle at.

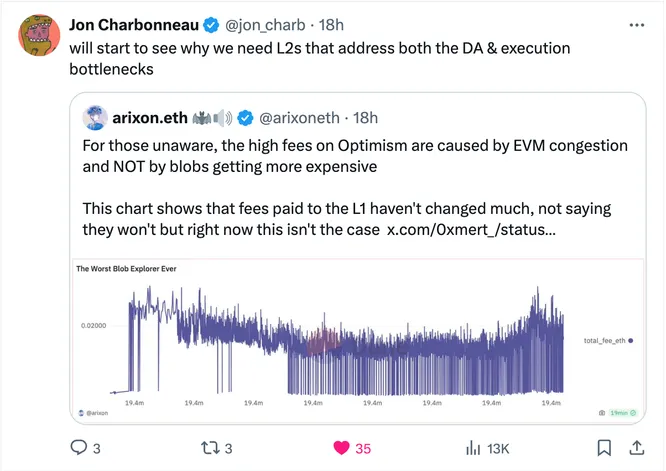

There is also the maybe under-appreciated angle that DA is just one side of the equation. Execution bottlenecks have still not been removed and global fee spikes on EVM L2s will still happen.

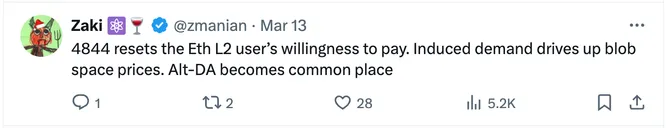

EIP-4844 is a significant technical feat that Ethereum engineers have been working on for years. Upgrading the network in real time is also something that we don’t really appreciate for how remarkable it really is. It’s a big win for Ethereum users to start to see reduced costs. At the same time, this resets everyone’s expectations around fees.

DA is moving from something blockchains could charge a premium for to a commodity (4844, Celestia, EigenDA, Avail, Near, etc). DA will not be a long-term value driver in my opinion for blockchain tokens and so it now comes down to execution. This is why I said that based rollups were the #2 narrative behind the ETF in my “ETH Narratives” post from a week or so ago. DA has now realized disruptive innovation; the game has changed. We’ll dive in deeper on next week’s episode of office hours.