DAOs are dead, AMMs are dead, fair launches are dead. Ballooned valuations, bloated foundations, and deceptive points programs are the new meta. Consequently, fundamentals have been overshadowed by memecoins and mercenary capital. A new project’s success is often benchmarked by its ability to tread water while incentives taper off and tokens begin vesting.

Ekubo is a DEX on Starknet that represents the antithesis of the current regime. It has a bold approach to its token and is the highlight of an overlooked Starknet ecosystem. In this post, we will recap Ekubo’s journey so far and consider its growth prospects.

Ekubo Overview

-

Till pattern – Ekubo’s singleton contract uses the “till” pattern, which allows all validation, token transfers, etc. to be deferred until the end of the transaction.

-

Tick size – Uniswap v3 has 1 bp ticks. Ekubo’s are 1/100th of a basis point, or 0.000001. This allows Ekubo to offer an order of magnitude more precision than other implementations of concentrated liquidity, capable of rivaling CEXs.

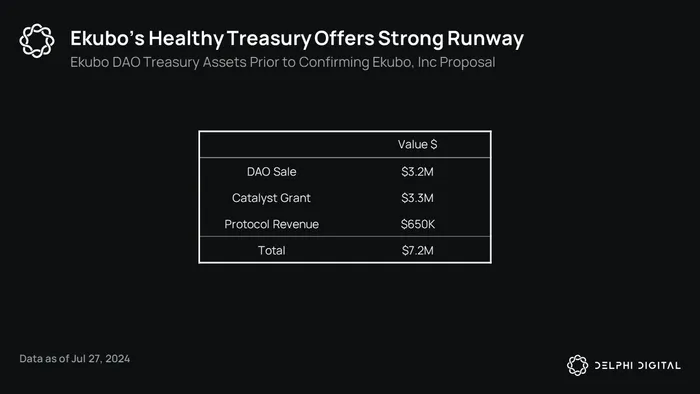

- Fee switch – Ekubo has an operational fee switch. It charges a fee on LP withdrawals that is equal to the fee tier of the pool. To date, the fee switch has generated $650K in revenue. Subject to governance, Ekubo will likely use its TWAMM extension to automate buybacks of EKUBO using protocol revenue, distributing repurchased EKUBO to stakers. At $1M annualized revenue and 65% stake rate, staking EKUBO would generate 6% yield at current prices. This may seem unimpressive, but it is far better than forecasts of Uniswap’s Fee Switch, and has the peripheral benefit of shepherding liquidity into lower fee tier pools.

Extensions

TWAMM – Ekubo’s time-weighted average market maker (TWAMM) extension allows users to place on-chain DCA orders. Since one cannot schedule smart contracts, previous implementations of DCA orders typically rely on keepers and are highly manual in practice. Ekubo’s TWAMM logic takes place on-chain and spreads trades out on a per-block basis. This thread offers a nice in-depth overview of the architecture. Ekubo demonstrated the TWAMM’s effectiveness with its DAO treasury sale, and could potentially offer treasury diversification as a service for other DAOs.

Token Fundamentals

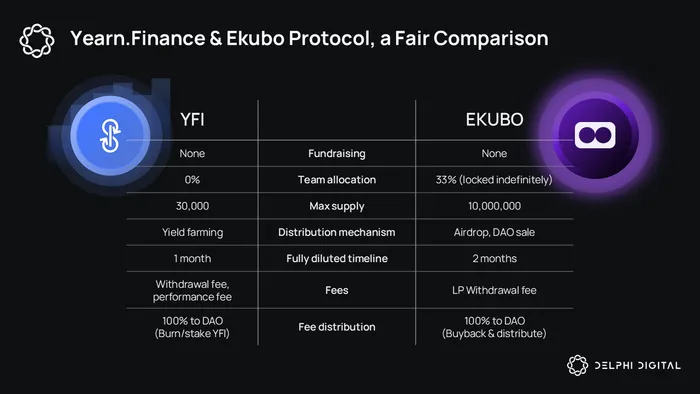

The Ekubo protocol is fully owned and operated by the DAO. Ekubo’s core contracts are owned by the DAO, rather than a multisig. The EKUBO token is an even greater indicator of the unwavering emphasis on best practices and decentralization.

