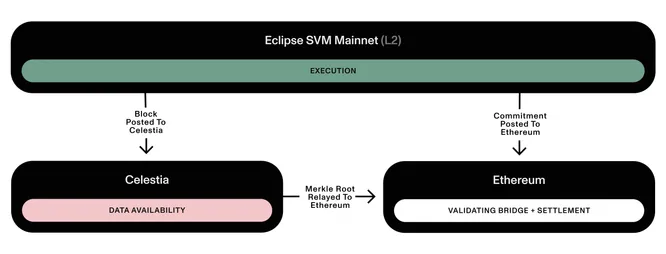

Eclipse announced their SVM rollup today. The architecture has many moving parts, and will be constructed as the following:

- Settlement: Ethereum for the validating bridge and to use ETH as gas token

- DA: Celestia for scalability

- Execution: SVM (Solana virtual machine)

- Proofs: Risc0

This is being pitched as the “best of all worlds”. Use Solana’s VM for parallel transaction execution and isolated fee markets, Ethereum as validating bridge to make ETH the main asset, and Celestia for more scalable and cheaper DA. I would definitely recommend reading the full post here (https://mirror.xyz/eclipsemainnet.eth/me7bXLWJDS177V6nl8j1uzF1mxpX6nbGOLNeyBAwXgs) if interested, but these are my high-level takeaways.

- Is ETH’s moat in ETH the asset itself or the EVM? In other words, do L2’s get a lot of adoption because people are familiar with the EVM and UX or because they like to use ETH? This will give us further data points around this question.

- It’s great to see more non-EVM rollups. A world with tens or hundreds of general purpose EVM rollups has never really made sense to me as they for the most part are just copy-pasta-ing projects on multiple L2s. An SVM rollup enables new opportunities for applications built on ETH, not just because of fee markets or parallelization, but because it brings in a new developer ecosystem.

- Celestia for DA is much more scalable than using Ethereum. Expect to see more Celestia and EigenDA rollups launch over the coming years while still maintaining validating bridges to Ethereum to tap into Ethereum’s liquidity. Celestia is also expected to have gold-standard light client support.

- This is great for Solana. More devs = good. What about SOL? While this doesn’t directly use SOL for anything, it further builds Solana’s developer moat and in turn continues driving interest in Solana development. The Solana core team maintains the SVM, so rollups will be dependent on Solana core team to keep their rollups current. Solana teams can also deploy easily on Eclipse if they desire (and vice versa).

Tl;dr – Eclipse uses ETH the asset, Celestia for scalable DA and light clients, and SVM for execution. We should note, however, that an SVM rollup on Celestia will still not have as much throughput as Solana L1, so apps like CLOBs will still be best suited there.

Overall it’s an interesting architecture, and is probably the best example of the “modular” thesis, utilizing what the Eclipse team believes to be the best parts from every ecosystem. This is a launch to watch.

I should add that I don’t really expect any of the Solana teams to build on Eclipse at this point as there’s really no point for them unless just re-deploying some contracts. Eclipse will need to sell new teams on mostly the “ETH liquidity” aspect to get developer adoption.