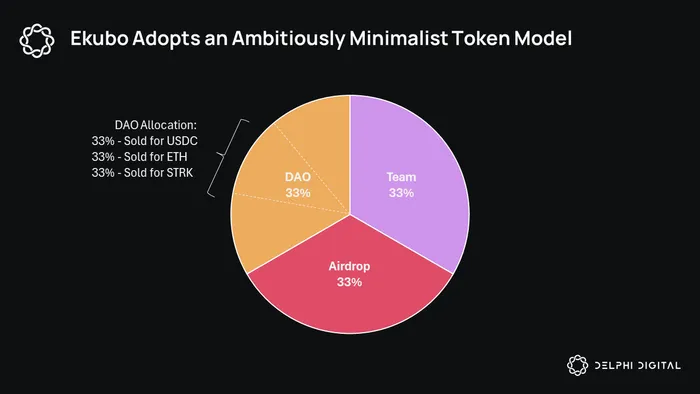

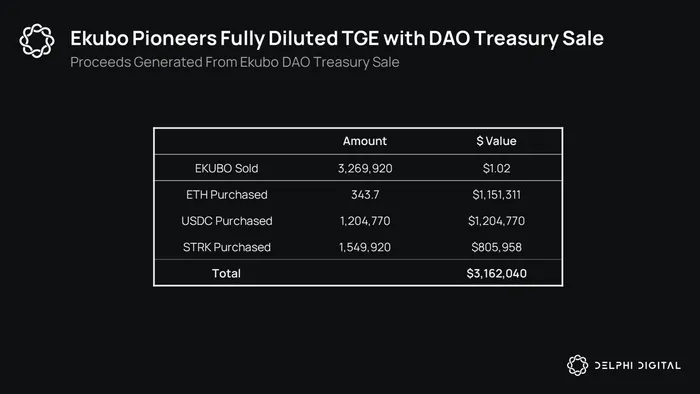

The token supply is split into thirds between the team, DAO, and Airdrop. The airdrop and team tokens were fully vested upon TGE. The DAO allocation was sold for USDC, ETH, and STARK via the TWAMM extension over two months, beginning May 23. The sale ended July 23, and EKUBO is now fully diluted.

Ekubo was the top recipient of the Starknet Catalyst grant, receiving twice the allocation of 2nd place AVNU. 50% of the 6M STRK grant is unlocked immediately, with the remaining tokens vesting over 4 years. The grant is worth $3.1M at current prices. To maintain the 1-1-1 USDC/ETH/STRK treasury ratio, the DAO has began selling its unlocked STRK to ETH and USDC via its DCA pools.

Confirming EKUBO, Inc’s role in the DAO

Relative Valuation Analysis

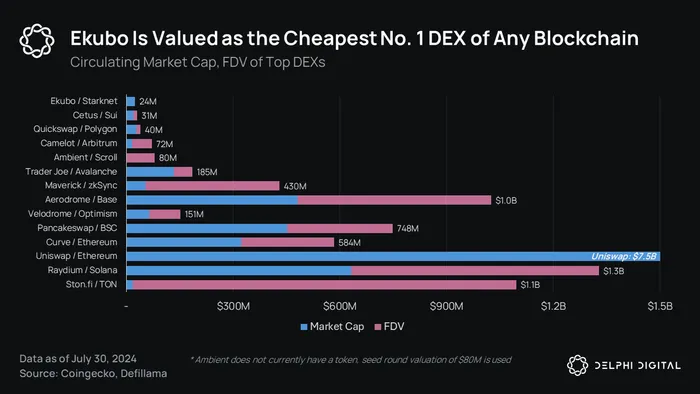

Ekubo has established itself as the no. 1 DEX on Starknet, servicing over 80% of its volume. The lowest valuation of any no. 1 DEX is Quickswap on Polygon ($20M/$27M) and Cetus ($15M/23M). Ekubo sits at $16M fully diluted.

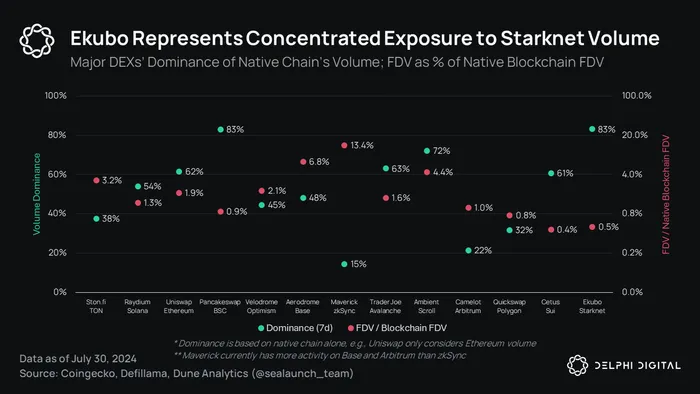

This valuation outlier is particularly noticeable when looking at the degree to which each DEX dominates volume on their chain. Quickswap is the no. 1 native DEX on Polygon, but it battles with Uniswap and earns only 32% of volume. PancakeSwap is the only other DEX that dominates its native chain’s volume to the extent that Ekubo does. But as Ekubo only exists on Starknet and has nearly the lowest FDV relative to its native blockchain, Ekubo is the most concentrated bet on its native chain’s DEX activity, dollar for dollar.

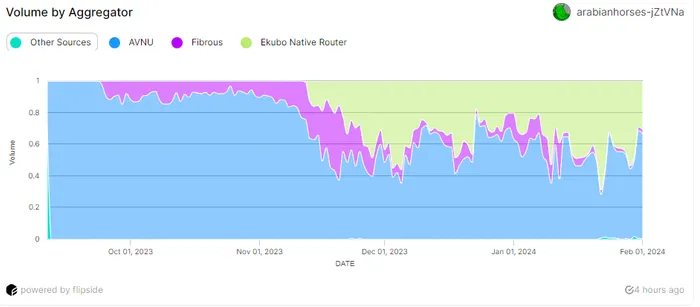

Ekubo is a strong fundamental and relative value play with an unprecedented token structure. On the other hand, Ekubo is tethered to Starknet, which appears to be holding back Ekubo’s growth for the time being. Starknet funding and mindshare wildly exceed its usage. Ekubo’s volume lags substantially behind comparable DEXs like Ambient.

Tailwinds for Starknet

Aptos and Sui are alt-VM chains that have overcome the onboarding bottleneck to attract $870M TVL between the two of them. This is over 3x Starknet’s $280M TVL. Indeed, one of the biggest risks to Ekubo is the ability of Starknet to overcome brand setbacks and regain attention. There are several potential catalysts that could aid in Starknet’s growth.

DeFi Spring – Starknet’s DeFi Spring program runs through at least end of year, with a budget of 90M STRK distributed to various ecosystem protocols. The program is similar to ecosystem incentive programs on Arbitrum, Optimism, and Avalanche, but the Starknet foundation assumes a more proactive role in curating the incentives. Recursive borrowing is not included, and Starknet adjusts emissions to achieve a desired level of yield. While this structure eliminates some degen gamesmanship, it also increases runway and substantially rewards organic activity that benefits the ecosystem. Yields from 15%-30% are commonplace across major Starknet protocols, Many of which are currently without tokens.

STRK Staking – Starknet will begin phase 1 of STRK staking in Q4 2024. Rewards for staking in phase 1 will me emission based, as Starknet pilots its economic incentive mechanism ahead of allowing stakers to begin validating and voting on blocks. STRK will likely be the first L2 token to embark on this journey, giving utility to its governance token. Locked tokens will not participating in phase 1, but will be allowed to participate in later phases.

Starknet v0.13.2 – Parallel execution and block packing are coming in Starknet’s August upgrade, which will lower transaction times to ~2 sec and block times to 20-60 sec. Transaction times are one of the bigger UX downsides to Starknet at the moment. Transaction times can be upwards of 10 seconds, with 5 minute block times.

blinks are for everyone, everywhere. pic.twitter.com/nWF3eNAC7k

— Solana (@solana) June 26, 2024

Slinks – Solana ‘Blinks’ have been one of the bigger new developments of the year so far. Debuted by Dialect in June, Blinks are an impressive new addition to the consumer UX mass-adoption tech bucket. Ekubo stealth-demoed a Slink (Starknet blink) on their post last week. The trend has quickly spread, with several other Starknet apps demonstrating the tool on X.

Argent Card – Argent recently announced their upcoming Argent card, a noncustodial debit card that uses session keys to pull funds from a users wallet for payment without manual approval for each transaction. The Argent card is another example of the consumer-facing use cases that Starknet’s native AA and expressive VM enable.

Metamask Snaps – Users can interact with Starknet through MetaMask Snaps. Starknet wallets like Argent and Braavos are recommended, but Snaps offer an alternative solution for users to access the Starknet ecosystem. AVNU, Starknet’s leading aggregator, recently released a MetaMask Snap.

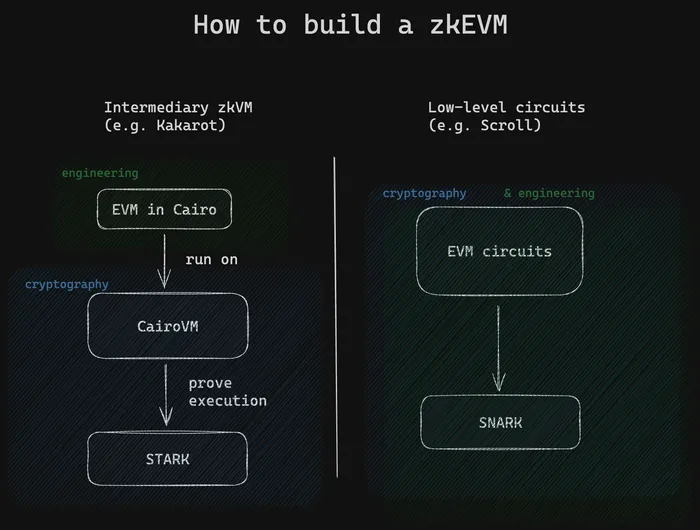

Kakarot – Kakarot is a zk-EVM built in Cairo. Cairo is a zk-VM, meaning anything running in the CairoVM is provable. By building an EVM implementation inside of the CairoVM, Kakarot delivers a zk-EVM, making Starknet a DualVM environment. Each Kakarot transaction is an EVM transaction wrapped inside a Starknet transaction.

To deploy on Kakarot, Cairo protocols would have to be rewritten in Solidity, so the degree to which Starknet-native protocols will directly benefit is unclear. Kakarot should be able to call Cairo contracts, allowing for integrations. At the very least, Kakarot will help onboard EVM users and Solidity developers to Starknet, bridging the gap between the two ecosystems. Kakarot will launch mainnet in December 2024.

OP_CAT – Bitcoin rollups appear to be real, and there is an immense amount of research into making them happen. Discussed in our Bitcoin Rollups Report, OP_CAT could allow for the implementation of covenants and STARK proofs in Bitcoins script, which would enable general computation. OP_CAT looks increasingly likely to be reactivated on Bitcoin via soft-fork, and Starknet could become a true Bitcoin L2 in mid-2025.

Starknet is extremely cheap to use and the wallet UX is clean, but there is a fair amount of onboarding friction and it doesn’t feel as fast as the L2 experience most users have become accustomed to. Starknet ecosystem tech is strong, and is making progress in DeFi, gaming, Bitcoin research, and in utilizing Starknet’s native account abstraction.

Conclusion

Ekubo’s approach is a remedy to all the persistent gripes that have fatigued the crypto space. Ekubo wholly embodies a no-frills, grassroots DAO while sitting on the cutting edge of AMM tech. Its success is contingent upon Starknet, but it is an intriguing play on many fronts that ticks several narratives.

Disclosure: I hold EKUBO